The information in this

preliminary pricing supplement is not complete and may be changed. This preliminary pricing supplement is not an offer to sell

nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion dated May

19, 2017

|

Pricing supplement

To prospectus dated April 15 2016,

prospectus supplement dated April 15, 2016 and

product supplement no. 1-I dated April 15, 2016

|

Registration Statement No. 333-209682

Dated May , 2017

Rule 424(b)(2)

|

$

Fixed to Floating Rate Notes Linked

to 3-Month USD LIBOR due May 31, 2023

General

|

·

|

The notes are unsecured and unsubordinated

obligations of JPMorgan Chase & Co.

Any payment on the notes is subject to the credit risk of JPMorgan Chase & Co.

|

|

·

|

The notes are designed for investors who

seek (a) periodic interest payments that for the Initial Interest Periods, are fixed at 3.00% per annum, and then for each Interest

Period (other than the Initial Interest Periods) are linked to 3-Month USD LIBOR as determined on each Determination Date

plus

0.50%,

provided

that this rate will not be less than the Minimum Interest Rate of 0.00% per annum or greater than the Maximum

Interest Rate of 3.00% per annum with respect to the remaining Interest Periods (years 3 to 6), and (b) the return of their principal

amount at maturity.

Any payment on the notes is subject to the credit risk of JPMorgan Chase & Co.

|

|

·

|

These notes have a relatively long maturity

relative to other fixed income products. Longer-dated notes may be riskier than shorter-dated notes. See “Selected Risk Considerations”

in this pricing supplement.

|

|

|

·

|

The

notes may be purchased in minimum denominations of $1,000 and in integral multiples of $1,000 thereafter.

|

Key Terms

|

Issuer:

|

JPMorgan Chase & Co.

|

|

Payment at Maturity:

|

On the Maturity Date, we will pay you the outstanding principal amount of your notes

plus

any accrued and unpaid interest.

|

|

Interest:

|

We will pay you interest on each Interest Payment Date based on the applicable Interest Rate and the applicable Day Count Fraction, subject to the Interest Accrual Convention described below and in the accompanying product supplement.

|

|

Initial Interest Period(s):

|

The Interest Periods beginning on and including the Original Issue Date of the notes and ending on but excluding May 31, 2019.

|

|

Initial Interest Rate:

|

3.00% per annum

|

|

Interest Periods:

|

The period beginning on and including the Original Issue Date of the notes and ending on but excluding the first Interest Payment Date, and each successive period beginning on and including an Interest Payment Date and ending on but excluding the next succeeding Interest Payment Date, subject to the Interest Accrual Convention described below and in the accompanying product supplement.

|

|

Interest Payment Dates:

|

Interest on the notes will be payable in arrears on the last day of each February, May, August and November, commencing on August 31, 2017, to and including the Maturity Date, subject to the Business Day Convention and Interest Accrual Convention described below and in the accompanying product supplement.

|

|

Interest Rate:

|

With respect to each Initial Interest Period, a rate per annum equal to the Initial Interest Rate, and, notwithstanding anything to the contrary in the accompanying product supplement, with respect to each Interest Period thereafter, a rate per annum equal to 3-Month USD LIBOR, as determined on each applicable Determination Date,

plus

0.50%,

provided

that this rate will not be less than the Minimum Interest Rate or greater than the Maximum Interest Rate

|

|

Minimum Interest Rate:

|

0.00% per annum

|

|

Maximum Interest Rate:

|

3.00% per annum with respect to the Interest Periods after the Initial Interest Periods (years 3 to 6)

|

|

3-Month USD LIBOR:

|

3-Month USD LIBOR refers to the London Interbank Offered Rate for deposits in U.S. dollars with a Designated Maturity of 3 months that appears on Reuters page “LIBOR01” (or any successor page) under the heading “3Mo” at approximately 11:00 a.m., London time, on the applicable Determination Date, as determined by the calculation agent. If, on the applicable Determination Date, 3-Month USD LIBOR cannot be determined by reference to Reuters page “LIBOR01” (or any successor page), then the calculation agent will determine 3-Month USD LIBOR for that Determination Date in accordance with the procedures set forth under “What Is 3-Month USD LIBOR?” below

|

|

Determination Date:

|

For each Interest Period after the Initial Interest Periods, two London Business Days immediately prior to the beginning of the applicable Interest Period

|

|

London Business Day:

|

Any day other than a day on which banking institutions in London, England are authorized or required by law, regulation or executive order to close

|

|

Business Day:

|

Any day other than a day on which banking institutions in The City of New York are authorized or required by law, regulation or executive order to close or a day on which transactions in U.S. dollars are not conducted

|

|

Pricing Date:

|

May 25, 2017, subject to the Business Day Convention

|

|

Original Issue Date:

|

May 31, 2017, subject to the Business Day Convention (Settlement Date)

|

|

Maturity Date:

|

May 31, 2023, subject to the Business Day Convention

|

|

Business Day Convention:

|

Following

|

|

Interest Accrual Convention:

|

Unadjusted

|

|

Day Count Fraction:

|

30/360

|

|

CUSIP:

|

48128GE30

|

I

nvesting in the notes involves a number of risks.

See “Risk Factors” beginning on page PS-19 of the accompanying product supplement and “Selected Risk Considerations”

beginning on page PS-2 of this pricing supplement.

Neither the Securities and Exchange Commission (the

“SEC”) nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or

the adequacy of this pricing supplement or the accompanying product supplement, prospectus supplement and prospectus. Any representation

to the contrary is a criminal offense.

|

|

Price to Public (1)

|

Fees and Commissions (2)

|

Proceeds to Issuer

|

|

Per note

|

$1,000

|

$

|

$

|

|

Total

|

$

|

$

|

$

|

(1) The price to the public includes the estimated

cost of hedging our obligations under the notes through one or more of our affiliates.

