Canadian Dollar Rises Amid Risk Appetite, Oil Price Rally

April 23 2017 - 10:39PM

RTTF2

The Canadian dollar advanced against its most major rivals in

pre-European deals on Monday, as investor sentiment lifted up after

Macron's victory in the first round of French Presidential election

and oil prices rose on optimism over OPEC extending the production

cuts beyond June.

Crude for June delivery rose $0.26 to $49.88 per barrel.

In the first-round of voting, Macron secured 23.9 percent of the

vote, while far-right leader Le Pen came behind with 21.7 percent

of votes. Both of them would face-off in the final round on May

7.

Oil prices were underpinned by hopes for extension of production

cuts by OPEC, as the cartel is set to meet on May 25.

Last week, Russian Energy Minister Alexander Novak said that

although OPEC and non-OPEC nations have not yet decided to extend

the oil pact, it would be discussed with OPEC on May 24.

The loonie showed mixed performance in the Asian session. While

the loonie fell against the aussie and the euro, it rose against

the greenback and the yen.

The loonie rose back to 1.3463 against the greenback, from an

early low of 1.3500. The loonie had already set a 5-day high of

1.3452 at the beginning of today's trading. The next possible

resistance for the loonie may be found around the 1.33 level.

The loonie, having fallen to a 5-month low of 1.4689 against the

euro at 5:00 pm ET, reversed direction with the pair trading at

1.4604. If the loonie extends rise, 1.43 is possibly seen as its

next resistance level.

The loonie was trading in a positive territory against the yen

with the pair trading at 81.71, after having advanced to a 11-day

high of 82.04 in early deals. Continuation of the loonie's uptrend

may see it challenging resistance around the 83.00 region.

Data from the Cabinet Office showed Japan's leading index

increased slightly in February instead of a decline reported

earlier.

The leading index, which measures the future economic activity,

rose to 104.8 in February from 104.7 in January, revised from

104.9. The preliminary reading for February was 104.4.

On the flip side, the loonie held steady at 1.0191 against the

aussie, following a decline to more than 3-week low of 1.0207 in

early deals. The pair ended Friday's trading at 1.0172.

Looking ahead, German Ifo business climate index for April is

due in the European session.

Canada wholesale sales for February is set for release in the

New York session.

At 11:30 am ET, Minneapolis Fed President Neel Kashkari speaks

at the University of California, in Los Angeles.

Subsequently, at 3:15 pm ET, Minneapolis Fed President Neel

Kashkari speaks about too big to fail at the Claremont McKenna

College in Claremont, Calif.

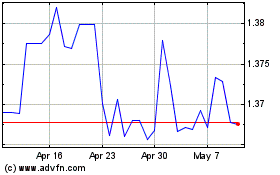

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024