Canadian Dollar Weakens On Falling Oil Prices

July 10 2017 - 4:07AM

RTTF2

The Canadian dollar declined against its major counterparts in

the European session on Monday, with rising oil rigs in the U.S.

dragging down crude prices.

Crude for August delivery dropped $0.48 to $43.75 per

barrel.

Data from energy services co. Baker Hughes showed that U.S. oil

rig count rose by 7 last week, taking the total count to 763, which

was the highest since April 2015.

Higher dollar also undermined oil prices, as the dollar rallied

in the wake of upbeat U.S. jobs data. Since the crude oil is quoted

in U.S. dollars, a high dollar is often viewed as negative for oil

prices.

Talks that OPEC members Libya and Nigeria, who are exempt from

the production cuts, may be asked to comply with production caps

failed to lift prices.

Libya and Nigeria may be requested to cap their production in a

meeting taking place in Russia on July 24, the Kuwaiti oil minister

Issam Almarzooq told Bloomberg on the sidelines of 22nd World

Petroleum Congress in Istanbul, Turkey.

The loonie has been trading modestly lower against its major

rivals in the Asian session, with the exception of the Japanese

yen.

The loonie dropped to 1.2932 against the greenback and 1.4729

against euro, off its early highs of 1.2872 and 1.4669,

respectively. The loonie is likely to find support around 1.32

against the greenback and 1.51 against the euro.

The loonie reversed from its early highs of 88.67 against the

yen and 0.9780 against the aussie, edging down to 88.24 and 0.9819,

respectively. The next possible support for the loonie is seen

around 86.00 against the yen and 1.01 against the aussie.

Looking ahead, U.S. labor market conditions index for June and

U.S. consumer credit for May are slated for release in the New York

session.

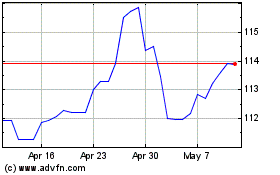

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

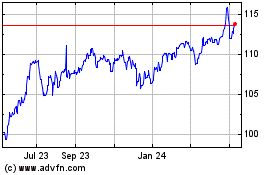

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024