Canadian Dollar Drops On Falling Oil Prices

March 27 2017 - 3:00AM

RTTF2

The Canadian dollar drifted lower against its major counterparts

in the European session on Monday, as oil prices fell on

indications of increased drilling activity in the U.S. and as the

OPEC put off a decision to extend historic production cuts to

balance oil market.

Crude for May delivery declined $0.38 to $47.59 per barrel.

Data from Baker Hughes showed that the oil rig count rose by 21

to 652 in the week ended March 17, which was its highest level

since September 2015. Signs of growing shale output undermines the

attempts by the OPEC to eliminate the supply glut.

The meeting of OPEC and non-OPEC oil producing nations over the

weekend agreed to review the oil market conditions and meet again

in April regarding an extension of the output deal. This was an

abrupt change from earlier draft of the statement which reported a

"high level of conformity and recommends six-month extension."

Further weighing on the currency on the currency was risk

aversion, as President Donald Trump's failure on healthcare reform

triggered concerns about the prospects for his plans to use fiscal

stimulus to boost growth.

The loonie showed mixed performance in the Asian session. While

the loonie rose against the aussie and the greenback, it held

steady against the euro. Against the yen, it declined.

The loonie slipped to 1.4504 against euro, a level unseen since

November 2016. The loonie is likely to find support around the 1.46

mark.

Survey data from Ifo institute showed that German business

sentiment improved in March.

The business confidence index rose to 112.3 in March from 111.1

in February. Economists had forecast the indicator to fall to

110.8.

The loonie eased to 1.0190 against the aussie and 1.3350 against

the greenback, from its early near 2-week high of 1.0155 and a

4-day high of 1.3321, respectively. On the downside, the loonie may

locate support around 1.03 against the aussie and 1.345 against the

greenback.

The loonie remained lower against the yen with the pair trading

at 82.66, after falling to more than a 4-month low of 82.56 early

in the session. The next possible support for the loonie-yen pair

is seen around the 81.00 level.

The summary of opinions from the monetary policy meeting showed

that Bank of Japan board members viewed that the bank should not

rush to action and it should pursue monetary easing under the

current framework with patience.

To achieve the price stability target, it is important to bring

the economy onto a self-sustaining growth path, members said at the

meeting held on March 15 and 16.

Looking ahead, Federal Reserve Bank of Chicago President Charles

Evans and European Central Bank Chief Economist Peter Praet are

expected to speak about the current economic conditions and

monetary policy at the Global Interdependence Center in Madrid at

1:15 pm ET.

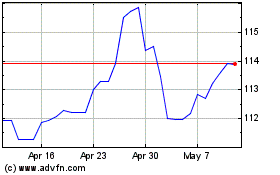

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

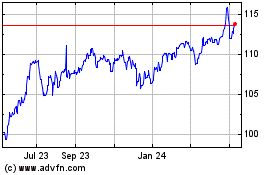

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024