UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

March 6, 2015

Foot Locker, Inc.

(Exact Name of Registrant as Specified in

Charter)

| New York |

1-10299 |

13-3513936 |

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number)

|

(IRS Employer

Identification No.) |

| 112 West 34th Street, New York, New York |

10120 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (212) 720-3700

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. | Results of Operations and Financial Condition. |

On March 6, 2015, Foot

Locker, Inc. (the “Company”) issued a press release announcing its operating results for the fourth quarter and full-year

2014. The press release includes a non-GAAP financial measure of fourth quarter and full-year 2014 net income excluding the after-tax

integration and transaction costs associated with the acquisition of Runners Point Group, the write-down of a trademark and the

impairment of certain other trademarks, and a gain on the sale of a property. The release also includes a non-GAAP

financial measure of fourth quarter and full-year 2013 net income excluding the after-tax integration and transaction costs associated

with the acquisition of Runners Point Group, costs associated with the closing of the CCS retail stores, and a tax benefit resulting

from the conclusion of a foreign tax audit which enabled a reduction in tax reserves established in prior periods. The Company

believes these non-GAAP financial measures provide useful information to investors because they allow for a more direct comparison

of the Company’s performance for the fourth quarter and full-year 2014 to the Company’s performance in the comparable

prior-year periods. The non-GAAP financial measures are provided in addition to, and not as an alternative to, the Company’s

reported results prepared in accordance with GAAP. A reconciliation to GAAP is provided in the Condensed Consolidated Statements

of Operations attached to the press release. A copy of the press release is furnished as Exhibit 99.1, which, in its entirety,

is incorporated herein by reference.

The Company is hosting

a conference call on March 6, 2015 to discuss its fourth quarter and full-year 2014 financial results, provide its current outlook

for 2015, comment on the status of its current initiatives, and discuss trends in its business and the athletic industry. A non-GAAP

to GAAP reconciliation schedule for the non-GAAP measures referred to in the Company’s prepared conference call remarks is

attached as Exhibit 99.2. The Company believes these non-GAAP financial measures provide useful information to investors in evaluating

the Company’s performance relative to its long-term financial objectives and allows for a more direct comparison of the Company’s

performance for 2014 as compared with prior years.

| Item 9.01. | Financial Statements

and Exhibits. |

| | |

| (d) |

Exhibits. |

| |

|

| No. |

Description |

| |

|

| 99.1 |

Press Release of Foot Locker, Inc. dated March 6, 2015 reporting operating results for the fourth quarter and full-year 2014 |

| |

|

| 99.2 |

Reconciliation of Non-GAAP Measures |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FOOT LOCKER, INC. |

|

| |

|

|

| Date: March 6, 2015 |

By: |

/s/

Lauren B. Peters |

|

| |

|

Name: |

Lauren B. Peters |

|

| |

|

Title: |

Executive Vice President and |

|

| |

|

|

Chief Financial Officer |

|

Exhibit

99.1

N

E W S R E L E A S E

| Contact: |

|

John A. Maurer |

| |

|

Vice President, |

| |

|

Treasurer and Investor Relations |

| |

|

Foot Locker, Inc. |

| |

|

(212) 720-4092 |

FOOT LOCKER, INC. REPORTS 2014 FOURTH QUARTER

AND FULL YEAR RESULTS

| · | Fourth Quarter Net Income of $1.01 Per Share, 25 Percent Above Last Year |

| · | Comparable-Store Sales Increased 10.2 Percent in Fourth Quarter |

| · | Annual Sales and Profit Highest Ever As Athletic Company |

| · | Fifth Consecutive Year With Double-Digit Earnings Per Share Increase |

NEW YORK, NY, March 6, 2015 – Foot Locker,

Inc. (NYSE: FL), the New York-based specialty athletic retailer, today reported financial results for its fourth quarter and full

year ended January 31, 2015.

Fourth Quarter Results

The Company reported net income of $146 million

for the 13 weeks ended January 31, 2015. This equates to earnings of $1.01 per share, an increase of 25 percent over earnings per

share of $0.81 for the 13-week period ended February 1, 2014.

