By Ese Erheriene

Apple Inc. and U.S. President Donald Trump are going

head-to-head for influence over one of Asia's key export economies.

And so far, Apple is winning.

Taiwan's stock market has been on a roll the past few months,

undeterred by Mr. Trump's ascent to the U.S. presidency and his

harder line on China and trade. On Tuesday, the market ended at a

fresh 23-month high.

The benchmark Taiex index has risen 11% since mid-September,

according to FactSet. This would make it the 10th best-performing

stock market globally during the period, in U.S. dollar terms.

Since its early-2016 bottom, the Taiex is up nearly 30%,

outstripping gains of 19% in Shanghai and 18% in South Korea.

The performance highlights global markets' resilience to

geopolitical events that could threaten to disrupt the good times.

Mr. Trump has pledged a more unpredictable foreign policy that

risks upturning longstanding diplomatic and trade ties--including

his early decision to question the "One China" policy that has

underpinned Sino-U.S. relations for decades.

But investors have focused instead on the prospect of improving

economic growth and a fading sense of crisis in China. In Taiwan,

they are focused on the iPhone.

The island's equities of late have "been doing well for a couple

of reasons," said Arthur Kwong, head of Asia-Pacific equities at

BNP Paribas Investment Partners. "On top is Apple."

Apple's share price has jumped nearly 25% over the past six

months amid hopes for a big year for the iPhone, which celebrates

its 10th anniversary in 2017. A number of Taiwan's technology

stocks are along for the ride.

Among them, Largan Precision Co., which manufactures dual

casings for the iPhone, added 30% since mid-September. Hon Hai

Precision Industry Co., or Foxconn, which assembles the iPhones,

was up 18%. Catcher Technology Co., which supplies casings, gained

12%.

Taiwanese tech stocks that supply Apple make up more than 25% of

the Taiex's weighting, with Apple accounting for up to 50% of the

companies' revenues. The gains have helped drive the index back

toward the 10000-point level that it hasn't been able to solidly

break through for two decades.

They have also helped boost Taiwan's attractiveness for

foreign-equity investors. Last month, foreigners bought a net $1.6

billion in Taiwanese stocks, the most since August, according to

data from Credit Suisse. For the first 10 weeks of 2017, Taiwan had

the highest amount of net foreign buying among emerging markets in

Asia excluding China at $2.8 billion.

"There's a move to own Apple supply stocks," said Randy Abrams,

a semiconductor analyst at Credit Suisse. Many emerging-market

funds can't buy directly into Apple, so they look to the supply

chain for alternatives, he said.

Meanwhile, Mr. Abrams called Taiwan's strong stock gains

noteworthy given Mr. Trump's tough talk on trade tariffs. The

country's stock market is typically more affected by trade issues

as exports make up around 70% of Taiwan's economy.

Beijing also has been ramping up its efforts to isolate the

island, which it considers Chinese territory, in the months since

the inauguration of President Tsai Ing-wen, leader of a party that

favors Taiwan independence.

Still, the effects of those developments on equities have been

muted. In December, after then President-elect Trump spoke on the

phone with Ms. Tsai-- the first time a U.S. president or

president-elect has spoken with the leader of Taiwan since

diplomatic ties were cut off in 1979, much to the ire of

Beijing--the Taiex reacted, but with a gentle 0.3% decline.

"We haven't seen [Trump's] threats carried through...[and] the

Taiwanese companies are very much required in the supply chain,"

said Andrew Gillan, head of Asia ex-Japan equities at Henderson

Global Investors, to explain the gains despite political

uncertainty.

Taiwan's benchmark stock index has logged the biggest gains

among Asian emerging markets over the past six months and hasn't

closed down 1% or more in any session since November. The current

82-session streak is easily the index's longest since at least

1986, according to Wall Street Journal market data. The Taiex dates

to 1966.

A bigger risk may be that Apple can take as well as give. In

September, the Taiex rose a combined 3% in the three sessions

leading up to the Sept. 7 launch of the iPhone 7. But the handset

didn't have much in the way of a wow factor, and the Taiex fell

3.9% the following week as Apple's share fell.

Fiscal 2016, which ended in September, marked the first time

Apple recorded lower year-over-year iPhone sales. Investors are

betting Apple will deliver more than just incremental improvements

for its next iPhone. If they are wrong, Apple's share price could

suffer and damp enthusiasm for Taiwan's tech stocks.

"If we have any downward demand shock, we could see

disappointment," said Credit Suisse's Mr. Abrams.

Kevin Kingsbury contributed to this article.

Write to Ese Erheriene at ese.erheriene@wsj.com

(END) Dow Jones Newswires

March 21, 2017 08:20 ET (12:20 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

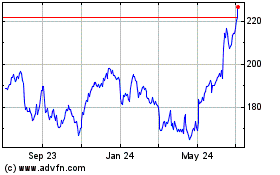

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

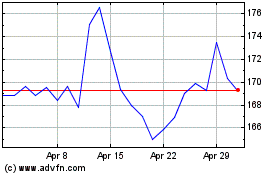

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2023 to Apr 2024