'Project Scalpel' envisions joint system for processing trades,

eliminating duplication

By Telis Demos and Liz Hoffman

Big banks have cut more than $40 billion of costs since the

financial crisis.

They aren't done.

While prospects for revenue growth at banks have brightened

since the election, a handful of the biggest firms are considering

ways to slash still more from their back-office budgets. One

effort, dubbed "Project Scalpel," is aimed at cutting the

administrative and operational costs involved with processing stock

and bond transactions after a trade is struck, according to people

familiar with the discussions.

Talks around this effort are at an early stage but so far have

included a number of banks, such as Goldman Sachs Group Inc.,

Morgan Stanley and Bank of America Corp., the people said. If the

idea materializes, it could create a joint venture that allows

banks to share trade processes and technology.

The hope is this would be widely used by the industry and

eventually trim at least $2 billion from the banks' annual

spending, the people said. In the past, banks viewed their ability

to efficiently process trades, and handle transfers of ownership

and associated activities like dividend and interest payments, as a

competitive advantage.

Now, the processes and systems around these functions have

become commoditized. Competing banks have redundant systems

handling the same functions.

A joint system would eliminate the duplication, spread the cost

burden and make it simpler to upgrade technology, according to the

people familiar with the discussions. It also would free up

resources for revenue-generating investments, they said.

There are plenty of obstacles. These include questions around

data privacy and ownership stakes in the venture, and whether to

use existing technology systems or build a new one. Some bankers

also fear a for-profit service provider could eventually grow too

powerful and boost fees.

Despite the hurdles, banks for decades have cooperated in other

areas such as creating transaction venues and building

clearinghouses. The recent discussions represent a possible

extension of that cooperation and underscore that banks remain

obsessively focused on keeping expenses in check.

The six biggest U.S. banks have eliminated more than 100,000

jobs since 2009, while shedding less-profitable business lines and

trimming compensation.

This is the result of a relatively fallow period on Wall Street

in which banks' returns on equity have been held down by a

combination of more-stringent capital requirements, lackluster

economic growth, superlow interest rates, and more subdued

trading.

On cost-cutting, "much of the easy stuff is done," said Mark

Alexander, a former senior technology and operations executive at

Bank of America. "Banks now need to think about doing something

different and transformational."

European banks including Barclays PLC and Société Générale SA

have said they are working with technology providers to outsource

and share some trading back-office operations in Europe.

Financial-services firms spend as much as $24 billion annually

on post-trade operations, or what is known in the industry as

activity that occurs "south of the trade blotter," according to a

study by technology firm Broadridge Financial Solutions Inc.

A shared-processing venture would potentially allow banks to cut

or reassign thousands of back-office workers. Each firm would keep

scores of risk managers, programmers and traders focused on making

trades happen.

Joint ventures involving rival banks are complex, though. A

couple of years ago, about 10 banks tried to create just such a

post-trade with clearinghouses including the Depository Trust &

Clearing Corp. Those talks foundered because there were too many

different views about what the finished product would do and the

technology that would underpin it.

The latest idea is to narrow the group. The Scalpel discussions

also involve a recently formed investment firm called Motive

Partners, the people familiar with the matter said. Motive is led

by bank-technology veterans including Morgan Stanley and Goldman

alum Stephen Daffron, and former Fidelity National Information

Services Inc. executives Rob Heyvaert and Michael Hayford.

Banks have previously collaborated on combining back-office

functions. In the 1970s, securities firms created a clearinghouse

to reduce and then computerize mountains of paper trading tickets.

The result was the DTCC, which handles trillions of dollars of

securities transactions daily.

Over the past two years, collaboration has accelerated again.

Banks recently created joint utilities for things like

anti-money-laundering compliance procedures and sharing basic

underlying information about stocks and bonds.

"The banking industry must find ways to structurally lower

costs," UBS Group AG Chief Executive Sergio Ermotti told analysts

last year. He says the way to achieve it is "closer collaboration

between financial institutions."

Write to Telis Demos at telis.demos@wsj.com and Liz Hoffman at

liz.hoffman@wsj.com

(END) Dow Jones Newswires

March 28, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

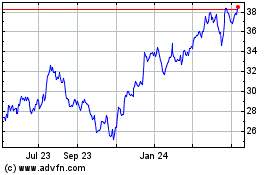

Bank of America (NYSE:BAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

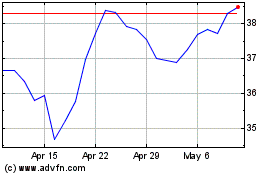

Bank of America (NYSE:BAC)

Historical Stock Chart

From Apr 2023 to Apr 2024