Fourth quarter comparable-store sales increased

10.2 percent. Total fourth quarter sales increased 6.7 percent, to $1,911 million this year, compared with sales of $1,791 million

in 2013. Excluding the effect of foreign currency fluctuations, total sales for the fourth quarter increased 10.1 percent.

During the fourth quarter, the Company realized

a gain from the sale of a property and wrote down a trademark. On a non-GAAP basis, excluding these one-time events, the Company

earned $1.00 per share, a 22 percent increase over the comparable 13-week non-GAAP earnings per share of $0.82 in 2013. A reconciliation

of GAAP to non-GAAP results is included in the tables below.

Fiscal Year Results

For fiscal year 2014, the Company reported net

income of $520 million, or $3.56 per share, compared to net income of $429 million, or $2.85 per share, in 2013. On a non-GAAP

basis, earnings were $3.58 per share in 2014, an increase of 25 percent over the $2.87 per share earned on a comparable basis in

2013. In 2014 the Company generated its fifth consecutive double-digit percentage increase in annual earnings per share and its

fourth consecutive year of record earnings as Foot Locker, Inc.

Total sales increased 9.9 percent in 2014 to $7,151

million, the highest level of sales ever recorded by the Company as Foot Locker, Inc., compared with sales of $6,505 million last

year. Comparable-store sales increased 8 percent in 2014.

“We remain intently focused on executing

our key strategies,” said Richard Johnson, President and Chief Executive Officer. “Along with elevating the level of

investments in our stores, digital capabilities, support facilities, and --- most importantly --- our people, that focus has enabled

us to develop into a high-performance company that has reached record heights of financial and operational success. In fact, we

have approached or surpassed many of the goals in our most recent set of long-term objectives, and I am very proud of the entire

team at Foot Locker, Inc. for this excellent accomplishment.”

-MORE-

Foot Locker, Inc. 112 West 34th Street,

New York, NY 10120

“Looking ahead,” Mr. Johnson continued,

“we intend to stay focused on our strategic priorities and seize opportunities to raise the bar again and achieve our next

set of financial milestones, the details of which we look forward to sharing on March 16th at our New York headquarters.”

“Our strong top-line

performance was accompanied by continued discipline in managing expenses,” added Lauren Peters, Executive Vice President

and Chief Financial Officer. “As a result, we set many new records for our Company in 2014, including increasing our gross

margin rate to 33.2 percent of sales and improving our annual SG&A expense rate to below 20 percent for the first time.”

“Our EBIT margin increased to 11.4 percent

of sales and net income margin improved to 7.3 percent, both surpassing our long-term goals,” continued Ms. Peters. “Return

on invested capital improved further to 15 percent, our sales per gross square foot posted a solid increase to $490, and inventory

turns also improved significantly.”

Financial Position

The Company’s merchandise inventory

at January 31, 2015 was $1,250 million, which was $30 million, or 2.5 percent, higher than at the end of last year.

At year-end 2014, the Company’s cash and

cash equivalents totaled $967 million, while the debt on its balance sheet was $134 million. During the fourth quarter of 2014,

the Company repurchased 2.34 million shares of its common stock for $131 million. For the full year, the Company repurchased 5.9

million shares for $305 million.

“As

previously announced in February, our Board of Directors

approved a new $1 billion share repurchase program,” said Mr. Johnson, “with the previous $600 million program having

been substantially completed. Our strong financial position also enabled the Board to authorize another double-digit percentage

increase in our quarterly dividend, to 25 cents per share, and approve a $220 million capital expenditure program for 2015.”

Store Base Update

The Company opened 86 new stores, remodeled/relocated

319 stores, and closed 136 stores during fiscal 2014. As of January 31, 2015, the Company operated 3,423 stores in 23 countries

in North America, Europe, Australia, and New Zealand. In addition, 51 franchised Foot Locker stores were operating in the Middle

East and South Korea, as well as 27 franchised Runners Point and Sidestep stores in Germany and Switzerland.

