Intel Fires Back At Rivals With New Line of Server Chips

July 11 2017 - 11:44AM

Dow Jones News

By Ted Greenwald

Intel Corp. on Tuesday brought to market a new generation of

chips used in the servers that run data centers, firing back at

competitors who lately have moved to challenge its hegemony in its

most profitable market.

The rollout of the Xeon Scalable Family, an updated line of 58

processors priced from roughly $200 to $10,000 each, highlighted

Intel's ambition to maintain its hold over all segments of the data

center market.

Intel makes most of its revenue on processors for personal

computers, but the powerful server chips bring higher prices and

profit margins. The server-chip division reported an

operating-profit margin of 44% in fiscal 2016 compared with 32% in

the segment that sells PC chips.

The server business has become more strategic lately as sales of

personal computers have plateaued in recent years.

Intel holds nearly 100% of the $16.5 billion global market for

server chips that run the software instructions called x86 that

form the foundation of nearly all commercial software, according to

Mercury Research.

But Intel's server business shows signs of contracting. Although

the chip giant has said it expects double-digit revenue growth in

its data-center division in coming years, half of that growth will

come not from chips but from ancillary products like storage and

networking, according to Bernstein Research analyst Stacy Rasgon.

In addition, Intel has said that profit margins in its data center

segment would narrow as that business absorbs more of the costs of

developing new manufacturing methods.

Meanwhile, the server sector has attracted a raft of rivals.

Advanced Micro Devices Inc. in June started shipping its Epyc line

of server chips aimed squarely at the lower-priced half of Intel's

offerings. Those products, AMD's first entry into the data-center

market since 2013, are giving server makers a welcome alternative

for Intel's products. However, any impact on Intel won't become

clear for some time.

Qualcomm Inc. and Cavium Inc. in March demonstrated chips

running Microsoft Corp.'s Windows Server operating system based on

technology from ARM Holdings, a division of SoftBank Group Corp.

Microsoft has said it expects to use such chips in its Azure cloud

service. International Business Machines Corp. has announced new

server chips expected later this year.

And the boom in artificial intelligence has spurred sales of

graphics processors made by Nvidia Corp., which has overshadowed

Intel in the training phase of machine learning.

Intel responded to the newly competitive environment with a New

York launch event Tuesday where it touted partnerships with

prominent software and hardware vendors, endorsements from

Amazon.com Inc. and Alphabet Inc.'s Google -- an early Xeon

Scalable Family customer -- and boasts of its central role in three

systems that are candidates for an annual list of top 500

supercomputers.

Spanning a range of uses and cost-per-performance

characteristics, the new product line is intended to encourage

customers to move into higher-price products, the company said.

Moreover, it is tightly coupled to Intel memory, data storage,

networking, and accelerator products intended to win the company a

larger portion of data-center budgets.

Intel claimed that the top-of-the-line Xeon Scalable Family unit

delivers nearly two-thirds higher performance, on average, than the

company's previous most-powerful server processor. It presented

dozens of what Intel called "world record" scores on performance

tests on various applications.

Industry watchers tend to withhold judgment about performance

until independent test results become available and generally agree

that performance is only one of many factors crucial to market

success.

"Anyone can put together a [processor] that will look good on

paper from a feature-comparison standpoint," said Lisa Spelman,

Intel's VP of data center marketing. But it is harder to build "a

well balanced system that can use the highest capacity of every

feature it has," she said.

Write to Ted Greenwald at Ted.Greenwald@wsj.com

(END) Dow Jones Newswires

July 11, 2017 12:29 ET (16:29 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

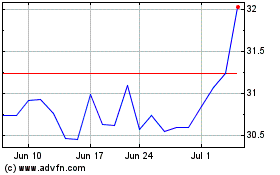

Intel (NASDAQ:INTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

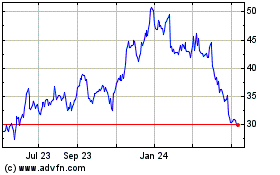

Intel (NASDAQ:INTC)

Historical Stock Chart

From Apr 2023 to Apr 2024