(2) J.P. Morgan Securities LLC, which we refer to as

JPMS, acting as agent for JPMorgan Chase & Co., will pay all of the selling commissions it receives from us to other affiliated

or unaffiliated dealers. If the notes priced today, the selling commissions would be approximately $5.00 per $1,000 principal amount

note and in no event will these selling commissions exceed $7.50 per $1,000 principal amount note. See “Plan of Distribution

(Conflicts of Interest)” in the accompanying product supplement.

The notes are not bank deposits, are not insured

or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, and are not the obligations of, or

guaranteed by, a bank.

Additional Terms Specific

to the Notes

You may revoke your offer to purchase the notes at any time

prior to the time at which we accept such offer by notifying the applicable agent. We reserve the right to change the terms of,

or reject any offer to purchase, the notes prior to their issuance. In the event of any changes to the terms of the notes, we will

notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes

in which case we may reject your offer to purchase.

You should read this pricing supplement together with the accompanying

prospectus, as supplemented by the accompanying prospectus supplement relating to our Series E medium-term notes of which these

notes are a part, and the more detailed information contained in the accompanying product supplement. This pricing supplement,

together with the documents listed below, contains the terms of the notes and supersedes all other prior or contemporaneous oral

statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas,

structures for implementation, sample structures, fact sheets, brochures or other educational materials of ours. You should carefully

consider, among other things, the matters set forth in the “Risk Factors” section of the accompanying product supplement,

as the notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax,

accounting and other advisers before you invest in the notes.

You may access these documents on the SEC website at www.sec.gov

as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

Our Central Index Key, or CIK, on the SEC website is 19617.

As used in this pricing supplement, the “Company,” “we,” “us” or “our” refers to

JPMorgan Chase & Co.

Selected Purchase Considerations

|

|

·

|

PRESERVATION

OF CAPITAL AT MATURITY —

Regardless of the performance of 3-Month USD LIBOR, we will pay you at least the principal

amount of your notes if you hold the notes to maturity.

Because the notes are our unsecured and unsubordinated obligations,

payment of any amount on the notes is subject to our ability to pay our obligations as they become due.

|

|

|

·

|

PERIODIC

INTEREST PAYMENTS —

The notes offer periodic interest payments on each Interest Payment Date. With respect to the Initial

Interest Periods, your notes will pay an annual interest rate equal to the Initial Interest Rate, and for the applicable Interest

Periods thereafter, your notes will pay an interest rate per annum equal to 3-Month USD LIBOR

plus

0.50%,

provided

that this rate will not be less than the Minimum Interest Rate or greater than the Maximum Interest Rate. The yield on the notes

may be less than the overall return you would receive from a conventional debt security that you could purchase today with the

same maturity as the notes.

|

|

|

·

|

TAX

TREATMENT

— You should review the section entitled "Material U.S. Federal Income Tax Consequences" in this

pricing supplement carefully and consult your tax adviser regarding the U.S. federal income tax consequences of an investment

in the notes.

|

|

|

·

|

INSOLVENCY

AND RESOLUTION CONSIDERATIONS —

The notes constitute “loss-absorbing capacity” within the meaning of the

final rules (the “TLAC rules”) issued by the Board of Governors of the Federal Reserve System (the “Federal

Reserve”) on December 15, 2016 regarding, among other things, the minimum levels of unsecured external long-term debt and

other loss-absorbing capacity that certain U.S. bank holding companies, including JPMorgan Chase & Co., will be required to

maintain, commencing January 1, 2019. Such debt must satisfy certain eligibility criteria under the TLAC rules. If JPMorgan Chase

& Co. were to enter into resolution, either in a proceeding under Chapter 11 of the U.S. Bankruptcy Code or into a receivership

administered by the Federal Deposit Insurance Corporation (the “FDIC”) under Title II of the Dodd-Frank Wall Street

Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), holders of the notes and other debt and equity

securities of JPMorgan Chase & Co. (including other notes issued by JPMorgan Chase & Co.) will absorb the losses of JPMorgan

Chase & Co. and its affiliates.

|

Under Title I of the Dodd-Frank Act and applicable

rules of the Federal Reserve and the FDIC, JPMorgan Chase & Co. is required to submit periodically to the Federal Reserve and

the FDIC a detailed plan (the “resolution plan”) for the rapid and orderly resolution of JPMorgan Chase & Co. and

its material subsidiaries under the U.S. Bankruptcy Code and other applicable insolvency laws in the event of material financial

distress or failure. JPMorgan Chase & Co.’s preferred resolution strategy under its resolution plan contemplates that

only JPMorgan Chase & Co. would enter bankruptcy proceedings under Chapter 11 of the U.S. Bankruptcy Code pursuant to a “single

point of entry” recapitalization strategy. JPMorgan Chase & Co.’s subsidiaries would be recapitalized as needed

so that they could continue normal operations or subsequently be wound down in an orderly manner. As a result, JPMorgan Chase &

Co.’s losses and any losses incurred by its subsidiaries would be imposed first on holders of JPMorgan Chase & Co.’s

equity securities and thereafter on unsecured creditors, including holders of the notes and other debt securities of JPMorgan Chase

& Co. (including other notes issued by JPMorgan Chase & Co.). Claims of holders of the notes and those other debt securities

would have a junior position to the claims of creditors of JPMorgan Chase & Co.’s subsidiaries and to the claims of priority

(as determined by statute) and secured creditors of JPMorgan Chase & Co. Accordingly, in a resolution of JPMorgan Chase &

Co. under Chapter 11 of the U.S. Bankruptcy Code, holders of the notes and other debt securities of JPMorgan Chase & Co. (including

other notes issued by JPMorgan Chase & Co.) would realize value only to the extent available to JPMorgan Chase & Co. as

a shareholder of JPMorgan Chase Bank, N.A. and its other subsidiaries and only after any claims of priority and secured creditors

of JPMorgan Chase & Co. have been fully repaid. If we were to enter into resolution, none of JPMorgan Chase & Co., the

Federal Reserve or the FDIC is obligated to follow JPMorgan Chase & Co.’s preferred resolution strategy under its resolution

plan.