The Company is hosting

a live conference call at 9:00 a.m. (EST) today to discuss these results and provide its initial outlook for 2015, comment on

the status of its current initiatives, and discuss trends in its business and the athletic industry. This conference call may

be accessed live by dialing 888-771-4371 (U.S. and Canada) or 847-585-4405 (International) using the passcode 38946260, or via

the Investor Relations section of the Foot Locker, Inc. website at http://www.footlocker-inc.com. Please log on to the

website 15 minutes prior to the call in order to download any necessary software. An archived replay of the conference call can

be accessed approximately one hour following the end of the call at 888-843-7419 with the passcode 38946260, through March 27,

2015. A replay of the call will also

be available via webcast from the same Investor Relations section of the Foot Locker, Inc. website at http://www.footlocker-inc.com.

Disclosure Regarding Forward-Looking

Statements

This report contains forward-looking statements

within the meaning of the federal securities laws. Other than statements of historical facts, all statements which address activities,

events, or developments that the Company anticipates will or may occur in the future, including, but not limited to, such things

as future capital expenditures, expansion, strategic plans, financial objectives, dividend payments, stock repurchases, growth

of the Company’s business and operations, including future cash flows, revenues, and earnings, and other such matters, are

forward-looking statements. These forward-looking statements are based on many assumptions and factors which are detailed in the

Company’s filings with the Securities and Exchange Commission, including the effects of currency fluctuations, customer demand,

fashion trends, competitive market forces, uncertainties related to the effect of competitive products and pricing, customer acceptance

of the Company’s merchandise mix and retail locations, the Company’s reliance on a few key vendors for a majority of

its merchandise purchases (including a significant portion from one key vendor), pandemics and similar major health concerns, unseasonable

weather, deterioration of global financial markets, economic conditions worldwide, deterioration of business and economic conditions,

any changes in business, political and economic conditions due to the threat of future terrorist activities in the United States

or in other parts of the world and related U.S. military action overseas, the ability of the Company to execute its business and

strategic plans effectively with regard to each of its business units, and risks associated with global product sourcing, including

political instability, changes in import regulations, and disruptions to transportation services and distribution.

For additional discussion on risks and uncertainties

that may affect forward-looking statements, see “Risk Factors” disclosed in the 2013 Annual Report on Form 10-K. Any

changes in such assumptions or factors could produce significantly different results. The Company undertakes no obligation to update

forward-looking statements, whether as a result of new information, future events, or otherwise.

-MORE-

FOOT LOCKER, INC.

Condensed Consolidated Statements of Operations

(unaudited)

Periods ended January 31, 2015 and February 1,

2014

(In millions, except per share amounts)

| |

|

Fourth

Quarter

2014 |

|

Fourth

Quarter

2013 |

|

|

Full Year

2014 |

|

|

Full Year

2013 |

|

|

| Sales |

|

$ |

1, 911 |

|

$ |

1,791 |

|

|

$ |

7,151 |

|

|

$ |

6,505 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

1,282 |

|

|

1,209 |

|

|

|

4,777 |

|

|

|

4,372 |

|

|

| SG&A |

|

|

375 |

|

|

365 |

|

|

|

1,426 |

|

|

|

1,334 |

|

|

| Depreciation and amortization |

|

|

33 |

|

|

36 |

|

|

|

139 |

|

|

|

133 |

|

|

| Impairment and other charges |

|

|

1 |

|

|

- |

|

|

|

4 |

|

|

|

2 |

|

|

| Interest expense, net |

|

|

2 |

|

|

1 |

|

|

|

5 |

|

|

|

5 |

|

|

| Other income |

|

|

(6 |

) |

|

(1 |

) |

|

|

(9 |

) |

|

|

(4 |

) |

|

| |

|

|

1,687 |

|

|

1,610 |

|

|

|

6,342 |

|

|

|

5,842 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before taxes |

|

$ |

224 |

|

$ |

181 |

|

|

$ |

809 |

|

|

$ |

663 |

|

|

| Income tax expense |

|

|

78 |

|

|

60 |

|

|

|

289 |

|

|

|

234 |

|

|

| Net income |

|

$ |

146 |

|

$ |

121 |

|

|

$ |

520 |

|

|

$ |

429 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted EPS |

|

$ |

1.01 |

|

$ |

0.81 |

|

|

$ |

3.56 |

|

|

$ |

2.85 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average diluted shares outstanding |

