Dollar Climbing Ahead Of Easter Holiday Weekend

April 13 2017 - 9:45AM

RTTF2

The dollar is rising against all of its major rivals Thursday

afternoon. The buck dipped in early trade after some comments from

President Trump, but has staged a recovery heading into the long

holiday weekend.

In an interview with the Wall Street Journal on Wednesday,

President Trump said he thinks the U.S. dollar "is getting too

strong." Trump also told the Journal he likes a low interest rate

policy and noted he has not decided whether to reappoint Federal

Reserve Chair Janet Yellen.

Trump also said that "it's very, very hard to compete when you

have a strong dollar and other countries are devaluing their

currency." The president also mentioned that he will not label

China a currency manipulator.

First-time claims for U.S. unemployment benefits unexpectedly

edged lower in the week ended April 8th, according to a report

released by the Labor Department on Thursday. The report said

initial jobless claims dipped to 234,000, a decrease of 1,000 from

the previous week's revised level of 235,000.

Economists had expected jobless claims to rise to 245,000 from

the 234,000 originally reported for the previous week.

A report released by the Labor Department on Thursday showed a

modest decrease in U.S. producer prices in the month of March. The

Labor Department said its producer price index for final demand

edged down by 0.1 percent in March after rising by 0.3 percent in

February. Economists had expected prices to come in flat.

Consumer sentiment in the U.S. has unexpectedly improved in the

month of April, according to a report released by the University of

Michigan on Thursday. The report said the consumer sentiment index

rose to 98.0 in April from 96.9 in March. Economists had expected

the index to edge down to 96.6.

The dollar dipped to an early low of $1.0677 against the Euro

Thursday, but has since climbed to around $1.0615.

Germany's consumer price inflation was unchanged at a four-month

low in March, final figures from Destatis confirmed Thursday. The

consumer price index rose 1.6 percent year-on-year following 2.2

percent surge in February. The inflation figure was the weakest

since November.

France's consumer price inflation slowed marginally as initially

estimated in March, latest figures from the statistical office

Insee showed Thursday. The consumer price index rose 1.1 percent

year-over-year in March, following a 1.2 percent climb in February.

That was in line with the flash data published on March 31.

The buck dropped to a 2-week low of $1.2573 against the pound

sterling Thursday morning, but has since rebounded to around

$1.2510.

U.K. house prices increased at the slowest pace in four years in

the three months ended March from a year ago, survey data from the

mortgage lender Halifax and IHS Markit showed Thursday. House

prices climbed 3.6 percent year-over-year in the first quarter,

slower than the 6.5 percent spike in the fourth quarter. Moreover,

this was the weakest rise in property prices since the first

quarter of 2013.

The house price balance in the United Kingdom came in at 22

percent in March, the Royal Institution of Chartered Surveyors said

on Thursday. That was in line with expectations and unchanged from

the February reading.

The greenback slipped to nearly a 5-month low of Y108.731

against the Japanese Yen Thursday morning, but has since bounced

back to around Y109.125.

The M2 money stock in Japan was up 4.3 percent on year in March,

the Bank of Japan said on Thursday, coming in at 962.8 trillion

yen. That topped expectations for a gain of 4.2 percent, which

would have been unchanged from the February reading.

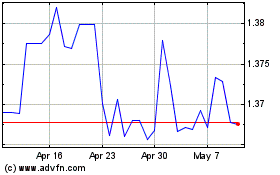

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024