Bank Of England To Stay Pat On Rates As UK Braces For Hung Parliament

June 14 2017 - 3:33AM

RTTF2

The Bank of England is likely to keep its monetary policy

unchanged at the first policy meeting held after Prime Minister

Theresa May lost the Conservative parliamentary majority at the

June 8 general election.

Policymakers are expected to unanimously decide to hold the

interest rate at a record low 0.25 percent and the quantitative

easing at GBP 435 billion.

June's meeting will be Kristin Forbes' last. After demanding a

quarter point rate increase in the past two meetings, she is likely

to drop her call on political uncertainty.

The minutes of the meeting will be simultaneously published on

Thursday.

The bank reappointed its Chief Economist Andrew Haldane to the

Monetary Policy Committee for a further three-year term on

Monday.

And following her resignation, Charlotte Hogg's spot is still

vacant. The MPC currently consists of only eight members.

The general election has raised the uncertainty over the policy

and Brexit. Moreover, ongoing political uncertainty is consuming

precious negotiating time with the European Union.

Data on the economic front showed that inflation has accelerated

to a near four-year high of 2.9 percent in May. Average earnings

grew only 1.7 percent in the three months to April, signaling a

squeeze on consumers spending.

The statistical office had revised down its first quarter GDP

growth to 0.2 percent from 0.3 percent.

The economy is experiencing a slower growth and higher

inflation, a combination that makes policymakers' task difficult.

Governor Mark Carney is set to speak at the Mansion House on

Thursday evening.

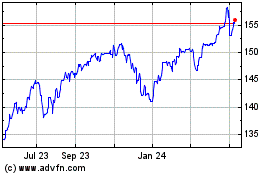

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

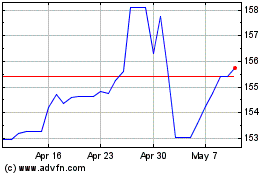

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024