|

|

144.3 |

|

|

148.4 |

|

|

|

146.0 |

|

|

|

150.5 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fourth

Quarter

2014 |

|

Fourth

Quarter

2013 |

|

|

Full Year

2014 |

|

|

Full Year

2013 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Results, After Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| RPG acquisition costs (1) |

|

|

|

|

$ |

1 |

|

|

$ |

2 |

|

|

$ |

5 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Impairment and other charges (2) |

|

$ |

1 |

|

|

|

|

|

|

3 |

|

|

|

1 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on property sale (3) |

|

|

(3 |

) |

|

|

|

|

|

(3 |

) |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tax items (4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

(3 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income |

|

$ |

144 |

|

$ |

122 |

|

|

$ |

522 |

|

|

$ |

432 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP diluted EPS |

|

$ |

1.00 |

|

$ |

0.82 |

|

|

$ |

3.58 |

|

|

$ |

2.87 |

|

|

Footnote to explain adjustments

| (1) | Integration and transaction costs associated with the acquisition and integration of Runners Point

Group. |

| (2) | For the fourth quarter of 2014, includes the write-down of a trademark. For the full year 2014,

also includes the impairment of certain other trademarks. For 2013, includes store closing costs related to CCS. |

| (3) | Gain on sale of a property. |

| (4) | The Company recorded a tax benefit of $3 million, or $0.02 per diluted share, related to the conclusion

of a foreign tax audit that resulted in a reduction of tax reserves established in prior periods. |

-MORE-

FOOT LOCKER, INC.

Condensed Consolidated Balance Sheets

(unaudited)

(In millions)

| | |

January 31,

2015 | | |

February 1,

2014 | |

| Assets | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash, cash equivalents and short-term investments | |

$ | 967 | | |

$ | 867 | |

| Merchandise inventories | |

| 1,250 | | |

| 1,220 | |

| Other current assets | |

| 239 | | |

| 263 | |

| | |

| 2,456 | | |

| 2,350 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 620 | | |

| 590 | |

| Deferred tax assets | |

| 221 | | |

| 241 | |

| Other assets | |

| 280 | | |

| 306 | |

| | |

$ | 3,577 | | |

$ | 3,487 | |

| | |

| | | |

| | |

| Liabilities and Shareholders’ Equity | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 301 | | |

$ | 263 | |

| Accrued and other liabilities | |

| 393 | | |

| 360 | |

| Current portion of capital lease obligations | |

| 2 | | |

| 3 | |

| | |

| 696 | | |

| 626 | |

| | |

| | | |

| | |

| Long-term debt and obligations under capital leases | |

| 132 | | |

| 136 | |

| Other liabilities | |

| 253 | | |

| 229 | |

| SHAREHOLDERS’ EQUITY | |

| 2,496 | | |

| 2,496 | |

| | |

$ | 3,577 | | |

$ | 3,487 | |

-MORE-

FOOT LOCKER, INC.

Store and Square Footage

(unaudited)

Store activity is as follows:

