Yen Rises On Japan GDP, Rising Risk Aversion

March 07 2017 - 7:30PM

RTTF2

The Japanese yen strengthened against the other major currencies

in the Asian session on Wednesday, after data showed that the

Japanese economy expanded faster than previously expected in the

fourth quarter. The negative cues from Wall Street and rising

geopolitical tensions in the region also triggered safe-haven

buying.

Data from the Cabinet Office showed that Japan's gross domestic

product expanded 0.3 percent on quarter in the fourth quarter of

2016. That missed forecasts for an increase of 0.4 percent, but was

up from last month's preliminary reading of 0.2 percent. GDP gained

0.3 percent in the third quarter.

On a yearly basis, GDP was revised up to 1.2 percent from 1.0

percent, although that also missed forecasts for 1.5 percent.

The Ministry of Finance said that Japan had a current account

surplus of 65.5 billion yen in January, down 88.9 percent on year.

The headline figure was shy of forecasts for a surplus of 270.0

billion yen and down from 1,112.2 billion yen in December.

The trade balance showed a deficit of 853.4 billion yen, missing

expectations for a shortfall of 800.2 billion yen following the

806.8 billion yen surplus in the previous month.

The Bank of Japan said that overall bank lending in Japan was up

2.8 percent on year in February, coming in at 510.808 trillion yen.

That follows the 2.5 percent increase in January.

Tuesday, the yen showed mixed trading against its major rivals.

While the yen rose against the pound and the Swiss franc, it fell

against the U.S. dollar. Against the euro, the yen held steady.

In the Asian trading, the yen rose to nearly a 4-month high of

79.09 against the NZ dollar and a 1-month high of 138.68 against

the pound, from yesterday's closing quotes of 79.26 and 139.07,

respectively. If the yen extends its uptrend, it is likely to find

resistance around 78.00 against the kiwi and 136.00 against the

pound.

Against the euro and the U.S. dollar, the yen advanced to a

5-day high of 120.02 and a 2-day high of 113.61 from yesterday's

closing quotes of 120.41 and 113.98, respectively. The yen may test

resistance around 119.00 against the euro and 111.00 against the

greenback.

Against the Swiss franc and the Canadian dollar, the yen climbed

to 1-week highs of 112.08 and 84.74 from yesterday's closing quotes

of 112.47 and 84.98, respectively. The yen is likely to find

resistance around 111.00 against the franc and 83.00 against the

loonie.

Looking ahead, the German industrial production for January is

due to be released in the pre-European session at 2:00 am ET.

Swiss CPI data for February is slated for release at 3:15 am

ET.

In the New York session, Canada housing starts for February and

building permits for January, U.S. ADP non-farm employment data for

February, wholesale inventories for January and crude oil

inventories data are set to be announced.

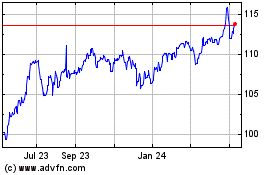

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

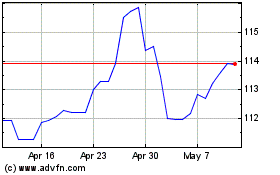

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024