The FDIC has similarly indicated that a “single

point of entry” recapitalization model could be a desirable strategy to resolve a systemically important financial institution,

such as JPMorgan Chase & Co., under Title II of the Dodd-Frank Act. Pursuant to that strategy, the FDIC would use its power

to create a “bridge entity” for JPMorgan Chase & Co.; transfer the systemically important and viable parts of JPMorgan

Chase & Co.’s business, principally the stock of JPMorgan Chase & Co.’s main operating subsidiaries and any

intercompany claims against such subsidiaries, to

|

JPMorgan Structured Investments —

Fixed to Floating Rate Notes Linked to 3-Month USD LIBOR

|

PS-

1

|

the bridge entity; recapitalize those subsidiaries using assets of

JPMorgan Chase & Co. that have been transferred to the bridge entity; and exchange external debt claims against JPMorgan Chase

& Co. for equity in the bridge entity. Under this Title II resolution strategy, the value of the stock of the bridge entity

that would be redistributed to holders of the notes and other debt securities of JPMorgan Chase & Co. (including other notes

issued by JPMorgan Chase & Co.) may not be sufficient to repay all or part of the principal amount and interest on the notes

and those other securities. To date, the FDIC has not formally adopted a “single point of entry” resolution strategy,

and it is not obligated to follow such a strategy in a Title II resolution of JPMorgan Chase & Co.

Selected Risk Considerations

An investment in the notes involves significant risks. These

risks are explained in more detail in the “Risk Factors” section of the accompanying product supplement.

|

|

·

|

THE

NOTES ARE NOT ORDINARY DEBT SECURITIES BECAUSE, OTHER THAN DURING THE INITIAL INTEREST PERIODS, THE INTEREST RATE ON THE NOTES

IS A FLOATING RATE AND MAY BE EQUAL TO THE MINIMUM INTEREST RATE

— With respect to the Initial Interest Periods, your

notes will pay a rate equal to the Initial Interest Rate, and for the applicable Interest Periods thereafter, your notes will

pay a rate per annum equal to 3-Month USD LIBOR

plus

0.50%,

provided

that this rate will not be less than the Minimum

Interest Rate or greater than the Maximum Interest Rate. If the Interest Rate for an Interest Period after the Initial Interest

Periods is equal to the Minimum Interest Rate, which will occur if 3-Month USD LIBOR on the applicable Determination Date is less

than or equal to -0.50% per annum, no interest will be payable with respect to that Interest Period. Accordingly, if 3-Month

USD LIBOR on the Determination Dates for some or all of the Interest Periods after the Initial Interest Periods is less than or

equal to -0.50% per annum, you may not receive any interest payments for an extended period over the term of the notes.

|

|

|

·

|

AFTER

THE INITIAL INTEREST PERIODS, THE INTEREST RATE ON THE NOTES IS BASED ON

3-Month USD LIBOR

— The amount of interest, if any, payable on the notes will depend on a number of factors that could affect the

levels of 3-Month USD LIBOR, and in turn, could affect the value of the notes. These factors include (but are not limited to)

the expected volatility of 3-Month USD LIBOR, interest and yield rates in the market generally, the performance of capital markets,

monetary policies, fiscal policies, regulatory or judicial events, inflation, general economic conditions, and public expectations

with respect to such factors. These and other factors may have a negative impact on 3-Month USD LIBOR and on the value of the

notes in the secondary market. The effect that any single factor may have on 3-Month USD LIBOR may be partially offset by other

factors. We cannot predict the factors that may cause 3-Month USD LIBOR, and consequently the Interest Rate for an Interest Period

(other than an Initial Interest Period), to increase or decrease. A decrease in 3-Month USD LIBOR will result in a reduction of

the applicable Interest Rate used to calculate the Interest for any Interest Period.

|

|

|

·

|

FLOATING

RATE NOTES DIFFER FROM FIXED RATE NOTES

— After the Initial Interest Periods, the rate of interest on your notes will

be variable and determined based on 3-Month USD LIBOR

plus

0.50%,

provided

that this rate will not be less than

the Minimum Interest Rate or greater than the Maximum Interest Rate, which may be less than returns otherwise payable on notes

issued by us with similar maturities. You should consider, among other things, the overall potential annual percentage rate of

interest to maturity of the notes as compared to other investment alternatives.

|

|

|

·

|

AFTER

THE INITIAL INTEREST PERIODS, THE INTEREST RATE OF THE NOTES IS CAPPED BY THE APPLICABLE MAXIMUM INTEREST RATE

— After

the Initial Interest Periods, the Interest Rate for each Interest Period is subject to a Maximum Interest Rate, regardless of

any appreciation of 3-Month USD LIBOR, which may be significant. The Maximum Interest Rate is 3.00% per annum with respect

to the Interest Periods after the Initial Interest Periods (years 3 to 6).

|

|

|

·

|

LONGER-DATED

NOTES MAY BE RISKIER THAN SHORTER-DATED NOTES

— By purchasing a note with a longer tenor, you are more exposed to fluctuations

in interest rates than if you purchased a note with a shorter tenor. The present value of a longer-dated note tends to be more

sensitive to rising interest rates than the present value of a shorter-dated note. If interest rates rise, the present value of

a longer-dated note will fall faster than the present value of a shorter-dated note. You should purchase these notes only if you

are comfortable with owning a note with a longer tenor.

|

|

|

·

|

CREDIT

RISK OF JPMORGAN CHASE & CO.

