Canadian Dollar Advances Amid Oil Rally

April 10 2017 - 1:55AM

RTTF2

The Canadian dollar climbed against the other major currencies

in the European session on Monday, trimming early losses, as oil

prices rose amid geopolitical worries in the Middle East and due to

another disruption of production from Libya's Sharara oil

field.

Crude for May delivery rose $0.41 to $52.65 per barrel.

Sharara, Libya's biggest oil field, halted oil production from

Sunday as the pipeline carrying crude was blocked by a group. The

field had just resumed production in early April, after clashes

among rival armed groups led to a halt in production since

March.

U.S. Secretary of State Rex Tillerson criticized Russia for

having failed to prevent Syria from carrying out a chemical attack

on a rebel-held town, stepping up pressure on Moscow to remove

Syrian leader Bashar al-Assad from power.

'I think the real failure here has been Russia's failure to live

up to its commitments under the chemical weapons agreements that

were entered into in 2013,' Tillerson told ABC's This Week on

Sunday.

Adding to fears, the U.S. ordered its war ships to move towards

the Korean peninsula at the weekend to defend North Korea's nuclear

weapons program, in a sign of escalating tensions between the two

countries.

The loonie was trading lower against most major rivals in the

Asian session, amid rising risk aversion.

Reversing from an early low of 1.0070 against the aussie, the

loonie rose to a 1-1/2-month high of 1.0023. Continuation of the

loonie's uptrend may see it challenging resistance around the 0.99

region.

The loonie was trading higher at 83.09 against the yen, heading

to pierce its early 5-day high of 83.16. The next possible

resistance for the loonie-yen pair is seen around the 86.00

level.

Survey results from the Cabinet Office showed that Japan's

current economic assessment as well as expectations weakened

unexpectedly in March.

The current conditions index fell to 47.4 in March from 48.6 in

February. The score was forecast to fall to 49.8.

The loonie extended gains to 1.4161 against the euro, a level

unseen since March 8. On the upside, 1.40 is possibly seen as the

next resistance level for the loonie. The pair finished last week's

trading at 1.4197.

Survey data from Sentix showed that Eurozone investor confidence

strengthened to the highest level in almost a decade in April.

The investor sentiment index climbed unexpectedly to 23.9 in

April from 20.7 in March. The reading was forecast to fall to

20.2.

The loonie bounced off to 1.3384 against the greenback, from a

low of 1.3426 hit at 10:30 pm ET. The loonie is seen finding

resistance around the 1.30 mark.

Looking ahead, Canada housing starts for March are due at 8:15

am ET.

The U.S. labor market conditions index for March is set for

release in the New York session.

At 4:10 am ET, Fed Chair Janet Yellen speaks at the University

of Michigan, U.S.

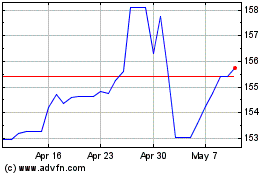

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

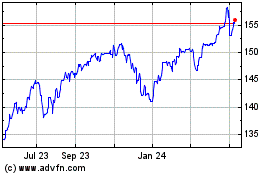

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024