Shell Deals Forsake Canada's Oil Sands -- WSJ

March 10 2017 - 2:02AM

Dow Jones News

Company pulls back from high-cost source in push to cut debt and

tighten its focus

By Michael Amon and Sarah Kent

LONDON -- Royal Dutch Shell PLC is selling nearly all of its

Canadian oil-sands developments in deals worth $7.25 billion,

deserting a region that has come to symbolize the risks for energy

companies in high-cost, carbon-intensive sources of oil.

The deal marks a another milestone in an ambitious plan by the

British-Dutch oil producer to sell off $30 billion of assets by

next year to help pay down debt and streamline the company

following its roughly $50 billion acquisition of BG Group PLC in

2016.

Selling the Canadian assets also cements a shift by Shell toward

deep-water oil projects and the fast-growing liquefied natural gas

market.

"We want to be a player that is world-class in integrated gas,

world-class in deep water," Shell Chief Executive Ben van Beurden

said in an interview at the CERAWeek conference in Houston. "We

want to have a large petrochemical portfolio. Over time we want to

be a world-class new energies player. There's only so many things

you can aspire to be at scale at and put money into."

Shell is pulling back from the Canadian oil sands only weeks

after its biggest rival, Exxon Mobil Corp., signaled that some of

its planned production had become unprofitable there at current

prices, and removed about 3.3 billion barrels of oil from its

stated reserves mostly as a result of the oil sands.

In the deals announced Thursday, Shell is selling a host of

oil-sands developments to a subsidiary of Canadian Natural

Resources Ltd., a Calgary-based company with significant oil-sands

interests. The deal includes Shell's Carmon Creek, a project it

abandoned in 2015 with a write-down of about $2 billion as oil

prices crashed.

The moves by Shell and Exxon highlight a stark reversal of

fortunes for Canada's oil sands. In the decade leading up to the

oil-price collapse of 2014, some of the world's biggest energy

companies raced to build megaprojects in northern Alberta, spending

an estimated $200 billion to tap reserves of heavy oil.

But the oil sands' high fixed costs and emissions levels, and

the long time horizons required to deliver a return on investment,

have deterred new spending there and made reserves less profitable

to tap.

Canada's oil output isn't expected to fall, because projects

that were already being built continue to add new barrels. But more

than 17 oil-sands projects that would have added about 2.5 million

barrels a day have been canceled or delayed, according to Arc

Financial. Companies have taken write-downs that total more than

$20 billion since 2012.

Tough new environmental rules, including a cap on emissions and

a carbon tax, are also chilling investment.

In an interview before the Shell announcement, Alberta Premier

Rachel Notley said she was encouraged by signs of investment

returning. Ms. Notley pointed to recent moves toward building a

pipeline that would carry more Canadian crude to the West Coast as

a positive sign for the industry, and said companies are also

finding new ways to bring down costs.

They are also finding ways to reduce emissions, so that even

with the introduction of a hard cap, "we can increase production

while staying under the cap," she said.

Shell is retaining a 10% interest in one oil-sands project known

as Athabasca, in a new joint venture with Canadian Natural. The

partnership will buy the 20% stake of Marathon Oil Corp.'s Canadian

subsidiary in Athabasca. Shell is also maintaining some processing

facilities in Alberta.

Write to Michael Amon at michael.amon@wsj.com and Sarah Kent at

sarah.kent@wsj.com

(END) Dow Jones Newswires

March 10, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

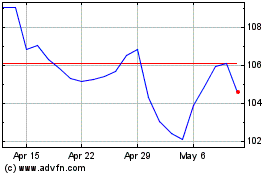

Canadian Natural Resources (TSX:CNQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian Natural Resources (TSX:CNQ)

Historical Stock Chart

From Apr 2023 to Apr 2024