— The notes are subject to the credit risk of JPMorgan Chase & Co., and our credit

ratings and credit spreads may adversely affect the market value of the notes. Investors are dependent on JPMorgan Chase &

Co.’s ability to pay all amounts due on the notes. Any actual or potential change in our creditworthiness or credit spreads,

as determined by the market for taking our credit risk, is likely to adversely affect the value of the notes. If we were to default

on our payment obligations, you may not receive any amounts owed to you under the notes and you could lose your entire investment.

|

|

|

·

|

POTENTIAL

CONFLICTS

— We and our affiliates play a variety of roles in connection with the issuance of the notes, including acting

as calculation agent and as an agent of the offering of the notes and hedging our obligations under the notes. In performing these

duties, our economic interests and the economic interests of the calculation agent and other affiliates of ours are potentially

adverse to your interests as an investor in the notes. In addition, our business activities, including hedging and trading activities

for our own accounts or on behalf of customers, could cause our economic interests to be adverse to yours and could adversely

affect any payment on the notes and the value of the notes. It is possible that hedging or trading activities of ours or our affiliates

in connection with the notes could result in substantial returns for us or our affiliates while the value of the notes declines.

Please refer to “Risk Factors — Risks Relating to Conflicts of Interest” in the accompanying product supplement

for additional information about these risks.

|

Furthermore, ICE Benchmark Administration calculates

3-Month USD LIBOR using submissions from contributing banks, including an affiliate of ours. We and our affiliates will have

no obligation to consider your interests as a holder of the notes in taking any actions in connection with acting as a 3-Month

USD LIBOR contributing bank that might affect 3-Month USD LIBOR or the notes.

|

|

|

·

3-Month USD LIBOR will be affected by

a number of factors

— The amount of interest payable on

the notes (after the Initial Interest Periods) will depend on 3-Month USD LIBOR. 3-Month USD LIBOR will depend on a number of

factors, including, but not limited to:

|

|

|

·

|

supply

and demand among banks in London for U.S. dollar-denominated deposits with approximately a three month term;

|

|

|

·

|

sentiment

regarding underlying strength in the U.S. and global economies;

|

|

|

·

|

expectations

regarding the level of price inflation;

|

|

|

·

|

sentiment

regarding credit quality in the U.S. and global credit markets;

|

|

JPMorgan Structured Investments —

Fixed to Floating Rate Notes Linked to 3-Month USD LIBOR

|

PS-

2

|

·

central bank policy regarding interest rates;

·

inflation and expectations concerning inflation; and

·

performance of capital markets.

These and other factors may have a negative

effect on the performance of 3-Month USD LIBOR, on the payment of interest on the notes and on the value of the notes in the secondary

market.

|

|

·

|

3-Month

USD LIBOR may be volatile

— 3-Month USD LIBOR is subject

to volatility due to a variety of factors affecting interest rates generally, including, but not limited to:

|

·

sentiment regarding underlying strength in the U.S. and global economies;

·

expectations regarding the level of price inflation;

·

sentiment regarding credit quality in U.S. and global credit markets;

·

central bank policy regarding interest rates; and

·

performance of capital markets.

|

|

|

·

3-MONTH USD LIBOR AND THE MANNER IN WHICH IT IS CALCULATED MAY

CHANGE IN THE FUTURE —

There can be no assurance that the method by which 3-Month USD LIBOR is calculated will continue

in its current form. Any changes in the method of calculation could reduce 3-Month USD LIBOR.

|

|

|

·

|

3-MONTH

USD LIBOR MAY BE CALCULATED BASED ON BANK QUOTATIONS OR BY REFERENCE TO 3-MONTH USD LIBOR ON AN EARLIER DATE

— If on

a Determination Date, 3-Month USD LIBOR cannot be determined by reference to Reuters page “LIBOR01” (or any successor

page), then 3-Month USD LIBOR for that Determination Date will be determined based on quotations from the principal London office

of four major banks in the London interbank market (which may include our affiliates), selected by the calculation agent, for

deposits in U.S. dollars in a Representative Amount and for a term equal to the Designated Maturity of 3 months, at approximately

11:00 a.m., London time, on that Determination Date. If fewer than two such quotations are provided, then 3-Month USD LIBOR

for that Determination Date,

provided

that that Determination Date is also a business day, will be determined based

on quotation from each of three major banks in The City of New York (which may include our affiliates) for that bank’s rate

to leading European banks for loans in U.S. dollars in a Representative Amount and for a term equal to the Designated Maturity

of 3 months, at approximately 11:00 a.m., New York City time, on that Determination Date. If fewer than two such rates are

provided, or if that Determination Date is not also a business day, then 3-Month USD LIBOR for that Determination Date will be

3-Month USD LIBOR for the immediately preceding London Business Day. 3-Month USD LIBOR determined in this manner may be

different from the rate that would have been published on the applicable Reuters page and may be different from other published

levels, or other estimated levels, of 3-Month USD LIBOR.

|

|

|

·

|

CERTAIN

BUILT-IN COSTS ARE LIKELY TO AFFECT ADVERSELY THE VALUE OF THE NOTES PRIOR TO MATURITY —

While the payment at maturity

described in this pricing supplement is based on the full principal amount of your notes, the original issue price of the notes

includes the agent’s commission and the estimated cost of hedging our obligations under the notes through one or more of

our affiliates. As a result, the price, if any, at which JPMS will be willing to purchase notes from you in secondary market

transactions, if at all, will likely be lower than the original issue price and any sale prior to the Maturity Date could result

in a substantial loss to you. This secondary market price will also be affected by a number of factors aside from the agent’s

commission and hedging costs, including those referred to under “Many Economic and Market Factors Will Impact the Value

of the Notes” below.

