Akzo Nobel to Detail Plan to Separate Its Specialty Chemicals Business -- Update

March 28 2017 - 6:24AM

Dow Jones News

By Ben Dummett and Christopher Alessi

Paint giant Akzo Nobel NV on Tuesday said it would announce next

month specific plans for the separation of its specialty chemicals

business, in the Dutch firm's latest effort to ward off a $24

billion takeover approach from U.S. rival PPG Industries Inc.

The plan, announced earlier this month, comes on the heels of

Akzo's rejection of a second, sweetened offer by PPG last week of

EUR88.72 ($96.4) a share, up from an initial bid of EUR83 a

share.

"Our new strategy will further unlock the value within the

company, including the creation of two focused businesses," Chief

Executive Ton Büchner said in a statement. "We are best placed to

deliver these plans ourselves," he added.

The company said it would outline plans for the separation of

the specialty chemicals unit from the paints business, along with a

fresh financial guidance, when it reports first-quarter results on

April 19.

The announcement comes amid efforts by some of Akzo's largest

investors to push the Amsterdam-based company to engage in

negotiations with Pittsburgh-based PPG Industries Inc.

Shareholders including Causeway Capital Management LLC's, Akzo's

biggest investor, and activist investor Elliott Management Corp.

have said that while PPG's latest offer was inadequate, it was high

enough that Akzo should start negotiating.

"As long-term shareholders, we believe combining Akzo Nobel and

PPG would create a stronger company and lead to improved prospects

for both shareholders and employees," Causeway Capital Management

Chief Executive Sarah Ketterer wrote in a letter to Akzo's

management board last week.

Causeway owns a 6.8% stake in Akzo and Elliott owns a 3%

stake.

Elliott has threatened to use corporate-governance rules

particular to Akzo's structure to call a special shareholders

meeting, in a bid to force Akzo's board to talk with PPG. To

achieve that goal, Elliott has said it would need 10% shareholder

support. Causeway's support bolsters that effort.

Still, investors see the deal as unlikely. Akzo's stocks was

down 0.2%, at EUR78.21, midmorning Tuesday, well below PPG's latest

offer price of EUR88.72.

Even if Elliott could remove members of Akzo's management and

supervisory board, it would likely struggle to push the Dutch

company into takeover talks because of the difficulty investors

would face appointing new nominees, says Edmund-Philipp Schuster, a

professor at the London School of Economics. That is because the

Foundation Akzo Nobel, whose board holds seats on Akzo's

supervisory board, "effectively has an exclusive nomination right

for any replacement directors," Mr. Schuster said. "The current

governance structure means that a hostile takeover would make

little sense for any acquirer."

Nonetheless, analysts have widely speculated that PPG will come

back with a higher, third offer. "We think PPG will raise its offer

to purchase Akzo for cash to EUR92 a share," analysts at J.P.

Morgan wrote in a recent note.

The trans-Atlantic standoff puts at odds two of the world's

oldest industrial companies. Akzo Nobel was created from the merger

of paint and chemicals companies in Sweden and the Netherlands that

dated back more than a century. Among them was a chemicals firm

founded by Alfred Nobel, who launched the prizes that bear his

name. After the merger in 1994, Akzo acquired two of Britain's

oldest paint and chemicals firms.

PPG, founded in 1883 as Pittsburgh Plate Glass Co., was the

first U.S. company to successfully market large sheets of glass,

until then an expensive rarity. It quickly expanded into chemicals

to secure a supply of raw materials and was an early supplier of

the automotive and aviation industries.

Write to Ben Dummett at ben.dummett@wsj.com and Christopher

Alessi at christopher.alessi@wsj.com

(END) Dow Jones Newswires

March 28, 2017 07:09 ET (11:09 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

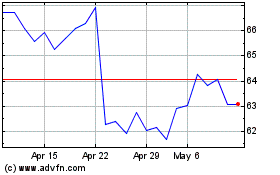

Akzo Nobel NV (EU:AKZA)

Historical Stock Chart

From Mar 2024 to Apr 2024

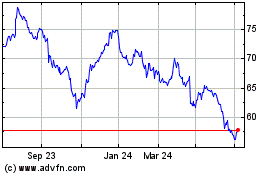

Akzo Nobel NV (EU:AKZA)

Historical Stock Chart

From Apr 2023 to Apr 2024