Canadian Dollar Drops Amid Falling Oil Prices

July 11 2017 - 4:11AM

RTTF2

The Canadian dollar weakened against its major counterparts in

the European session on Tuesday, as oil prices fell and investors

await the Bank of Canada decision due tomorrow, which is widely

forecast to raise benchmark rate for the first time in nearly seven

years.

Crude oil fell ahead of U.S. inventories data that may show

dwindling supplies for the second consecutive week.

Crude for August delivery dropped $0.41 to $43.99 per

barrel.

Despite low oil prices, a sharp increase in spending by U.S.

shale producers has led the global recovery in oil investment, said

the International Energy Agency.

"The largest planned increase in upstream spending in 2017 in

percentage terms is in the United States, in particular in shale

assets that have benefited from a reduction in breakeven prices as

a result of a combination of improvement in costs and efficiency

gains," the IEA said.

The BoC meets tomorrow, with economists forecasting it to

deliver a 25 basis-point rate hike to 0.75 percent. The rate has

been kept unchanged at 0.50 percent since 2015.

Sentiment was subdued as investors awaited the U.S. earnings

season as well as the testimony from Fed chair Janet Yellen this

week for clues on the timing of the next U.S. rate hike.

Data from Canada mortgage and housing Corp. showed that Canada

housing starts rose more-than-forecast in June.

The seasonally adjusted annual rate of starts were 212,695 units

in June, up from 194,955 units in May. Economists had forecast an

increase of 200,000 units.

The loonie showed mixed performance in the Asian session. While

the loonie fell against the greenback and the aussie, it held

steady against the euro. Against the yen, it rose.

The loonie dropped to 4-day lows of 0.9839 against the aussie

and 1.4747 against the euro, from its early highs of 0.9800 and

1.4673,respectively. Continuation of the loonie's downtrend may see

it challenging support around 1.00 against the aussie and 1.50

against the euro.

The loonie retreated to 88.46 against the yen, from a 7-month

high of 88.84 hit at 3:00 am ET. If the loonie-yen pair extends

decline, 86.00 is likely seen as its next support level.

Data from the the Bank of Japan showed that Japan's M2 money

stock rose 3.9 percent on year in June, coming in at 976.6 trillion

yen.

That was in line with expectations and up from the downwardly

revised 3.8 percent increase in May.

Reversing from an early high of 1.2885 against the greenback,

the loonie edged down to 1.2926. Next likely support for the loonie

may be found around the 1.31 region.

Looking ahead, U.S. wholesale inventories for May are due

shortly.

At 12:30 pm ET, the Federal Reserve Governor Lael Brainard

speaks about normalizing central banks' balance sheets at a

conference jointly sponsored by Columbia University and the Federal

Reserve Bank of New York.

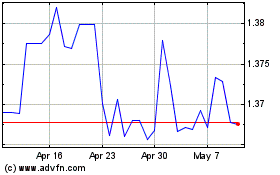

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024