|

The notes are not designed to be short-term trading

instruments. Accordingly, you should be able and willing to hold your notes to maturity.

|

|

·

|

LACK

OF LIQUIDITY

— The notes will not be listed on any securities exchange. JPMS intends to offer to purchase the notes in the secondary

market but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to

trade or sell the notes easily. Because other dealers are not likely to make a secondary market for the notes, the price at which

you may be able to trade your notes is likely to depend on the price, if any, at which JPMS is willing to buy the notes.

|

|

|

·

|

MANY

ECONOMIC AND MARKET FACTORS WILL IMPACT THE VALUE OF THE NOTES

— In addition to 3-Month USD LIBOR on any day, the value of the notes will be affected by a number of economic and market

factors that may either offset or magnify each other, including:

|

|

|

·

|

any

actual or potential change in our creditworthiness or credit spreads;

|

|

|

·

|

the

actual and expected volatility of 3-Month USD LIBOR;

|

|

|

·

|

the

time to maturity of the notes;

|

|

|

·

|

interest

and yield rates in the market generally, as well as the volatility of those rates; and

|

|

|

·

|

a

variety of economic, financial, political, regulatory or judicial events.

|

|

JPMorgan Structured Investments —

Fixed to Floating Rate Notes Linked to 3-Month USD LIBOR

|

PS-

3

|

Hypothetical Interest

Rate for an Interest Period (Other Than an Initial Interest Period)

The following table illustrates the Interest Rate determination

for an Interest Period (other than an Initial Interest Period) for a hypothetical range of performance of 3-Month USD LIBOR and

reflects the Minimum Interest Rate and the Maximum Interest Rate set forth on the cover of this pricing supplement. The hypothetical

3-Month USD LIBOR and interest payments set forth in the following examples are for illustrative purposes only and may not be the

actual 3-Month USD LIBOR or interest payment applicable to a purchaser of the notes.

|

Hypothetical

3-Month USD LIBOR

|

Hypothetical

Interest Rate

for Years 3 to 6*

|

|

9.00%

|

3.00%

|

|

8.00%

|

3.00%

|

|

7.00%

|

3.00%

|

|

6.00%

|

3.00%

|

|

5.00%

|

3.00%

|

|

4.00%

|

3.00%

|

|

3.00%

|

3.00%

|

|

2.00%

|

2.50%

|

|

1.00%

|

1.50%

|

|

0.00%

|

0.50%

|

|

-0.50%

|

0.00%

|

|

-1.00%

|

0.00%

|

|

-2.00%

|

0.00%

|

*The Interest Rate cannot be less than the Minimum Interest

Rate of 0.00% per annum or more than the Maximum Interest Rate of 3.00% per annum with respect to years 3 to 6.

Hypothetical

Examples of Interest Rate Calculation for an Interest Period (Other Than an Initial Interest Period)

Hypothetical

Examples of Interest Rate Calculation for an Interest Period (Other Than an Initial Interest Period)

The following examples illustrate how the hypothetical Interest

Rate is calculated for a particular Interest Period occurring after the Initial Interest Periods and assume that that the actual

number of calendar days in the applicable Interest Period is 90. The hypothetical Interest Rates in the following examples are

for illustrative purposes only and may not correspond to the actual Interest Rate for any Interest Period applicable to a purchaser

of the notes. The numbers appearing in the following examples have been rounded for ease of analysis.

Example 1: After the Initial Interest Periods, with respect

to a particular Interest Period, 3-Month USD LIBOR is 2.00% on the applicable Determination Date.

The Interest Rate applicable

to this Interest Period is 2.50% per annum.

The corresponding interest payment per $1,000 principal amount

note is calculated as follows:

$1,000 × [2.00% + 0.50%] ×

(90/360) = $6.25

Example 2: After the Initial Interest Periods, with respect

to a particular Interest Period, 3-Month USD LIBOR is 3.00% on the applicable Determination Date.

Because 3-Month USD LIBOR

plus

0.50% exceeds the Maximum Interest Rate of 3.00%, the Interest Rate applicable to this Interest Period is 3.00% per

annum.

The corresponding interest payment per $1,000 principal amount

note is calculated as follows:

$1,000 ×

3.00% ×

(90/360) = $7.50

Example 3: After the Initial Interest Periods, with respect to

a particular Interest Period, 3-Month USD LIBOR is -2.00% on the applicable Determination Date.

Because 3-Month USD LIBOR of

-2.00%

plus

0.50% is less than the Minimum Interest Rate of 0.00% per annum, the Interest Rate for this Interest Period

is 0.00% per annum and no interest is payable with respect to this Interest Period.

The hypothetical payments on these notes shown above apply

only

if you hold the notes for their entire term

. These hypotheticals do not reflect fees or expenses that would be associated

with any sale in the secondary market. If these fees and expenses were included, the hypothetical payments shown above would

likely be lower.

What is 3-Month USD LIBOR?

3-Month USD LIBOR is the London Interbank Offered Rate for deposits

in U.S. dollars with a Designated Maturity of 3 months that appears on Reuters page “LIBOR01” (or any successor page)

under the heading “3Mo” at

|

JPMorgan Structured Investments —

Fixed to Floating Rate Notes Linked to 3-Month USD LIBOR

|

PS-

4

|

approximately 11:00 a.m., London time, on the applicable Determination

Date, as determined by the calculation agent, subject to the following paragraph.

