Osisko Mining Corporation ("Osisko") (TSX:OSK)(FRANKFURT:EWX), Yamana Gold Inc.

(TSX:YRI)(NYSE:AUY) ("Yamana") and Agnico Eagle Mines Limited

(NYSE:AEM)(TSX:AEM) ("Agnico Eagle") are pleased to announce that they have

entered into an agreement ("the Agreement") pursuant to which Yamana and Agnico

Eagle will jointly acquire 100% of Osisko's issued and outstanding common shares

for total consideration of C$3.9 billion or C$8.15 per share. The total offer

consists of approximately C$1.0 billion in cash, C$2.3 billion in Yamana and

Agnico Eagle shares, and creation of a new company ("New Osisko") with an

implied value of approximately C$575 million.

The offer represents an 11% premium to the current Goldcorp hostile bid. Yamana,

Agnico Eagle and Osisko will be hosting a joint conference call today at 10:00

a.m. EDT to discuss the transaction.

Terms of the Agreement

Under the Agreement, Yamana and Agnico Eagle will form a joint acquisition

entity (with each company owning 50%) which will acquire, by way of a plan of

arrangement (the "Arrangement"), all of the outstanding common shares of Osisko.

Upon closing of the transaction, Yamana and Agnico Eagle will each own Osisko,

and will form joint committees to operate the Canadian Malartic Mine in Quebec.

The partners will also jointly explore and potentially develop the Kirkland Lake

assets, and continue the exploration at Hammond Reef, Pandora/Wood, and Pandora

properties, all located in Ontario.

Upon implementation of the Agreement, each outstanding common share of Osisko

will be exchanged for:

i. C$2.09 in cash;

ii. 0.26471 of a Yamana common share (a value of C$2.43 based on the closing

price of C$9.18 for Yamana shares on the Toronto Stock Exchange as of

April 15, 2014);

iii.0.07264 of an Agnico Eagle common share (a value of C$2.43 based on the

closing price of C$33.45 for Agnico Eagle shares on the Toronto Stock

Exchange as of April 15, 2014);

iv. one new common share of New Osisko with a value of C$1.20 per share.

Pursuant to Arrangement, certain assets of Osisko will be transferred to New

Osisko, the shares of which will be distributed to Osisko shareholders as part

of the consideration. The following will be transferred to New Osisko:

i. a 5% net smelter return royalty ("NSR") on the Canadian Malartic mine;

ii. a 2% NSR on all existing exploration properties including Kirkland Lake,

Hammond Reef, Pandora/Wood and Pandora assets;

iii.C$155 million cash;

iv. all assets and liabilities of Osisko in the Guerrero camp;

v. other investments.

The total value of the transaction is C$3.9 billion, or C$8.15 per common share

of Osisko on a fully diluted basis. Following the completion of the transaction,

Osisko shareholders will own approximately 14% of Yamana and approximately 17%

of Agnico Eagle.

Value to Osisko Shareholders

-- Values Osisko at C$3.9 billion or C$8.15 per share - a material premium

to the current implied value of Goldcorp's revised hostile bid for

Osisko and Osisko's current trading levels.

-- In addition to meaningful continued participation in the Canadian

Malartic mine, shareholders gain exposure to two leading mid-tier

Americas gold producers.

-- Participation in New Osisko, which will hold a significant portfolio of

exploration assets with the ability to self-finance through its existing

cash holdings and a 5% NSR on the producing Canadian Malartic mine.

-- Potential additional upside from a 2% NSR on all existing exploration

properties including Kirkland Lake, Hammond Reef, Pandora/Wood and

Pandora.

-- An attractive equity investment portfolio which has the potential to

generate additional growth opportunities.

Osisko's board of directors has unanimously determined that the Agreement is in

the best interests of Osisko and its shareholders and will recommend that Osisko

shareholders vote in favour of the Agreement. Shareholders, including the

directors and senior officers of Osisko, holding in aggregate over 5% of the

issued and outstanding common shares of Osisko, have entered into voting

agreements with Yamana and Agnico Eagle, pursuant to which they have agreed to

vote their shares in favor of the Agreement.

