Hershey Trust Agrees To Changes -- WSJ

July 23 2016 - 2:03AM

Dow Jones News

By Annie Gasparro

Hershey Co.'s largest shareholder -- a trust that oversees

billions of dollars for a local, nonprofit school -- has agreed to

make significant governance changes that could affect the future of

the chocolate company, according to people familiar with the

matter.

Hershey Trust Co. has agreed on terms of a settlement with

Pennsylvania's top law-enforcement officer, which has been

investigating the trust board over allegations of excessive

compensation and conflicts of interest.

The parties are in the process of drafting a legal document

outlining the terms, which would lead to resignations of some trust

board members, these people said. The settlement would include

enforcing a cap on compensation and term limits of board members,

according to these people.

With its roughly 30% stake in Hershey and 81% of its voting

power, the Hershey Trust plays a key role in the future of the

chocolate company.

A few weeks ago, Mondelez International Inc., maker of Oreo

cookies and Ritz crackers, made a $23 billion bid for Hershey. The

offer was rejected unanimously by Hershey's corporate board, which

includes three members of the trust's board.

"We have reached an agreement in principle and are working on

the final details in productive discussions with the Office of the

Attorney General," a spokesman for the trust said Friday.

First Deputy Attorney General Bruce Castor said in an email

Friday that he met with board members and a lawyer for the trust on

Thursday and agreed "in principal to a series of changes." He

declined to give further details on the proposed deal.

Industry experts say the upheaval, and a nearly entirely new

10-person board, could give Mondelez or other potential bidders an

opening to try to buy the company.

Any future offers for Hershey that are accepted by the corporate

board would require the approval of the trust as well as the

Pennsylvania Attorney General's Office, which has oversight powers

over the trust and can take it to court to stop a sale if it thinks

it will hurt the local economy.

The Hershey Trust has opposed efforts to sell the company in the

past, as it has been under pressure by the local community to keep

Hershey independent. In 2002, the trust ultimately rejected an

offer by Wm. Wrigley Jr. Co.

The trust's board has a legal obligation to act in the best

interest of the Milton Hershey School for underprivileged children.

Proceeds from the trust's investments provide the revenue to run

the school, which has about 2,000 students, many of whom get jobs

and internships within the Hershey empire, including the chocolate

factory in town, the Hershey resort and the local theme park.

But the trust's roughly $12 billion endowment is largely tied up

in Hershey stock, making its portfolio heavily concentrated. Some

say selling the company would benefit the school by diversifying

the trust's assets and generating higher returns.

At issue in the current investigation by the attorney general's

office were concerns about alleged overpayments for board members,

reimbursements for exorbitant travel expenses and term limits that

exceed 10 years, according to internal memos from the attorney

general's office reviewed by The Wall Street Journal.

Under the settlement, several board members would resign at the

end of the year, according to people familiar with the matter. This

would be in addition to the four who have resigned in the past

several months.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

July 23, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

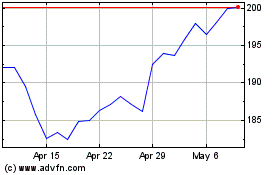

Hershey (NYSE:HSY)

Historical Stock Chart

From Mar 2024 to Apr 2024

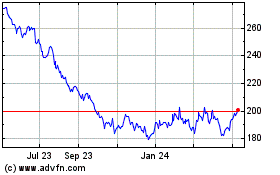

Hershey (NYSE:HSY)

Historical Stock Chart

From Apr 2023 to Apr 2024