Canadian Dollar Rises As Falling Inventories Lift Oil Prices

May 10 2017 - 2:48AM

RTTF2

The Canadian dollar climbed against its major counterparts in

the European session on Wednesday, as oil prices slipped following

a larger than expected decline in U.S. crude stock piles and as

Saudi Arabia signaled a possible reduction in crude supplies to

Asian buyers in June.

Crude for June delivery rose $0.55 to $46.43 per barrel.

Data from the American Petroleum Institute showed that U.S.

crude oil inventories fell 5.8 million barrels last week, far

higher than forecasts for a 1.8 million barrel drop.

Official data from the U.S. Energy Information Administration is

due at 10:30 am ET, with analysts expecting a draw of 1.786 million

barrels in crude supplies.

Further aiding oil prices were a media report that Saudi Aramco

is planning to trim oil supplies to Asia by about 7 million barrels

in June. The reductions in June allocations are part of the

commitment to meet the OPEC deal to balance oil market.

The loonie showed mixed performance in the Asian session. While

the loonie dropped against the aussie and the euro, it held steady

against the greenback and the yen.

The loonie rose to 83.20 against the yen and held steady

thereafter. The next possible resistance for the loonie-yen pair is

seen around the 84.00 region.

Preliminary data from the Cabinet Office showed that Japan's

leading index rose to a 21-month high in March.

The leading index, which measures the future economic activity,

rose to 105.5 in March from 104.7 in February. This was the highest

since June 2015.

Reversing from an early low of 1.3733 against the greenback, the

loonie edged up to 1.3687. On the upside, 1.35 is likely seen as

the next resistance level for the loonie.

The loonie advanced to a 9-day high of 1.4878 against the euro,

off its early low of 1.4956. If the loonie extends gain, 1.47 is

possibly seen as its next resistance level.

On the flip side, the loonie slipped to 1.0123 against the

aussie, compared to 1.0072 hit late New York Tuesday. Further

downtrend may take the loonie to a support around the 1.03

mark.

Looking ahead, U.S. export and import prices for April are due

in the New York session.

At 12:00 pm ET, Boston Fed President Eric Rosengren delivers a

luncheon speech in South Burlington, Vermont.

The U.S. monthly budget statement for April is set for release

at 2:00 pm ET.

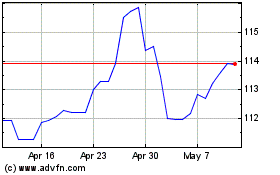

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

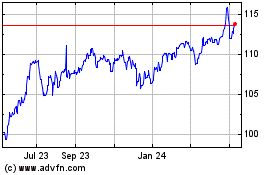

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024