Canadian Dollar Weakens Amid Risk Aversion, Falling Oil Prices

July 06 2017 - 10:53PM

RTTF2

The Canadian dollar declined against its most major rivals in

the Asian session on Friday, with rising global bond yields amid

indications of a hawkish shift by the European Central Bank sapping

investor appetite for riskier assets.

The minutes from the European Central Bank's June meeting showed

that policymakers considered dropping their pledge to expand or

extend the bond-buying program. This came on the heels of a speech

by the ECB chief Mario Draghi last week, when he sounded optimistic

on future inflationary movements.

Yesterday's weaker-than-expected ADP private payrolls data

suggested a possible slowdown in labor market activity ahead of

non-farm payrolls due 8:30 a.m. ET Friday.

U.S. private sector employers added 158,000 jobs last month,

lower than the 230,000 positions created in May and below

expectations for a gain of 185,000, according to the report from

payroll processor ADP.

The escalating tensions surrounding North Korea's test launch

this week of an intercontinental ballistic missile also continues

to be a point of concern. U.S. President Donald Trump on Thursday

said in Warsaw that he's considering some pretty severe things in

response to North Korea's efforts to develop nuclear weapons aimed

at the U.S.

The loonie was also undermined by falling oil prices, as a data

from the Energy Information Administration showed that U.S. oil

production rose to 9.34 million barrels per day last week.

Crude for August delivery fell $0.55 to $44.97 per barrel.

The loonie was lower against its major rivals, except the aussie

on Friday.

The loonie dropped to 1.4835 against the euro, its lowest since

June 30. Continuation of the loonie's downtrend may see it

challenging support around the 1.50 region.

Data from Destatis showed that German industrial production grew

at the fastest pace in four months in May.

Industrial production grew 1.2 percent month-on-month in May,

faster than the 0.4 percent increase seen in April and exceeded

economists' forecast of 0.2 percent.

The loonie edged down to 0.9864 against the aussie, compared to

Thursday's closing value of 0.9843. If the loonie's downtrend, 1.00

is likely seen as its next support level.

The loonie weakened to a 2-day low of 1.2994 against the

greenback and held steady thereafter. The next possible support for

the loonie is seen around the 1.31 area.

On the flip side, the loonie rose to 87.67 against the yen, off

its early low of 87.13. The loonie is seen finding resistance

around the 89.00 level.

Preliminary data from the Cabinet Office showed that Japan's

leading index strengthened in May, while coincident index fell from

April.

The leading index that measures the future economic activity,

rose to 104.7 in May from 104.2 in April. The score was forecast to

rise to 104.6.

Looking ahead, U.K. industrial production and trade data for May

are set for release in the European session.

In the New York session, U.S. and Canada jobs data as well as

Ivey PMI - all for June will be out.

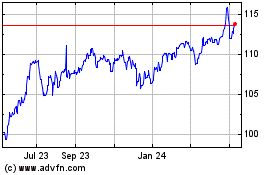

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

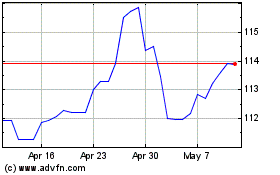

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024