Bank Shares Lead European Markets Higher

June 26 2017 - 3:08AM

Dow Jones News

By Christopher Whittall and Kenan Machado

Global stocks moved higher Monday as a stabilization in oil

prices and gains in European banking shares supported equity

markets.

The Stoxx 600 rose 0.6% in early trade after Asian markets

broadly advanced. U.S. futures pointed to a 0.2% opening gain for

the S&P 500.

Investors scooped up European banking stocks after Italian

authorities said Sunday they were prepared to spend as much as

EUR17 billion as part of the shut down of two regional banks.

Italian banks have been a concern for years, weighed down by

about EUR200 billion in bad loans, low profitability and

insufficient capital. Their troubles have cast a shadow over the

wider European banking system, which accounts for a large chunk of

regional equity benchmarks.

The Stoxx Europe 600 Banks subindex was up 0.9% recently, while

the FTSE Italia All-Share Banks was up 2.5%. Intesa Sanpaolo SpA

rose 3.5%, while UniCredit SpA gained 2.3%.

European food and beverage shares logged strong gains, rising

2%, following news that billionaire activist investor Daniel Loeb's

Third Point LLC hedge fund has taken a $3.5 billion stake in Nestlé

SA. Shares in Nestlé were up over 4%.

Gains in oil prices also added to the positive tone in markets

on Monday. Investors have eyed warily a sharp slide in energy

prices in recent days.

U.S. oil prices entered a bear market last week after falling

more than 20% since a recent February high amid a persistent glut

in crude prices despite moves to limit production from the

Organization of the Petroleum Exporting Countries.

In early 2016, a sharp decline in oil prices pushed down major

stock indexes as investors worried about the knock-on effects of

rising defaults in the energy sector. The energy market is also

crucial for the earnings recovery in the U.S., where the sector is

expected to account for nearly half of the S&P 500's earnings

growth in the second quarter, according to FactSet.

Brent crude oil, the international benchmark, rose 1.4% Monday

to $46.18 a barrel. The Stoxx Europe 600 Oil and Gas subindex rose

0.9%.

In Asia, the Shanghai Composite index rose 0.9%, with Chinese

stocks continuing to perform strongly following MSCI's decision to

add them to its indexes. Gains there also helped boost Hong Kong

equities on Monday. The Hang Seng Index rose 0.7%.

Meanwhile, Taiwan's tech-heavy Taiex index rose 1.3% to hit

fresh 27-year highs.

In Japan, the Nikkei Stock Average rose 0.1%, with financial

stocks weighing on the broader index. Signs that interest rates

will remain low continue to weigh on Japanese financials, said

Hisao Matsuura, chief strategist for equities at Nomura Japan.

The yield on the 10-year Treasury note edged up to 2.152% from

2.146% on Friday. Yields rise as prices fall. Investors are looking

ahead to a raft of inflation data out of Europe and the U.S. this

week.

In currency markets, the WSJ Dollar Index, which measures the

dollar against a basket of 16 currencies, declined 0.1%.

Write to Christopher Whittall at christopher.whittall@wsj.com

and Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

June 26, 2017 03:53 ET (07:53 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

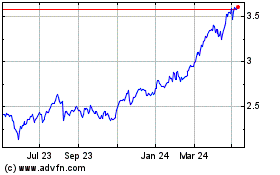

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Mar 2024 to Apr 2024

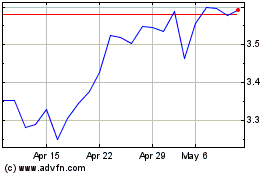

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Apr 2023 to Apr 2024