| | |

February 1,

2014 | |

Opened | |

Closed | |

January 31,

2015 | |

Relocations

/Remodels |

| Foot Locker US | |

1,044 |

| |

11 | |

40 | |

1,015 |

| |

94 |

| Foot Locker Europe | |

604 |

| |

13 | |

14 | |

603 |

| |

40 |

| Foot Locker Canada | |

128 |

| |

- | |

2 | |

126 |

| |

31 |

| Foot Locker Asia Pacific | |

92 |

| |

3 | |

4 | |

91 |

| |

4 |

| Lady Foot Locker/SIX:02 | |

257 |

| |

8 | |

52 | |

213 |

| |

51 |

| Kids Foot Locker | |

336 |

| |

28 | |

7 | |

357 |

| |

25 |

| Footaction | |

277 |

| |

2 | |

7 | |

272 |

| |

20 |

| Champs Sports | |

542 |

| |

11 | |

6 | |

547 |

| |

50 |

| Runners Point | |

115 |

| |

5 | |

4 | |

116 |

| |

4 |

| Sidestep | |

78 |

| |

5 | |

- | |

83 |

| |

- |

| Total | |

3,473 |

| |

86 | |

136 | |

3,423 |

| |

319 |

Selling and gross square footage are as follows:

| |

|

February 1, 2014 |

|

|

January 31, 2015 |

| (in thousands) |

|

Selling |

|

Gross |

|

|

Selling |

|

Gross |

| Foot Locker US |

|

2,492 |

|

|

4,301 |

|

|

|

2,494 |

|

|

4,298 |

|

| Foot Locker Europe |

|

836 |

|

|

1,815 |

|

|

|

846 |

|

|

1,839 |

|

| Foot Locker Canada |

|

270 |

|

|

423 |

|

|

|

270 |

|

|

422 |

|

| Foot Locker Asia Pacific |

|

126 |

|

|

205 |

|

|

|

125 |

|

|

204 |

|

| Lady Foot Locker/SIX:02 |

|

351 |

|

|

592 |

|

|

|

299 |

|

|

501 |

|

| Kids Foot Locker |

|

477 |

|

|

830 |

|

|

|

529 |

|

|

912 |

|

| Footaction |

|

811 |

|

|

1,287 |

|

|

|

789 |

|

|

1,258 |

|

| Champs Sports |

|

1,894 |

|

|

2,886 |

|

|

|

1,913 |

|

|

2,927 |

|

| Runners Point |

|

143 |

|

|

245 |

|

|

|

143 |

|

|

244 |

|

| Sidestep |

|

71 |

|

|

121 |

|

|

|

75 |

|

|

129 |

|

| Total |

|

7,471 |

|

|

12,705 |

|

|

|

7,483 |

|

|

12,734 |

|

- XXX -

Exhibit 99.2

Reconciliation of Non-GAAP Measures

In the following tables, the Company has

presented certain financial measures and ratios identified as non-GAAP. The Company believes this non-GAAP information is a useful

measure to investors because it allows for a more direct comparison of the Company’s performance for 2014 as compared with

prior years and is useful in assessing the Company’s progress in achieving its long-term financial objectives. The 2014 and

2013 results represent the 52 weeks ended January 31, 2015 and February 1, 2014, respectively, as compared with the 53 weeks in

the 2012 reporting year. The following represents a reconciliation of the non-GAAP measures:

