Amazon to Buy Middle East E-Commerce Site Souq.com

March 28 2017 - 7:56AM

Dow Jones News

By Nicolas Parasie

DUBAI-- Amazon.com Inc. said Tuesday it is acquiring Dubai-based

Souq.com, placing one of its biggest global bets in recent years on

the small but rapidly expanding Middle Eastern online shopping

market.

Amazon didn't give a value but a banker familiar with the deal

said it was worth around $700 million. The acquisition is one of

the biggest in recent years for the global giant, which has spent

heavily on expanding its footprint around the world but doesn't

often splash out taking over whole companies as large as

Souq.com.

"We're looking forward to both learning from and supporting them

with Amazon technology and global resources," said Russ

Grandinetti, Amazon's senior vice president for international

consumer.

Souq.com, founded in 2005 by Syrian-born entrepreneur Ronaldo

Mouchawar, has grown into one of the region's biggest e-commerce

businesses--offering over 8.4 million products across categories

such as consumer electronics, fashion and household goods--with

around 6,000 employees and local operations in Saudi Arabia, the

United Arab Emirates and Egypt.

Amazon beat Dubai's shopping-center heavyweight, Emaar Malls,

which made a last-ditch $800 million offer to acquire Souq.com.

Amazon's acquisition of video technology company Twitch Interactive

Inc. for about $842 million, after adjustments, in 2014 was its

last publicly announced deal of a larger size.

"We are guided by many of the same principles as Amazon, and

this acquisition is a critical next step in growing our e-commerce

presence on behalf of customers across the region," Mr. Mouchawar

said. "We'll be able to vastly expand our delivery capabilities and

customer selection much faster."

The acquisition is expected to close this year.

Amazon's takeover of Souq sets up the U.S. retail giant for a

fierce battle with regional real-estate billionaire Mohamed

Alabbar. His $1 billion e-commerce platform is expected to start

within weeks, according to a person familiar with the company's

plans. The new venture called Noon will offer 20 million products

and is backed by Saudi Arabia's sovereign-wealth fund, the Public

Investment Fund.

Emaar Malls, which made the rival bid for Souq.com, is the

retail unit of real-estate giant Emaar Properties, whose chairman

is Mr. Alabbar.

Both Souq, which means market in Arabic, and Noon are eager to

profit from population growth in the Middle East, high levels of

disposable income and smartphone penetration.

While still small compared with more mature markets, the Gulf

region has the potential to become one of the world's

fastest-growing e-commerce regions. Consultancy A.T. Kearney

estimates that the Gulf's online shopping market could swell to $20

billion by 2020 from $5.3 billion in 2015.

The acquisition of Souq will give Amazon strength in the region

thanks to Souq's existing customer base and infrastructure.

Souq.com attracts over 45 million visits a month, according to the

company.

Amazon already has a small presence in the Middle East. Its

subsidiary Amazon Web Services, the company's cloud computing

platform, opened offices in Dubai and Bahrain earlier this

year.

Souq.com has often attracted interest from international

investors. Last year, it raised $275 million from investors

including New York-based Tiger Global Management, South Africa's

Naspers and Standard Chartered's private equity arm.

Amazon's takeover of Souq was welcomed by the leadership of

Dubai, the region's business and tourism hub which has been seeking

to attract international companies.

Mr. Mouchawar's "story is a beautiful one," said Mohammed Al

Gergawi, the U.A.E. minister of cabinet affairs. "You want a story

like his, a Syrian who is doing a company worth hundreds of

millions of dollars."

Souq originally planned a public listing or a partial stake sale

in the company but the transaction evolved into a full sale, said

bankers familiar with the deal. The sale process was delayed due to

strong disagreements on price and amid interest from other regional

companies keen on expanding in e-commerce.

The sale to Amazon represents a rare successful exit for a

Middle Eastern startup. Yahoo in 2009 acquired internet portal

Maktoob. In 2015, German e-commerce group Rocket Internet acquired

Kuwaiti food-delivery business Talabat for about $170 million.

Sam Schechner contributed to this article.

Write to Nicolas Parasie at nicolas.parasie@wsj.com

(END) Dow Jones Newswires

March 28, 2017 08:41 ET (12:41 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

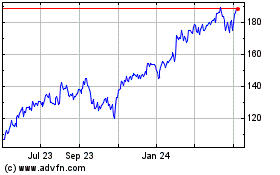

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024