UniCredit Reports First-Quarter Profit of EUR907 Million

May 11 2017 - 12:55AM

Dow Jones News

By Manuela Mesco and Giovanni Legorano

UniCredit SPA (UCG.MI) posted a first-quarter net profit after

reporting a large fourth-quarter loss, which reflected a clean-up

of its balance sheet designed to strengthen its capital base and

increase profitability.

The bank said its first-quarter profit was EUR907 million,

compared with a year-earlier profit of EUR406 million. In the

fourth quarter, the bank reported a loss of EUR13.56 billion.

The fourth-quarter loss was mainly the result of EUR12.2 billion

in one-time charges for bad-loan provisions and other items.

In February, the bank successfully completed a EUR13 billion

rights issue, one of the biggest-ever transactions of its kind in

Europe.

For the first quarter, provisions for bad loans stood at EUR670

million compared with EUR760 million in the year-earlier

period.

Net interest income dropped by 2.5% to EUR2.56 billion, while

fees and commissions were up to EUR1.48 billion.

The bank is pushing to generate higher fees and commissions to

compensate for dropping proceeds from its lending activity, which

has been severely hit by low and negative interest rates.

(END) Dow Jones Newswires

May 11, 2017 01:40 ET (05:40 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

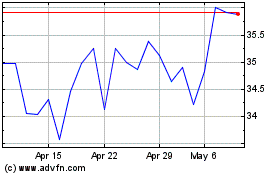

Unicredit (BIT:UCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

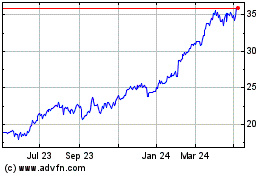

Unicredit (BIT:UCG)

Historical Stock Chart

From Apr 2023 to Apr 2024