What GM Is Paying for European Exit--Heard on the Street

March 06 2017 - 8:24AM

Dow Jones News

By Stephen Wilmot

General Motors is so eager to offload its loss-making European

arm that it is paying Peugeot to buy it.

The French car manufacturer has agreed to give GM EUR1.32

billion for Opel, a historic German brand, and Vauxhall, a British

one.

This lowly valuation equates to 7.4% of sales, compared with 12%

on average for European mass-market car makers, according to UBS.

Only about half of the purchase price will be in cash. The rest

will take the form of warrants that give GM the right to buy and

immediately sell new Peugeot shares in between five and nine years'

time.

Peugeot and French bank BNP Paribas are also jointly paying

EUR0.9 billion in cash for Opel-Vauxhall's financing arm. That

brings the value of the deal to GM up to about EUR2.2 billion in

total.

On the debit side, however, GM is giving Peugeot EUR3 billion to

shoulder some of its European pension obligations, including those

concerning active workers in Germany. GM is also retaining a

European pension deficit currently valued at about EUR6.5 billion

on its balance sheet.

On a net basis, GM is therefore paying EUR0.8 billion--and more

if Peugeot's share price falls--to not quite rid itself of its

European problems. This may be the cash part of the $4 billion to

$4.5 billion write-down the U.S. auto maker announced in connection

with the deal Monday. Chief Executive Mary Barra instead emphasized

a $2 billion reduction in the company's "cash-balance requirement

under its capital-allocation framework." The spare cash could be

used to buy back shares, Ms. Barra said.

Peugeot shares jumped on news of the financial details. The car

maker has bought a big increase in European market share on the

cheap. Whether shareholders, including GM indirectly through its

warrants, continue to benefit depends mainly on Peugeot's capacity

to achieve cost savings. These are estimated at EUR1.7 billion,

which would easily justify the paltry sum the company has paid, but

are expected over an unusually long period of a decade. About

two-thirds of the savings should materialize by 2020, however.

Under pressure from politicians across the Continent, Peugeot's

Portuguese Chief Executive Carlos Tavares has carefully avoided

talk of staff cuts or factory closures. Only a fifth of the

targeted savings are supposed to come from the manufacturing

operation, which is perhaps most politically sensitive. The rest

will be sought by sharing purchasing, research, sales and capital

spending.

Mr. Tavares has been credited with working miracles on Peugeot's

cost base, but the company's capacity utilization has also

benefited from a buoyant market backdrop, particularly in its key

French market. With limited scope to cut factory capacity, profits

at Peugeot-Opel will be even more dependent on the health of the

European market than Peugeot's currently are.

The risks in this deal are substantial, but at least Peugeot

isn't paying much to take them.

Write to Stephen Wilmot at stephen.wilmot@wsj.com

(END) Dow Jones Newswires

March 06, 2017 09:09 ET (14:09 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

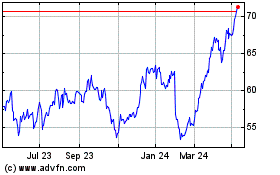

BNP Paribas (EU:BNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

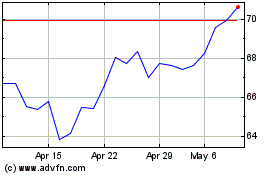

BNP Paribas (EU:BNP)

Historical Stock Chart

From Apr 2023 to Apr 2024