Intesa Sanpaolo Cuts Dividend Guidance for Year but Confirms EUR10 Billion 2014-17 Payout -- Update

February 03 2017 - 10:40AM

Dow Jones News

By Giovanni Legorano

ROME--Italian bank Intesa Sanpaolo SpA on Friday cut its

guidance on the dividend it aims to pay for this year, but

confirmed it would distribute 3 billion euros ($3.23 billion) in

dividends for last year, after it reported a rise in both its

fourth-quarter and full-year net profit.

Intesa Chief Executive Carlo Messina said the bank planned to

pay EUR3.4 billion in dividends for 2016 because of the challenging

market environment, while last year it had said it aimed to pay

EUR4 billion.

"I decided to take a more conservative approach and would prefer

to over-deliver in an environment like this," Mr. Messina told

analysts.

Still, Intesa also confirmed its target of a total dividend

payout of EUR10 billion over the period of 2014 to 2017.

The bank said its fourth-quarter net profit soared to EUR776

million, from EUR13 million in the same period of 2015, when the

bank was hit by a one-off contribution to a bailout fund set up to

rescue four smaller Italian lenders.

The bank said that without one-off contributions to a national

resolution fund for banks and other funds, as well as a writedown

of its stake in Atlante, a rescue fund for banks, its net profit

for the fourth quarter of 2016 would have been EUR1.15 billion.

Net profit for the year rose 14% to EUR3.11 billion.

Intesa's shares pared gains immediately after the release of its

fourth-quarter results but then rose again and were recently up

3.4% at EUR2.25.

The bank has been under the spotlight after it said last week it

was assessing a potential tie-up with Assicurazioni Generali SpA as

part of its strategy of growth in the insurance, asset-management

and private banking sectors.

In a statement earlier Friday, the bank reiterated a tie-up with

Generali was one of the many options the bank was assessing,

denying press reports that the bank was ready to put a takeover

offer on the table.

"We are players in the European context, ready to seize growth

opportunities on condition that we maintain unchanged our ability

to significantly reward our shareholders and our capital strength,"

Mr. Messina said after the release of the fourth-quarter results.

He told analysts the bank was still assessing whether a tie-up with

Generali fits with Intesa's strategic priorities.

Apart from the one-off charges, which analysts said would weaken

most Italian banks' results, the lender posted higher revenue

helped by rising commissions and trading income.

Net commissions for the quarter rose 7% to EUR2.02 billion from

the same three months a year earlier, as the bank continued with

its transition to a more fee-based business.

Trading income rose more than fourfold to EUR247 million in the

fourth quarter, compared with the last quarter of 2015.

This helped compensate for declining net interest income--the

difference between what lenders earn from loans and pay for

deposits, and a key profit driver for retail banks--and higher

provisions for losses on bad loans.

However, the bank said the stock of bad loans sitting on its

balance sheet declined by 10% from the end of 2015.

The bank also said it had agreed to sell a 4.88% stake in the

Bank of Italy to a number of Italian banking foundations and

pension funds for a total EUR366 million.

Intesa will hold a 27.81% stake in the Bank of Italy after the

share sale. In 2014, the central bank's capital was raised to

EUR7.5 billion from EUR156,000, a level that hasn't changed since

1936, when local banks recapitalized the Bank of Italy. At the

time, the Italian Parliament also set a 3% limit on stakes that

individual investors could own in the central bank.

Write to Giovanni Legorano at Giovanni.Legorano@wsj.com

(END) Dow Jones Newswires

February 03, 2017 11:25 ET (16:25 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

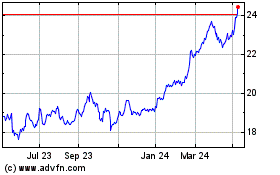

Generali (BIT:G)

Historical Stock Chart

From Mar 2024 to Apr 2024

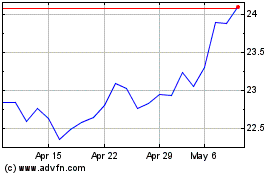

Generali (BIT:G)

Historical Stock Chart

From Apr 2023 to Apr 2024