Notwithstanding anything to the contrary in the accompanying

product supplement, if, on a Determination Date, 3-Month USD LIBOR cannot be determined by reference to Reuters page “LIBOR01”

(or any successor page), then the calculation agent will request the principal London office of four major banks in the London

interbank market, selected by the calculation agent, for deposits in U.S. dollars in a Representative Amount and for a term equal

to the Designated Maturity of 3 months, at approximately 11:00 a.m., London time, on that Determination Date. If at least

two such quotations are provided, 3-Month USD LIBOR for that Determination Date will be the arithmetic average of those quotations.

If fewer than two such quotations are provided, the calculation agent,

provided

that that Determination Date is also

a business day, will request each of three major banks in The City of New York to provide that bank’s rate to leading European

banks for loans in U.S. dollars in a Representative Amount and for a term equal to the Designated Maturity of 3 months, at approximately

11:00 a.m., New York City time, on that Determination Date. If at least two such rates are provided, then 3-Month USD LIBOR

for that Determination Date will be the arithmetic average of those rates. If fewer than two such rates are provided, or

if that Determination Date is not also a business day, then 3-Month USD LIBOR for that Determination Date will be 3-Month USD LIBOR

for the immediately preceding London Business Day. The “Representative Amount” means an amount equal to the outstanding

principal amount of the notes as of the applicable Determination Date.

Historical Information

The following graph sets forth the historical weekly performance

of 3-Month USD LIBOR from January 6, 2012 through May 12, 2017. 3-Month USD LIBOR on May 18, 2017 was 1.17172%. We obtained the

levels of 3-Month USD LIBOR above and below from the Bloomberg Professional

®

service (“Bloomberg”),

without independent verification.

The historical rates should not be taken as an indication of

future performance, and no assurance can be given as to 3-Month USD LIBOR on any Determination Date. There can be no assurance

that the performance of 3-Month USD LIBOR will result in an Interest Rate for any Interest Period (other than an Initial Interest

Period) that is greater than the Minimum Interest Rate.

|

JPMorgan Structured Investments —

Fixed to Floating Rate Notes Linked to 3-Month USD LIBOR

|

PS-

5

|

Supplemental Use of Proceeds

Notwithstanding anything to the contrary in the accompanying

prospectus, we will contribute the net proceeds that we receive from the sale of the notes offered by this pricing supplement to

our “intermediate holding company” subsidiary, JPMorgan Chase Holdings LLC, which will use those net proceeds for general

corporate purposes. General corporate purposes may include investments in our subsidiaries, payments of dividends to us, extensions

of credit to us or our subsidiaries or the financing of possible acquisitions or business expansion. Interest on our debt securities

(including interest on the notes offered by this pricing supplement) and dividends on our equity securities, as well as redemptions

or repurchases of our outstanding securities, will be made using amounts we receive as dividends or extensions of credit from JPMorgan

Chase Holdings LLC or as dividends from JPMorgan Chase Bank, N.A.

Supplemental Terms of the Notes

Events of Default

The notes will be issued under an Indenture dated May 25, 2001,

between us and Deutsche Bank Trust Company Americas (formerly Bankers Trust Company), as trustee (as has been and as may be further

supplemented from time to time, the “Indenture”).

Notwithstanding anything to the contrary in the accompanying

prospectus, under the Indenture, any one of the following events will be an “Event of Default” with respect to the

notes:

(1)

default in the payment of principal of the notes and continuance of

such default for 30 days;

(2)

default in the payment of interest on the notes and continuance of

such default for 30 days; and

(3)

specified events of our bankruptcy, insolvency, winding

up or liquidation, whether voluntary or involuntary.

Senior debt securities issued by us prior to December 31, 2016

(the “Pre-2017 Senior Debt”) contain events of default that are different from those set forth above. In particular:

|

|

·

|

the

events of default applicable to the Pre-2017 Senior Debt do not provide for a 30-day cure period with respect to any failure by

us to pay the principal of those senior debt securities;

|

|

|

·

|

most

series of Pre-2017 Senior Debt contain an additional event of default that is applicable if we fail to perform any of the covenants

contained in the terms and conditions of, or the governing instrument for, those senior debt securities and that failure continues

for 90 days; and

|

|

|

·

|

the events of default applicable to certain series of Pre-2017 Senior

Debt provide that specified events of bankruptcy, insolvency or reorganization of JPMorgan Chase Bank, N.A. would constitute an

event of default with respect to those senior debt securities.

|

In addition, certain series of senior debt securities which

we assumed in connection with our merger with The Bear Stearns Companies Inc. include additional events of default.

Accordingly, if we fail to pay the principal of any series of

Pre-2017 Senior Debt when due, the holders of those senior debt securities would be entitled to declare their securities due and

payable immediately, whereas holders of the notes would not be entitled to accelerate the notes until 30 days after our failure

to pay the principal of the notes. In addition, holders of the notes will not have the benefit of the additional events of default

described above that are applicable to the Pre-2017 Senior Debt.

Under the Indenture, if a default in the payment of principal

or interest with respect to one or more series of debt securities occurs and is continuing, either the trustee or the holders of

at least 25% in aggregate principal amount of the debt securities of such series then outstanding, treated as one class, by written

notice, may declare the principal of all outstanding debt securities of such series and any interest accrued thereon, to be due

and payable immediately. For this purpose, the notes will be deemed not to be in the same series as debt securities issued under

the Indenture prior to January 12, 2017. If a default due to specified events of our bankruptcy, insolvency, winding up or liquidation

occurs and is continuing, either the trustee or the holders of at least 25% in aggregate principal amount of all debt securities

then outstanding, treated as one class, by written notice, may declare the principal of all outstanding debt securities and any

interest accrued thereon, to be due and payable immediately. Subject to certain conditions, such declarations may be annulled and

past defaults may be waived by the holders of a majority in principal amount of the outstanding debt securities of the series affected.

