Metals: Copper Pulls Back as Mine Strike Ends in Chile

March 24 2017 - 1:55PM

Dow Jones News

By Katherine Dunn and Ryan Dube

Copper prices fell on Friday, as the end of a strike at the

world's largest copper mine eased supply worries.

Copper for May delivery settled down 0.5% at $2.6310 a pound on

the Comex division of the New York Mercantile Exchange.

On Thursday, workers at the Escondida copper mine in northern

Chile said they would end a strike at the mine, which is

majority-owned by BHP Billiton Ltd.

The leader of the mine's largest union, Union No. 1, said

workers would return to work on Saturday. The workers had agreed to

implement an article that will allow them to return to work with

their current collective agreement for 18 months.

On Friday, the agreement to end the strike, which began Feb. 9,

was pushing prices down, but the size of the decline was muted,

noted Nitesh Shah, a commodities strategist at ETF Securities in

London, as the agreement hasn't resolved the underlying issues

behind the strike.

"It is sort of kicking the can down the road a bit," said Mr.

Shah.

The mine produces about 5% of the world's copper, and the

six-week strike took out about 1% of the world's annual copper

production, he estimated.

Other supply disruptions, at Freeport-McMoRan Inc.'s Grasberg

copper mine in Indonesia, which is stalled over an export dispute

with the government, and a strike at the Cerro Verde copper mine in

Peru, are continuing.

The decline in copper's price was likely muted by a lingering

expectation of better demand prospects for industrial metals on the

back of President Donald Trump's campaign promises to fuel

infrastructure spending and overhaul tax reform, Commerzbank said

in a note.

"This could turn out to be a mistake, however, especially if

U.S. President Trump loses the U.S. House of Representatives health

care reform vote that was postponed until today -- as this would

also jeopardize the planned tax reform," the German bank said.

Restrictions in Chinese cities on new real-estate buying could

also damp demand from China, the world's top consumer of copper,

the bank said. Chinese appetite for the metal far outstrips U.S.

demand, which is around 8%, and so any change in demand from China

is likely to have a far bigger effect on the supply balance than

Mr. Trump's policies, analysts have said.

Gold for April delivery edged higher, closing up 0.1% at

$1,248.50 a troy ounce ahead of the vote in the U.S. House of

Representatives on a health-care bill, which is being viewed by

some investors as a test of the Trump administration's ability to

enact its agenda.

The vote is scheduled for 3:30 p.m. EDT on Friday, but concerns

have been raised that the bill doesn't have sufficient support to

pass. Gold prices traded as low as $1,243.30 a troy ounce on Friday

before reversing losses.

"If it gets passed, the market will see it as one hurdle out of

the way for finally moving on to tax reform and other fiscal

stimulus measures," said Paul Wong, senior portfolio manager at

Sprott Asset Management. "If the Health-care Bill does not get

passed then the opposite is likely and gold should rise."

--Stephanie Yang contributed to this article.

Write to Katherine Dunn at Katherine.Dunn@wsj.com and Ryan Dube

at ryan.dube@dowjones.com

(END) Dow Jones Newswires

March 24, 2017 14:40 ET (18:40 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

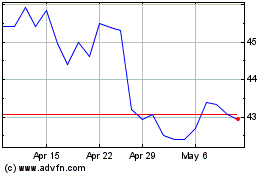

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

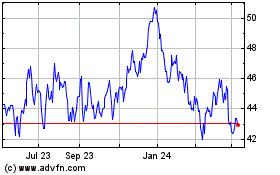

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024