Current Report Filing (8-k)

June 20 2017 - 5:58AM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported)

April 1, 2017

The Travelers Companies, Inc.

(Exact name of registrant as specified in its charter)

|

Minnesota

|

|

001-10898

|

|

41-0518860

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

485 Lexington Avenue

New York, New York

|

|

10017

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(917) 778-6000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 7.01. Regulation FD Disclosure.

The Travelers Companies, Inc. (the Company) is furnishing this Item 7.01 of this Current Report on Form 8-K to reclassify certain of its historical segment information in its Financial Supplement for the quarter ended March 31, 2017 (the Financial Supplement), as originally furnished to the Securities and Exchange Commission on April 20, 2017, to conform the presentation of such segment information to the manner in which the Company’s businesses have been managed starting April 1, 2017, as described below, and reflect the revised names and descriptions of certain businesses comprising these segments and other related changes. This reclassified historical segment information is furnished as

Exhibit 99.1 to this Current Report on Form 8-K (revisions to pages 8-20, 28 and 34).

Effective April 1, 2017, the Company’s results are being reported in the following three business segments — Business Insurance, Bond & Specialty Insurance and Personal Insurance, reflecting a change in the manner in which the Company’s businesses are being managed as of that date, as well as the aggregation of products and services based on the type of customer, how the business is marketed and the manner in which risks are underwritten. While the segmentation of the Company’s domestic businesses is unchanged, the Company’s international businesses, which were previously managed and reported in total within the Business and International Insurance segment, are now being disaggregated by product type among the three newly aligned reportable business segments. All prior periods presented have been reclassified to conform to this presentation.

In connection with these changes, the Company has revised the names and descriptions of certain businesses comprising the Company’s segments and has reflected other related changes.

The reclassification of historical segment information has no effect on the Company’s previously reported consolidated results of operations, financial condition, cash flows or the quantitative value of ratios presented in the Financial Supplement; however, as indicated above, the reclassifications impacted the presentation of certain historical segment data.

All other information in the Financial Supplement remains unchanged and has not been otherwise updated for events occurring after the date of such Supplement.

As provided in General Instruction B.2 of Form 8-K, the information furnished in Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 pertaining to the Financial Supplement shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall such information be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01. Other Events.

The Company is filing this Item 8.01 of this Current Report on Form 8-K to reclassify certain of its historical segment information contained in the Company’s Quarterly Report on Form 10-Q for the period ended March 31, 2017 (the Quarterly Report), as filed with the Securities and Exchange Commission on April 20, 2017, to conform the presentation of such segment information to the manner in which the Company’s businesses have been managed starting April 1, 2017, as described in Item 7.01 above, and reflect the revised names and descriptions of certain businesses comprising these segments and other related changes. This reclassified segment information is filed as Exhibit 99.2 to Item 8.01 of this Current Report on Form 8-K.

The reclassification of historical segment information has no effect on the Company’s previously reported consolidated results of operations, financial condition, cash flows or the quantitative value of ratios presented in the Quarterly Report; however, as indicated above, the reclassifications impacted the presentation of certain historical segment data.

All other information in the Quarterly Report remains unchanged and has not been otherwise updated for events occurring after the date of such report.

Concurrent with the filing of this Current Report on Form 8-K, the Company has filed a separate Item 8.01 Current Report on Form 8-K to (1) reclassify certain of its historical segment information contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016 as filed with the Securities and Exchange Commission on February 16, 2017 (the Annual Report), to conform the presentation of such segment information to the manner in which the Company’s businesses have been managed starting April 1, 2017, as described above, and reflect the revised names and descriptions of certain businesses comprising these segments and other related changes and (2) update and add certain insurance terms defined in the Glossary of Selected Insurance Terms of the Annual Report.

2

Item 9.01(d) Exhibits.