Consolidations, Mergers, Sales and Transfers of Assets

Notwithstanding anything to the contrary in the accompanying

prospectus or prospectus supplement, for purposes of the notes, we may not merge or consolidate with any other entity or sell,

convey or transfer all or substantially all of our assets to any other entity (other than the sale, conveyance or transfer of all

or substantially all of our assets to one or more of our direct or indirect subsidiaries), unless:

|

|

·

|

either

we are the continuing entity or the successor entity or the entity to whom those assets are sold, conveyed or transferred is a

United States corporation or limited liability company that expressly assumes the due and punctual payment of the principal of,

any interest on, or any other amounts due under the debt securities issued under the Indenture and the due and punctual performance

and observance of all the covenants and conditions of the Indenture binding upon us, and

|

|

|

·

|

we

or the successor entity will not, immediately after the merger or consolidation, sale, conveyance or transfer, be in default in

the performance of any covenant or condition of the Indenture binding on us.

|

|

JPMorgan Structured Investments —

Fixed to Floating Rate Notes Linked to 3-Month USD LIBOR

|

PS-

6

|

Material U.S. Federal Income Tax Consequences

Prospective investors should note that the discussion under

“Material U.S. Federal Income Tax Consequences” in the accompanying product supplement 1-I does not apply to the notes

issued under this pricing supplement and is superseded by the following discussion.

The following is a discussion of the material U.S. federal

income and certain estate tax consequences of owning and disposing of the notes, and constitutes the full opinion of our special

tax counsel, Davis Polk & Wardwell LLP. It applies to you only if you are an initial investor who purchases a note at its issue

price for cash and holds it as a capital asset within the meaning of Section 1221 of the Internal Revenue Code of 1986, as amended

(the “Code”).

This discussion does not address all aspects of U.S. federal

income and estate taxation that may be relevant to you in light of your particular circumstances, including alternative minimum

tax consequences, the potential application of the provision of the Code known as the Medicare contribution tax and the different

consequences that may apply if you are an investor subject to special treatment under the U.S. federal income tax laws, such as:

|

|

·

|

a

financial institution;

|

|

|

·

|

a “regulated investment company”

as defined in Code Section 851;

|

|

|

·

|

a tax-exempt entity, including an “individual

retirement account” or “Roth IRA” as defined in Code Section 408 or 408A, respectively;

|

|

|

·

|

a dealer in securities;

|

|

|

·

|

a person holding a note as part of a “straddle,”

conversion transaction or integrated transaction, or who has entered into a “constructive sale” with respect to a note;

|

|

|

·

|

a U.S. Holder (as defined below) whose functional

currency is not the U.S. dollar;

|

|

|

·

|

a trader in securities who elects to apply

a mark-to-market method of tax accounting; or

|

|

|

·

|

a partnership or other entity classified as

a partnership for U.S. federal income tax purposes.

|

If you are a partnership for U.S. federal income tax purposes,

the U.S. federal income tax treatment of a partner will generally depend on the status of the partner and your activities.

This discussion is based on the Code, administrative pronouncements,

judicial decisions and final, temporary and proposed Treasury regulations as of the date hereof, changes to any of which, subsequent

to the date hereof, may affect the tax consequences described herein, possibly with retroactive effect. As the law applicable to

the U.S. federal income taxation of instruments such as the notes is technical and complex, the discussion below necessarily represents

only a general discussion. Moreover, the effects of any applicable state, local or non-U.S. tax laws are not discussed.

You

should consult your tax adviser concerning the application of U.S. federal income and estate tax laws to your particular situation,

as well as any tax consequences arising under the laws of any state, local or non-U.S. jurisdiction.

Tax Treatment of the Notes

You

and we agree to treat the notes as “variable rate debt instruments” that provide for a single fixed rate followed by

a single qualified floating rate (“QFR”) for U.S. federal income tax purposes. A QFR is any variable rate for which

variations in the value of the rate can reasonably be expected to measure contemporaneous variations in the cost of newly borrowed

funds in the currency in which the note is denominated.

Tax Consequences to U.S. Holders

You are a “U.S. Holder” if

for U.S. federal income tax purposes you are a beneficial owner of a note that is:

|

|

·

|

a citizen or individual resident of the United

States;

|

|

|

·

|

a corporation created or organized in or under

the laws of the United States, any state therein or the District of Columbia; or

|

|

|

·

|

an estate or trust the income of which is

subject to U.S. federal income taxation regardless of its source.

|

|

JPMorgan Structured Investments —

Fixed to Floating Rate Notes Linked to 3-Month USD LIBOR

|

PS-

7

|

Qualified Stated Interest and Original

Issue Discount.

If a debt instrument’s stated redemption price at maturity exceeds its issue price by an amount that

does not satisfy a

de minimis

test, the excess will be treated as original issue discount (“OID”) for U.S. federal

income tax purposes. Under applicable Treasury Regulations, the “stated redemption price at maturity” of a debt instrument

generally will equal the sum of all payments required under the debt instrument other than payments of qualified stated interest

(“QSI”). QSI generally includes stated interest unconditionally payable (other than in debt instruments of the issuer)

at least annually at a single rate.

In order to determine the amount of QSI

and OID (if any) in respect of the notes, an equivalent fixed rate debt instrument must be constructed. The equivalent fixed rate

debt instrument is constructed in the following manner: (i) first, the initial fixed rate is converted to a QFR that would preserve

the fair market value of the notes, and (ii) second, each QFR (including the QFR determined under (i) above) is converted to a

fixed rate substitute (which will generally be the value of that QFR as of the issue date of the notes). Then, the rules described

in the preceding paragraph will apply to the equivalent fixed rate debt instrument to determine the amount of QSI and OID on the

notes. Under these rules, the notes may be issued with OID.