Sean Roosen, President and CEO of Osisko stated: "Ten years ago we embarked on a

journey to find a gold deposit. It was a plan that grew into the successful and

highly profitable world class mine that is now Canadian Malartic. From the

beginning, we have never strayed from our objective of building shareholder

value. With the announcement today of the combined bid by Yamana and Agnico

Eagle, I believe we have delivered shareholders the superior value option to the

hostile attempt to acquire our Company. The new Osisko will be well funded with

$155 million in cash, strong participation in the future cash flow from the

Canadian Malartic camp through our 5% NSR, potential future benefits from the

balance of Osisko's Canadian exploration portfolio through an overall 2% NSR,

and a 100% ownership of Osisko's significant greenstone exploration project in

Guerrero. The new Osisko will be a company with regular and strong cash flow,

strong future potential for increasing cash flow, and tremendous upside

exploration potential."

Strategic Rationale for Yamana

Yamana is a proven operator with the stated objectives of operating in mining

friendly jurisdictions in the Americas with a balanced approach to production

growth, cost containment and margin preservation to maximize and increase cash

flow. This partnership with Agnico Eagle provides Yamana with significant

production growth at costs consistent with its existing cost structure, enhanced

generation of cash flow and an expanded future project pipeline. It will also

provide entry into one of the world's best mining jurisdictions without the

level of risk generally associated with new locales given the strong operational

management at Canadian Malartic and Agnico Eagle's decades-long experience in

the region.

Peter Marrone, Chairman and Chief Executive Officer of Yamana commented: "At

Yamana, we focus on both top-line and bottom-line growth as we strive to deliver

value to shareholders, and with this acquisition we expect to deliver

exceptional value to our shareholders. This acquisition provides value across

all key per share metrics. The Canadian Malartic mine is a world class asset

that will become a cornerstone in our portfolio alongside Chapada and El Penon.

We are also pleased with this relatively low risk entry into Quebec, a province

with an established pedigree of mining that complements our existing presence in

the Americas. Consistent with our disciplined and balanced approach to growth,

we are able to acquire 50% of the Canadian Malartic mine and the other Canadian

development and exploration properties of Osisko while maintaining our strong

balance sheet and financial flexibility.

"We are delighted with our improved structure and offer. With Agnico as our

partner, the operational management at Canadian Malartic and as we open our own

operational office in Quebec, these benefits will be further enhanced with our

collective experience with large open pit conventional mining with their

jurisdictional expertise. We are pleased with our entry into Quebec and we look

forward to increasing our profile in this mining friendly jurisdiction."

Strategic Rationale for Agnico Eagle

Agnico Eagle has a long history of operating in Quebec, and the Osisko

acquisition is a great strategic fit with the company's existing production

platform in the Abitibi region. The acquisition enhances Agnico Eagle's existing

production and cost profile, increases reserves and resources, and is expected

to increase free cash flow generation. Partnering with Yamana allows Agnico

Eagle to maintain a strong balance sheet, and keep equity dilution at a minimum.

The transaction fits strategically and is in line with the size of some of

Agnico Eagle's previous acquisitions, but comes without permitting construction

or start-up risk.

Sean Boyd, President and Chief Executive Officer of Agnico Eagle stated: "Agnico

Eagle has approximately 50 years of operating history in Quebec, and over that

time the company has continued to expand its mining presence in a measured and

systematic way. This transaction further enhances our Quebec operating platform

through the addition of a fourth producing mine. With this acquisition, Agnico

Eagle will become Quebec's largest gold producer, which demonstrates our

commitment to Quebec and various stakeholders in the province.

"Traditionally, Agnico has focused on acquisitions with minimal dilution to

shareholders. With Osisko shareholders holding a 17% interest in Agnico Eagle

post the transaction, we believe that the dilution is in line with many of the

Company's previous acquisitions. However, this transaction comes without

permitting, construction capital, and start-up capital risk, and is immediately

accretive to Agnico Eagle on a number of key per share metrics. In addition, the

transaction is expected to lower our total cash costs and all-in sustaining

costs.