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

99.1

|

|

Items from The Travelers Companies, Inc. Financial Supplement for the quarter ended March 31, 2017, as furnished under cover of Form 8-K with the Securities and Exchange Commission on April 20, 2017, revised to reflect reclassified segment information to conform the presentation of such segment information to the Company’s revised segment alignment and reflect the revised names and descriptions of certain businesses comprising these segments and other related changes (revisions to pages 8-20, 28 and 34).

|

|

|

|

|

|

99.2

|

|

The following items from The Travelers Companies, Inc. Quarterly Report on Form 10-Q for the period ended March 31, 2017, as filed with the Securities and Exchange Commission on April 20, 2017, revised to reclassify certain of its historical segment information to conform the presentation of such segment information to the Company’s revised segment alignment and reflect the revised names and descriptions of certain businesses comprising these segments and other related changes: Part I, “Item 1. Financial Statements” and Part I, “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Due to its forward-looking rather than historical nature, the Company has not provided reclassified segment information with respect to the section entitled “Outlook” in the MD&A and has omitted this section from Exhibit 99.2 of this Form 8-K.

|

|

|

|

|

|

101.1

|

|

The following financial information from The Travelers Companies, Inc.’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2017, as filed with the Securities and Exchange Commission on April 20, 2017, formatted in XBRL and revised to reflect reclassified segment information: (i) Consolidated Statement of Income for the three months ended March 31, 2017 and 2016; (ii) Consolidated Statement of Comprehensive Income for the three months ended March 31, 2017 and 2016; (iii) Consolidated Balance Sheet at March 31, 2017 and December 31, 2016; (iv) Consolidated Statement of Changes in Shareholders’ Equity for the three months ended March 31, 2017 and 2016; (v) Consolidated Statement of Cash Flows for the three months ended March 31, 2017 and 2016; and (vi) Notes to Consolidated Financial Statements.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, The Travelers Companies, Inc. has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

THE TRAVELERS COMPANIES, INC.

|

|

|

|

|

|

|

|

Date: June 20, 2017

|

By

|

/

S/ KENNETH F. SPENCE III

|

|

|

|

Name: Kenneth F. Spence III

|

|

|

|

Title: Executive Vice President and General Counsel

|

3

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Items from The Travelers Companies, Inc. Financial Supplement for the quarter ended March 31, 2017, as furnished under cover of Form 8-K with the Securities and Exchange Commission on April 20, 2017, revised to reflect reclassified segment information to conform the presentation of such segment information to the Company’s revised segment alignment and reflect the revised names and descriptions of certain businesses comprising these segments and other related changes (revisions to pages 8-20, 28 and 34).

|

|

|

|

|

|

99.2

|

|

The following items from The Travelers Companies, Inc. Quarterly Report on Form 10-Q for the period ended March 31, 2017, as filed with the Securities and Exchange Commission on April 20, 2017, revised to reclassify certain of its historical segment information to conform the presentation of such segment information to the Company’s revised segment alignment and reflect the revised names and descriptions of certain businesses comprising these segments and other related changes: Part I, “Item 1. Financial Statements” and Part I, “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Due to its forward-looking rather than historical nature, the Company has not provided reclassified segment information with respect to the section entitled “Outlook” in the MD&A and has omitted this section from Exhibit 99.2 of this Form 8-K.

|

|

|

|

|

|

101.1

|

|

The following financial information from The Travelers Companies, Inc.’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2017, as filed with the Securities and Exchange Commission on April 20, 2017, formatted in XBRL and revised to reflect reclassified segment information: (i) Consolidated Statement of Income for the three months ended March 31, 2017 and 2016; (ii) Consolidated Statement of Comprehensive Income for the three months ended March 31, 2017 and 2016; (iii) Consolidated Balance Sheet at March 31, 2017 and December 31, 2016; (iv) Consolidated Statement of Changes in Shareholders’ Equity for the three months ended March 31, 2017 and 2016; (v) Consolidated Statement of Cash Flows for the three months ended March 31, 2017 and 2016; and (vi) Notes to Consolidated Financial Statements.

|

4

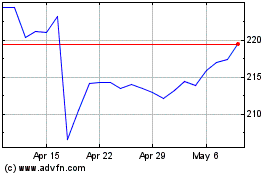

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

From Apr 2023 to Apr 2024