| | |

2014 | | |

2013 | | |

2012 | |

| | |

(in millions, except per share amounts) | |

| Sales: | |

| | | |

| | | |

| | |

| Sales | |

$ | 7,151 | | |

$ | 6,505 | | |

$ | 6,182 | |

| 53rd week | |

| — | | |

| — | | |

| 81 | |

| Sales excluding 53rd week (non-GAAP) | |

$ | 7,151 | | |

$ | 6,505 | | |

$ | 6,101 | |

| Pre-tax income: | |

| | | |

| | | |

| | |

| Income before income taxes | |

$ | 809 | | |

$ | 663 | | |

$ | 607 | |

| Pre-tax amounts excluded from GAAP: | |

| | | |

| | | |

| | |

| Runners Point Group integration and acquisition costs | |

| 2 | | |

| 6 | | |

| — | |

| Impairment and other charges | |

| 4 | | |

| 2 | | |

| 12 | |

| Gain on sale of real estate | |

| (4 | ) | |

| — | | |

| — | |

| 53rd week | |

| — | | |

| — | | |

| (22 | ) |

| Total pre-tax amounts excluded | |

| 2 | | |

| 8 | | |

| (10 | ) |

| Income before income taxes (non-GAAP) | |

$ | 811 | | |

$ | 671 | | |

$ | 597 | |

| Calculation of Earnings Before Interest and Taxes (EBIT): | |

| | | |

| | | |

| | |

| Income before income taxes | |

$ | 809 | | |

$ | 663 | | |

$ | 607 | |

| Interest expense, net | |

| 5 | | |

| 5 | | |

| 5 | |

| EBIT | |

$ | 814 | | |

$ | 668 | | |

$ | 612 | |

| Income before income taxes (non-GAAP) | |

$ | 811 | | |

$ | 671 | | |

$ | 597 | |

| Interest expense, net | |

| 5 | | |

| 5 | | |

| 5 | |

| EBIT (non-GAAP) | |

$ | 816 | | |

$ | 676 | | |

$ | 602 | |

| EBIT margin % | |

| 11.4 | % | |

| 10.3 | % | |

| 9.9 | % |

| EBIT margin % (non-GAAP) | |

| 11.4 | % | |

| 10.4 | % | |

| 9.9 | % |

| After-tax income: | |

| | | |

| | | |

| | |

| Net income | |

$ | 520 | | |

$ | 429 | | |

$ | 397 | |

| After-tax amounts excluded from GAAP: | |

| | | |

| | | |

| | |

| Runners Point Group acquisition and integration costs | |

| 2 | | |

| 5 | | |

| — | |

| Impairment and other charges | |

| 3 | | |

| 1 | | |

| 7 | |

| Gain on sale of property | |

| (3 | ) | |

| — | | |

| — | |

| 53rd week | |

| — | | |

| — | | |

| (14 | ) |

| Settlement of foreign tax audits | |

| — | | |

| (3 | ) | |

| (9 | ) |

| Canadian tax rate changes | |

| — | | |

| — | | |

| (1 | ) |

| Net income (non-GAAP) | |

$ | 522 | | |

$ | 432 | | |

$ | 380 | |

| Net income margin % | |

| 7.3 | % | |

| 6.6 | % | |

| 6.4 | % |

| Net income margin % (non-GAAP) | |

| 7.3 | % | |

| 6.6 | % | |

| 6.2 | % |

| Diluted earnings per share: | |

| | | |

| | | |

| | |

| Net income | |

$ | 3.56 | | |

$ | 2.85 | | |

$ | 2.58 | |

| Runners Point Group acquisition and integration costs | |

| 0.01 | | |

| 0.03 | | |

| — | |

| Impairment and other charges | |

| 0.02 | | |

| 0.01 | | |

| 0.05 | |

| Gain on sale of property | |

| (0.01 | ) | |

| — | | |

| — | |

| 53rd week | |

| — | | |

| — | | |

| (0.09 | ) |

| Settlement of foreign tax audits | |

| — | | |

| (0.02 | ) | |

| (0.06 | ) |

| Canadian tax rate changes | |

| — | | |

| — | | |

| (0.01 | ) |

| Net income (non-GAAP) | |

$ | 3.58 | | |

$ | 2.87 | | |

$ | 2.47 | |

The Company estimates the tax effect of

the non-GAAP adjustments by applying its marginal tax rate to each of the respective items.

During 2013 and 2012, the Company recorded

benefits of $3 million and $9 million, or $0.02 per diluted share and $0.06 per diluted share, respectively, to reflect the settlement

of foreign tax audits, which resulted in a reduction in tax reserves established in prior periods. Additionally in 2012, the Company

recorded a benefit of $1 million, or $0.01 per diluted share, to reflect the repeal of the last two stages of certain Canadian

provincial tax rate changes.

When assessing Return on Invested Capital

(“ROIC”), the Company adjusts its results to reflect its operating leases as if they qualified for capital lease treatment.

Operating leases are the primary financing vehicle used to fund store expansion and, therefore, we believe that the presentation

of these leases as if they were capital leases is appropriate. Accordingly, the asset base and net income amounts are adjusted

to reflect this in the calculation of ROIC. ROIC, subject to certain adjustments, is also used as a measure in executive long-term

incentive compensation.

