UniCredit Falls to Net Loss on Provisions for Bad Loans

February 09 2017 - 9:36AM

Dow Jones News

By Giovanni Legorano

ROME-Italy's UniCredit SpA posted a multibillion fourth-quarter

net loss, as expected, while a EUR13 billion share ($13.87 billion)

sale launched on Monday to shore up the Italian lender's finances

continues.

The bank said it swung to a net loss of EUR13.56 billion in the

three months to end-December compared with a net profit of EUR153

million in the same period the previous year, reflecting a clean-up

of its balance sheet designed ultimately to strengthen its capital

base and increase profitability.

Unicredit said at the end of last month that it expected a net

loss of EUR11.8 billion for the whole year, a figure which it

confirmed on Thursday.

The bank said the annual loss was mainly the result of EUR12.2

billion in one-time charges for bad-loan provisions and other items

that it announced at the end of last year, as part of a strategic

plan put together by new Chief Executive Jean-Pierre Mustier.

Provisions for bad loans stood at EUR9.59 billion at Dec.

31.

-Write to Giovanni Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

February 09, 2017 10:21 ET (15:21 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

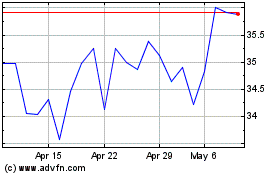

Unicredit (BIT:UCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

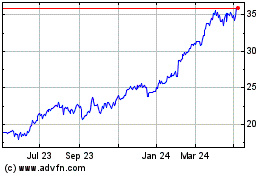

Unicredit (BIT:UCG)

Historical Stock Chart

From Apr 2023 to Apr 2024