"We look forward to working with Yamana as a partner at the Canadian Malartic

mine, and at the exploration properties. Yamana's expertise at their large open

pit Chapada gold copper mine in Brazil should complement our operating

experience at Meadowbank and in the Abitibi region."

The transaction is subject to the approval of Osisko shareholders by a two

thirds vote at a meeting to be held sometime in mid-May. The approval of the

shareholders of Agnico Eagle and Yamana is not required. The Agreement is

expected to close by May 30th, 2014 following receipt of all shareholder and

court, regulatory and exchange approvals.

Pursuant to the terms of the Agreement, Osisko is subject to customary

non-solicitation covenants. In the event a superior proposal is made to Osisko,

Yamana and Agnico Eagle have a 5 business day right to match such proposal, and

under certain circumstances in the event Osisko's Board of Directors changes its

recommendation or terminates the Agreement, Osisko has agreed to pay a

termination fee of C$195 million to Yamana and Agnico Eagle, shared equally. In

certain other circumstances where the transaction is not completed, Osisko has

agreed to reimburse Yamana's and Agnico Eagle's expenses in the amount of C$10

million each for their costs.

Osisko's Board of Directors has determined that the offer by Yamana and Agnico

Eagle is superior to the proposal made by Yamana on April 2nd, 2014 and the

parties have agreed to terminate their agreement. Yamana has agreed to waive its

break fee under the agreement.

Osisko has engaged BMO Capital Markets and Maxit Capital LP as its financial

advisors and Bennett Jones LLP and Stikeman Elliott LLP as its legal advisors in

connection with the Arrangement.

Yamana has engaged Canaccord Genuity Corp. as its financial advisor and Norton

Rose Fulbright Canada LLP and Paul, Weiss, Rifkind, Wharton & Garrison LLP as

its legal advisors in connection with the Arrangement. Yamana has also engaged

National Bank Financial Markets to provide an opinion as to the fairness of the

consideration payable by Yamana, from a financial point of view, to Yamana.

Agnico Eagle has engaged TD Securities Inc. and Bank of America Merrill Lynch as

its financial advisors and Davies Ward Phillips & Vineberg LLP as its legal

advisors in connection with the Arrangement.

Conference Call Information

Osisko, Yamana and Agnico Eagle will host a conference call on Wednesday, April

16, 2014 at 10:00 a.m. EDT, where senior management of each company will discuss

the details of the transaction.

Toll Free (North America): 1-800-769-8320

Toronto Local and International: 416-340-9432

Webcast: www.yamana.com

Conference Call REPLAY:

Toll Free (North America): 1-800-408-3053 Passcode 6977252

Toronto Local and International: 905-694-9451 Passcode 6977252

The conference call replay will be available from 1:00 pm. EDT on April 16, 2014

until 11:59 p.m. EDT on April 30, 2014.

For further information on the conference call or webcast, please contact the

Investor Relations Department at investor@yamana.com or visit www.yamana.com.

About Osisko

Osisko Mining Corporation operates the Canadian Malartic Gold Mine in Malartic,

Quebec and is pursuing exploration on a number of properties, notably in Quebec,

Ontario and Mexico.

About Yamana

Yamana is a Canadian-based gold producer with significant gold production, gold

development stage properties, exploration properties, and land positions

throughout the Americas including Brazil, Argentina, Chile and Mexico. Yamana

plans to continue to build on this base through existing operating mine

expansions, throughput increases, development of new mines, the advancement of

its exploration properties and by targeting other gold consolidation

opportunities with a primary focus in the Americas.

About Agnico Eagle

Agnico Eagle is a senior Canadian gold mining company that has produced precious

metals since 1957. Its seven mines are located in Canada, Finland and Mexico,

with exploration and development activities in each of these regions as well as

in the United States. The Company and its shareholders have full exposure to

gold prices due to its long-standing policy of no forward gold sales. Agnico

Eagle has declared a cash dividend every year since 1983.

