BlackBerry Arbitration Ruling Cuts Into Qualcomm's Profit -- 2nd Update

April 19 2017 - 7:12PM

Dow Jones News

By Ted Greenwald

An arbitration decision in a dispute with BlackBerry Ltd.

weighed on Qualcomm Inc.'s earnings in the latest quarter, a

further blow to its results after the chip maker paid a hefty South

Korean government fine the previous quarter, and a reminder of

ongoing challenges to its patent licensing business.

The smartphone chip leader reported a second-quarter profit of

$749 million on total sales of $5.02 billion, as the arbitration

decision cut sharply into the company's top line and helped pull

down revenue in its patent licensing segment by 40%, to $1.33

billion. That division, which licenses patents essential to mobile

communications and collects royalties on nearly every smartphone

sold, typically brings the majority of Qualcomm's pretax net

profit. The impact from the BlackBerry decision amounted to $974

million, the company said.

Qualcomm, meanwhile, worked to quell concerns over royalty

payments withheld on sales of Apple Inc. iPhones, a consequence of

disputes between the two companies that came to a head in lawsuits

filed by Apple in January. It said it expected Apple's contract

manufacturers to underpay royalties during the quarter commensurate

with the amount that is currently in dispute, but also widened its

range of guidance for the third quarter to reflect uncertainty over

iPhone-related royalties. The guidance doesn't include a scenario

in which no payments are made by the contract manufacturers,

Qualcomm said.

The question is how much of those royalties will continue to be

absent going forward. Qualcomm noted as much in its report, saying

it wasn't clear whether Apple's manufacturers would underpay during

the third quarter, potentially hurting its revenue and profit.

"Things we can control, we're executing well on," Qualcomm Chief

Executive Steve Mollenkopf said in an interview.

Still, shares of Qualcomm rose on the earnings beat, climbing

2.4% after hours to $53.85. The stock's price has dropped sharply

this year, down 19% through Wednesday's close and the worst

performer in the PHLX Semiconductor Sector Index year-to-date, as

the U.S. Federal Trade Commission sued the company for

anticompetitive practices in its patent licensing division.

Qualcomm has filed a motion to dismiss the case.

Days later, Apple filed its own allegations of unfair dealing

around Qualcomm's intellectual property licensing business.

Qualcomm has characterized the conflict as a commercial dispute in

which Apple aims to cut costs.

Qualcomm, in a recent court filing answering Apple's lawsuit,

alleged that Apple influenced contract manufacturers that assemble

iPhones, and which have license agreements with Qualcomm, to stop

paying royalties for their use of Qualcomm's patents. Apple's

alleged interference was retaliation for the chip maker's own

withholding of payments it owed to Apple in a separate contract

dispute, Qualcomm claimed. Apple, in its lawsuit, tallied those

payments at $1 billion. Qualcomm said it expects iPhone royalties

to be withheld only up to that amount.

Royalties on iPhone sales lately have accounted for about 12% of

Qualcomm's total revenue and as much as 30% of its per-share

earnings, according to Srini Pajjuri of Macquarie Capital.

Beyond its business licensing patents to phone makers, the San

Diego, Calif., company holds dominant market share in mobile chips.

Its latest high-end smartphone chip is in a portion of Samsung

Electronics Co.'s flagship Galaxy S8 phones as well as flagship

devices from Sony and Xiaomi, Qualcomm said, and Apple uses its

communications chips in some iPhones.

Qualcomm's chip sales have declined in recent years after a

period of robust growth, reflecting slowing growth in smartphones.

The falloff has led the company to set its sights on new markets.

In the latest quarter, its MSM chip shipments fell to 179 million

from 189 million in the year-earlier period.

One target of growth: Cars. Qualcomm agreed to purchase NXP

Semiconductors NV, a leader in chips for the automotive industry,

for $39 billion in late 2016. The purchase, which hasn't yet

closed, is a bet that Qualcomm can boost sales of its own products

through NXP's automotive relationships and extend its role in the

Internet of Things, the trend toward outfitting a wide variety of

everyday devices with computing and communications capability. It

also may make Qualcomm less dependent on intellectual property

sales -- which are threatened by recent regulatory and legal

actions -- in favor of revenue from product sales.

Qualcomm said Wednesday the deal is on track to close by the end

of the year.

Write to Ted Greenwald at Ted.Greenwald@wsj.com

(END) Dow Jones Newswires

April 19, 2017 19:57 ET (23:57 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

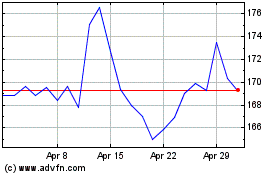

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

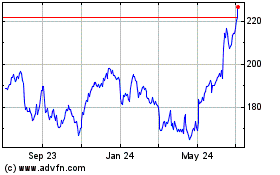

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2023 to Apr 2024