Australia to Block Elliott's Plan to Shift BHP Billiton's Listing to London -- Update

May 04 2017 - 3:55AM

Dow Jones News

By Rob Taylor

CANBERRA, Australia--Australia's government warned it would

block moves being orchestrated by activist investor Elliott

Management Corp. to shift mining giant BHP Billiton Ltd.'s stock

listing from Australia to the U.K.

Representatives from the U.S. hedge fund have been in Australia

this week seeking to convince BHP shareholders to support a move to

spin off its American petroleum assets and significantly

restructure the world's largest listed miner.

In BHP, Elliot has targeted a company that has lagged behind its

mining peers during a commodity-price upswing. Elliott took

particular aim at BHP's oil-and-gas portfolio in the U.S., which

has been hit with hefty write-downs in recent years and has dragged

on the company's profit amid a prolonged crude-price downturn.

Elliott has called on the miner to ditch its dual Sydney-London

listing and offer its shares only in the U.K., while making its

headquarters and tax residences in Australia. The shares would

trade in Sydney as depositary instruments.

On Thursday, Australian Treasurer Scott Morrison said the move

would be contrary to the country's national interest and would

breach orders put in place by the government more than 15 years ago

that mandated a listing on the Australian Securities Exchange.

In 2001, former Treasurer Peter Costello agreed to a merger

between BHP Ltd. and Billiton PLC on condition that the combined

company was listed on the ASX and BHP remained the ultimate holding

company for the businesses owned before the merger.

"It is unthinkable that any Australian government could allow

this original 'Big Australian' to head offshore," Mr. Morrison

said. "The government welcomes foreign investment in Australia but

it is important that such investment be consistent with the

national interest. This includes compliance with foreign investment

conditions imposed on investments."

Both Elliott and BHP Billiton declined to comment on Mr.

Morrison's remarks. BHP has previously said the costs and

associated risks of Elliott's proposal significantly outweighed any

potential benefits.

Mr. Morrison said if BHP implemented Elliott's proposal contrary

to the previously imposed conditions then it could be subject to

civil penalties under Australia's Foreign Acquisitions and

Takeovers Act.

"These conditions apply indefinitely unless revoked or varied by

me," Mr. Morrison said. "It is clear that the proposals under

discussion would not be consistent with these conditions."

BHP traces its history to the Broken Hill Proprietary Company,

which began mining in Australia in 1885. It opened its head office

in Melbourne that year.

Mr. Morrison said BHP played an important role in Australia's

resource-reliant economy and its shares were held by hundreds of

thousands of Australians directly and by millions more through

superannuation savings funds and other investments.

If a deal proceeded without the government's consent, Mr.

Morrison said he would order a divestment of the assets acquired

and take court action.

"The conditions set down by then-Treasurer Costello are in

Australia's national interest and remain necessary and

appropriate," he said. "There is nothing in what I have seen of the

proposals to suggest otherwise."

Rio Tinto PLC, another major global miner that has maintained a

dual Sydney-London listing since 1995, hasn't been approached by

any activist shareholders about the structure, Chairman Jan due

Plessis told the company's annual general meeting on Thursday. "The

cost is minimal and therefore we have not given serious thought at

any time to changing the structure," he said.

Ben Collins in Wellington contributed to this article.

Write to Rob Taylor at rob.taylor@wsj.com

(END) Dow Jones Newswires

May 04, 2017 04:40 ET (08:40 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

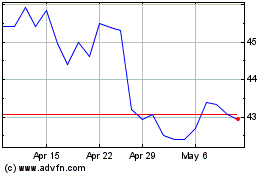

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

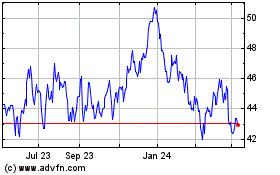

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024