Reject the Inadequate Goldcorp Offer

As previously disclosed, the Osisko Board of Directors has unanimously

recommended that Osisko shareholders reject the hostile take-over bid initiated

by Goldcorp Inc. and not tender their Osisko shares to the Goldcorp offer. The

Osisko Board determined that the Goldcorp offer fails to adequately compensate

Osisko shareholders for, among others things, the strategic value of Osisko's

world-class asset base, the significant upside potential of Osisko's Canadian

Malartic Mine, or the increased risk inherent in Goldcorp common shares. The

full basis for the Osisko Board's recommendation is available in a Directors'

Circular, a copy of which is available online at www.osisko.com.

Shareholders who have questions or who may have already tendered their shares to

the Goldcorp Offer and wish to withdraw them, may do so by contacting our

Information Agent, Laurel Hill Advisory Group at:

North American Toll Free: 1-877-452-7184

Banks, Brokers or collect calls: 416-304-2011

Email: assistance@laurelhill.com

Forward-Looking Statements

Certain statements contained in this press release may be deemed

"forward-looking statements". All statements in this release, other than

statements of historical fact, that address events or developments that Osisko,

Agnico Eagle and Yamana expect to occur, are forward looking statements. Forward

looking statements are statements that are not historical facts and are

generally, but not always, identified by the words "expects", "plans",

"anticipates", "believes", "intends", "estimates", "projects", "potential",

"scheduled" and similar expressions, or that events or conditions "will",

"would", "may", "could" or "should" occur including, without limitation, the

satisfaction of all technical, economical, regulatory and financial conditions

in order to complete the Arrangement between Osisko, Agnico Eagle and Yamana,

the realization of all expected benefits of this Arrangement, and the view on

(i) the quality and the potential of Osisko's exploration and mining assets,

(ii) the consideration offered to Osisko shareholders, (iii) the potential of

the New Osisko and (iv) the value of the Goldcorp common shares and offer.

Although Osisko, Agnico Eagle and Yamana believe the expectations expressed in

such forward-looking statements are based on reasonable assumptions, such

statements are not guarantees of future performance and actual results may

differ materially from those in forward looking statements.

Factors that could cause the actual results to differ materially from those in

forward-looking statements include, gold prices, results of exploration and

development activities, the Corporation's limited experience with production and

development stage mining operations uninsured risks, regulatory changes, defects

in title, availability of personnel, materials and equipment, timeliness of

government or court approvals, actual performance of facilities, equipment and

processes relative to specifications and expectations, unanticipated

environmental impacts on operations market prices, continued availability of

capital and financing and general economic, market or business conditions. These

factors are discussed in greater detail in Osisko, Agnico Eagle and Yamana's

most recent Annual Information Forms, which are filed on SEDAR and also provide

additional general assumptions in connection with these statements. Osisko,

Agnico Eagle and Yamana caution that the foregoing list of important factors is

not exhaustive. Investors and others who base themselves on the forward looking

statements contained herein should carefully consider the above factors as well

as the uncertainties they represent and the risk they entail. Osisko, Agnico

Eagle and Yamana believe that the expectations reflected in those

forward-looking statements are reasonable, but no assurance can be given that

these expectations will prove to be correct and such forward-looking statements

included in this press release should not be unduly relied upon. These

statements speak only as of the date of this press release. Osisko, Agnico Eagle

and Yamana undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information, future

events or otherwise, other than as required by applicable law.

FOR FURTHER INFORMATION PLEASE CONTACT:

John Burzynski

Vice-President Corporate Development

(416) 363-8653

www.osisko.com

Sylvie Prud'homme

Director of Investor Relations

(514) 735-7131

Toll Free: 1-888-674-7563

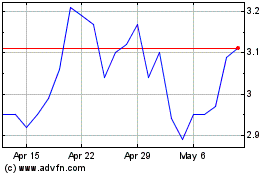

Osisko Mining (TSX:OSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

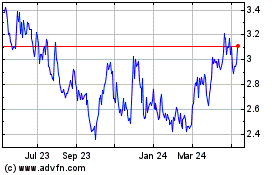

Osisko Mining (TSX:OSK)

Historical Stock Chart

From Apr 2023 to Apr 2024