QSI on the notes generally will be taxable

to you as ordinary interest income at the time it accrues or is received, in accordance with your method of tax accounting. Unless

any OID is less than

de minimis

, you will be required to include the OID, if any, in income for federal income tax purposes

as it accrues, in accordance with a constant-yield method based on a compounding of interest. If the amount of interest you receive

on the notes in a calendar year is greater than the amount of interest assumed to be paid or accrued under the equivalent fixed

rate debt instrument, the excess is treated as additional QSI taxable to you as ordinary income. If less, any difference will reduce

the amount of QSI you are treated as receiving and will therefore reduce the amount of ordinary income you are required to take

into income.

Sale, Exchange or Retirement of the

Notes.

Upon a sale, exchange or retirement of the notes, you generally will recognize capital gain or loss equal to the difference

between the amount realized on the sale, exchange or retirement (excluding amounts attributable to accrued QSI, which will be treated

as a payment of QSI) and your tax basis in the notes. Your tax basis in the notes generally will equal the amount you paid to acquire

them, increased by the amount of OID (if any) previously included in income with respect to the notes and reduced by any payments

other than QSI received. The gain or loss generally will be long-term capital gain or loss if, at the time of the sale, exchange

or retirement, you held the notes for more than one year, and short-term capital gain or loss otherwise. Long-term capital gains

recognized by non-corporate U.S. holders are generally subject to taxation at reduced rates. The deductibility of capital losses

is subject to certain limitations.

Tax

Consequences to Non-U.S. Holders

You are a “Non-U.S. Holder”

if for U.S. federal income tax purposes you are a beneficial owner of a note that is:

|

|

·

|

a nonresident alien individual;

|

|

|

·

|

a foreign corporation; or

|

|

|

·

|

a foreign estate or trust.

|

You are not a “Non-U.S. Holder”

for purposes of this discussion if you are an individual present in the United States for 183 days or more in the taxable year

of disposition of a note. In this case, you should consult your tax adviser regarding the U.S. federal income tax consequences

of the sale or exchange of a note (including redemption at maturity).

Subject to the discussion of “FATCA”

below, income and gain from a note generally will be exempt from U.S. federal income tax (including withholding tax) if these amounts

are not effectively connected with your conduct of a U.S. trade or business and you provide a properly completed applicable Internal

Revenue Service (“IRS”) Form W-8 appropriate to your circumstances.

If you are engaged in a U.S. trade or

business, and if income or gain from a note is effectively connected with your conduct of that trade or business (and, if an applicable

income tax treaty so requires, is attributable to a permanent establishment in the United States), although exempt from the withholding

tax discussed above, you generally will be taxed in the same manner as a U.S. Holder with respect to that income. You will not

be subject to withholding in this case if you provide a properly completed IRS Form W-8ECI. If this paragraph applies to you, you

should consult your tax adviser with respect to other U.S. tax consequences of owning and disposing of notes, including the possible

imposition of a 30% branch profits tax if you are a corporation.

|

JPMorgan Structured Investments —

Fixed to Floating Rate Notes Linked to 3-Month USD LIBOR

|

PS-

8

|

Federal Estate Tax

If you are an individual Non-U.S. Holder,

your notes will not be treated as U.S.-situs property subject to U.S. federal estate tax, provided that your income from the notes

is not then effectively connected with your conduct of a U.S. trade or business.

Backup Withholding and Information

Reporting

Interest accrued or paid on your notes and the proceeds received

from a sale or exchange of your notes (including

acceleration or redemption at maturity) will generally

be subject to information reporting unless you are an “exempt recipient.” You may also be subject to backup withholding

on payments in respect of your notes unless you provide proof of an applicable exemption or a correct taxpayer identification number

and otherwise comply with applicable requirements of the backup withholding rules. If you are a Non-U.S. Holder, you will not be

subject to backup withholding if you provide a properly completed IRS Form W-8 appropriate to your circumstances. Amounts withheld

under the backup withholding rules are not additional taxes and may be refunded or credited against your U.S. federal income tax

liability, provided the required information is furnished to the IRS.

FATCA

Legislation commonly referred to as “FATCA,” and

regulations promulgated thereunder, generally impose a 30% withholding tax on payments to certain foreign entities (including financial

intermediaries) with respect to debt instruments such as the notes, unless various U.S. information reporting and due diligence

requirements have been satisfied. An intergovernmental agreement between the United States and the foreign entity’s jurisdiction

may modify these requirements. This regime applies to payments of interest and to the payment on your notes at maturity, as well

as the proceeds of any sale or other disposition of a note occurring after December 31, 2018. You should consult your tax adviser

regarding the potential application of FATCA to the notes.

The Issuer will not pay any additional

amounts with respect to any withholding tax.

THE TAX CONSEQUENCES TO YOU OF OWNING AND DISPOSING OF NOTES

ARE UNCLEAR. YOU SHOULD CONSULT YOUR TAX ADVISER REGARDING THE TAX CONSEQUENCES OF OWNING AND DISPOSING OF NOTES, INCLUDING THE

TAX CONSEQUENCES UNDER STATE, LOCAL, NON-U.S. AND OTHER TAX LAWS AND THE POSSIBLE EFFECTS OF CHANGES IN U.S. FEDERAL OR OTHER TAX

LAWS.

|

JPMorgan Structured Investments —

Fixed to Floating Rate Notes Linked to 3-Month USD

LIBOR

|

PS- 9

|

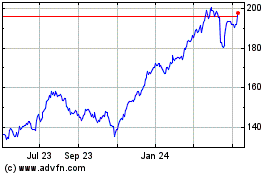

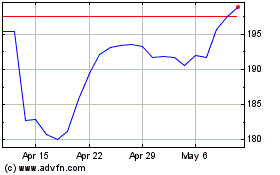

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024