The closest GAAP measure is Return on Assets

(“ROA”) and is also represented below. ROA increased to 14.7 percent as compared with 12.5 percent in the prior year

reflecting the Company’s overall strong performance in 2014. Our ROIC improvement is due to an increase in our earnings before

interest and income taxes, partially offset by an increase in our average invested capital, primarily related to an increase in

capitalized operating leases. This reflected the effect of opening larger stores, and resulting additional rent, supporting the

various vendor shop-in-shop initiatives.

| | |

| 2014 | | |

| 2013 | | |

| 2012 | |

| ROA (1) | |

| 14.7 | % | |

| 12.5 | % | |

| 12.4 | % |

| ROIC % (non-GAAP)(2) | |

| 15.0 | % | |

| 14.1 | % | |

| 14.2 | % |

| (1) |

Represents net income of $520 million, $429 million, and $397

million divided by average total assets of $3,532 million, $3,427 million, and $3,209 million for 2014, 2013, and 2012, respectively. |

| |

|

| (2) |

See below for the calculation of ROIC. |

| |

| |

2014 | | |

2013 | | |

2012 | |

| |

| |

(in millions) | |

| |

EBIT (non-GAAP) | |

$ | 816 | | |

$ | 676 | | |

$ | 602 | |

| |

+ Rent expense | |

| 635 | | |

| 600 | | |

| 560 | |

| |

- Estimated depreciation on capitalized operating leases (3) | |

| (482 | ) | |

| (443 | ) | |

| (409 | ) |

| |

Net operating profit | |

| 969 | | |

| 833 | | |

| 753 | |

| |

- Adjusted income tax expense (4) | |

| (347 | ) | |

| (298 | ) | |

| (274 | ) |

| |

= Adjusted return after taxes | |

$ | 622 | | |

$ | 535 | | |

$ | 479 | |

| |

Average total assets | |

$ | 3,532 | | |

$ | 3,427 | | |

$ | 3,209 | |

| |

- Average cash, cash equivalents and short-term investments | |

| (917 | ) | |

| (898 | ) | |

| (890 | ) |

| |

- Average non-interest bearing current liabilities | |

| (659 | ) | |

| (630 | ) | |

| (592 | ) |

| |

- Average merchandise inventories | |

| (1,235 | ) | |

| (1,194 | ) | |

| (1,118 | ) |

| |

+ Average estimated asset base of capitalized operating leases (3) | |

| 2,093 | | |

| 1,829 | | |

| 1,552 | |

| |

+ 13-month average merchandise inventories | |

| 1,325 | | |

| 1,269 | | |

| 1,200 | |

| |

= Average invested capital | |

$ | 4,139 | | |

$ | 3,803 | | |

$ | 3,361 | |

| |

ROIC % | |

| 15.0 | % | |

| 14.1 | % | |

| 14.2 | % |

| (3) |

The determination of the capitalized operating leases and the

adjustments to income have been calculated on a lease-by-lease basis and have been consistently calculated in each of the

years presented above. Capitalized operating leases represent the best estimate of the asset base that would be recorded for

operating leases as if they had been classified as capital or as if the property were purchased. The present value of operating

leases is discounted using various interest rates ranging from 2.8 percent to 14.5 percent, which represent the Company’s

incremental borrowing rate at inception of the lease. |

| |

|

| (4) |

The adjusted income tax expense represents the marginal tax rate applied to

net operating profit for each of the periods presented. |

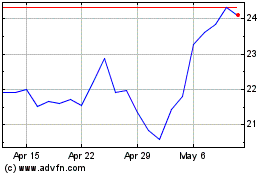

Foot Locker (NYSE:FL)

Historical Stock Chart

From Mar 2024 to Apr 2024

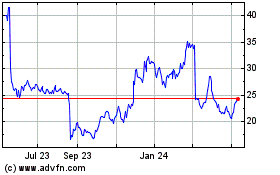

Foot Locker (NYSE:FL)

Historical Stock Chart

From Apr 2023 to Apr 2024