EU Antitrust Chief Says Handful of Companies May Have Misled Regulator to Obtain Merger Clearance

March 24 2017 - 12:32PM

Dow Jones News

By Natalia Drozdiak

BRUSSELS--The European Union's antitrust chief said Friday that

her department is reviewing a handful of recent merger clearances

because of suspicions that companies misled investigators to secure

approval.

The unusual reassessment of past mergers could lead to

significant fines for the companies or--though highly unlikely and

complicated--overturning the clearance.

It suggests that the regulator could be preparing charges

against other companies similar to the ones it leveled in December

against Facebook Inc.

In that case, the EU accused the social-media company of giving

incorrect or misleading information to investigators during the

probe of its purchase of chat app WhatsApp in 2014. Facebook said

it provided accurate information to the EU about its plans and

technical capabilities.

In an interview with The Wall Street Journal, Margrethe Vestager

said the European Commission was scrutinizing instances in which

company representatives from a range of different industries

intentionally or negligently misinformed regulators probing planned

mergers.

"In each and every individual case...we need correct

information, in order to have the very high quality of our casework

that we want to have, " Ms. Vestager said. "We have found in more

than one case, that there was a case of misleading

information."

The EU declined to identify the companies under the microscope,

but the cases involve mergers whose reviews took place no more than

five years ago. The commissioner said the EU was still deciding

whether it would formally accuse the companies in these other cases

as well.

If found guilty, Facebook and the other companies could face

fines of up to 1% of global revenue. In an unlikely scenario, the

EU could also revoke its decision to clear the merger, if the

misleading evidence would have fundamentally changed the outcome of

the merger's review.

The EU has already said its case against Facebook won't affect

its previous decision to clear the merger.

The commission suspects Facebook inaccurately claimed during the

2014 takeover that it was unable to reliably match user accounts

between Facebook and WhatsApp--something the company started doing

two years later when it began combining user data across the

services. The EU regulator is in the process of analyzing

Facebook's response to the accusations, Ms. Vestager said.

It is rare for companies to be charged with making misleading

statements during a merger-approval process in Europe, given the

potential for fines and other sanctions. Lawyers representing

companies in the merger-review process who are found to have lied

to regulators could also be stripped of their licenses to practice

law. The EU in December said it hadn't opened such cases since new

rules that boosted fines came into effect in 2004.

Ms. Vestager said the commission over the past year had been

looking at several cases involving misleading information, but that

they wouldn't all necessarily be formally opened or decided upon as

a package.

"We have to respect the flow of each individual case, even in

these areas where it's procedural concerns that we have," she

said.

Separately, the commission has been looking at whether it should

change its rules that would expand the number of mergers that fall

under its purview--to include companies with less revenue but which

may hold commercially valuable data or products under development.

That initiative, however, is unrelated to the procedural cases, the

commissioner said.

In the interview, the EU antitrust chief also spoke about three

open cases against Alphabet Inc.'s Google, including the case in

which the EU has formally accused Google of skewing its online

search results to favor its comparison-shopping service. Google

rejects the EU's accusations in all three cases.

On the shopping case, Ms. Vestager said the EU was approaching

"a final phase" of its investigation, adding that any negative

decision against Google likely would involve remedies that are

"future-proof" and therefore likely broader in scope.

"Instead of being specific on page design or screen design, I

think it's very important [for us] to focus on how to allow

competition," she said. "If you're very specific about what design,

you may very quickly be caught up in time."

In an additional statement sent last year setting out its

charges against Google in the shopping case, the EU already partly

sketched out its demands as to how Google should change its

business practices to assuage the bloc's antitrust concerns.

"Remedies may require Google to position and display

competitors' comparison shopping services in the same way as it

positions its own comparison shopping service in general search

results," the EU shopping charge sheet said.

The EU also has formally accused Google of violating the bloc's

rules by abusing its dominance with its Android mobile-operating

system as well as its advertising service Adsense. News Corp, owner

of The Wall Street Journal, has formally complained to the EU over

Google's alleged anticompetitive behavior.

Write to Natalia Drozdiak at natalia.drozdiak@wsj.com

(END) Dow Jones Newswires

March 24, 2017 13:17 ET (17:17 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

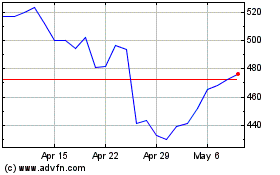

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024