Intel Announces Receipt of Israel Tax Authority Ruling for Mobileye Asset Sale & Further Extension of Cash Tender Offer for A...

July 14 2017 - 7:30AM

Business Wire

Intel Corporation (NASDAQ:INTC) today announced that the Israel

Tax Authority has issued an acceptable tax ruling with respect to

the tax treatment of the potential asset sale, liquidation and

second step distribution contemplated in connection with the all

cash tender offer to purchase all of the outstanding ordinary

shares of Mobileye N.V. (“Mobileye”) by Intel. The tender offer is

being made pursuant to the Purchase Agreement, dated as of March

12, 2017, by and among Intel, Cyclops Holdings, Inc., a wholly

owned subsidiary of Intel that was later converted to Cyclops

Holdings, LLC (“Cyclops”), and Mobileye (the “Purchase Agreement”).

Cyclops filed a tender offer statement on Schedule TO with the

U.S. Securities and Exchange Commission (the “SEC”) on April

5, 2017 (as amended and supplemented, the “Schedule TO”).

As a result of receipt of the tax ruling and the adoption of

certain shareholder resolutions at the general meeting of Mobileye

shareholders in June, the minimum number of Mobileye shares that

must be validly tendered and not withdrawn prior to the expiration

of the tender offer (including any extensions) (the “Expiration

Time”) has been lowered from 95 percent to 67 percent of

outstanding Mobileye shares (the “Minimum Condition”). Withdrawal

rights will terminate following the Expiration Time. Mobileye

shareholders who have already tendered their Mobileye shares in the

tender offer but whose willingness to tender is affected by the

lower threshold for the Minimum Condition should withdraw their

Mobileye shares from the tender offer immediately but in any event

before the Expiration Time.

In connection with the receipt of the tax ruling and the

lowering of the Minimum Condition, Intel also announced that Intel

and Mobileye have agreed that Cyclops will extend the offering

period of the tender offer. The tender offer, which was previously

set to expire at 5:00 p.m., New York City time, on July 20, 2017,

is now scheduled to expire at 5:00 p.m., New York City time, on

July 28, 2017, unless the tender offer is extended or earlier

terminated, in either case pursuant to the terms of the Purchase

Agreement. The transaction is currently expected to close during

the third quarter of 2017.

Mobileye shareholders who have already tendered and not

withdrawn their ordinary shares of Mobileye do not have to

re-tender their shares or take any other action as a result of the

extension of the expiration date of the tender offer.

In addition to satisfaction of the revised Minimum Condition,

completion of the tender offer remains subject to additional

conditions described in the Schedule TO, including the receipt of

regulatory approval from the Korean Fair Trade Authority. The

tender offer will continue to be extended until all conditions are

satisfied or waived, or until the tender offer is terminated, in

either case pursuant to the terms of the Purchase Agreement and as

described in the Schedule TO.

As promptly as practicable following the Expiration Time and

during the subsequent offering period, Intel intends to cause

Mobileye to be converted from a public limited liability company

(naamloze vennootschap or N.V.) to a private limited liability

company (besloten vennootschap met beperkte aansprakelijkheid or

B.V.) under Dutch law (the “Conversion”). The Conversion could

occur as soon as one day after the Expiration Time. Mobileye

shareholders should be aware that following the Conversion,

Mobileye shares held in registered form may only be transferred by

way of a notarial deed executed by a Dutch notary (as more fully

described in the Schedule TO). Fees for execution of a Dutch

notarial deed for the transfer of Mobileye shares can be expected

to be between EUR 2,000 and EUR 5,000 for each such Dutch notarial

deed executed by a Dutch notary. Mobileye shareholders can avoid

the time and cost associated with the requirement of Dutch notarial

deeds by tendering their Mobileye shares prior to the Expiration

Time.

Mobileye shareholders should also be aware that pursuant to the

further amended Mobileye articles of association to go into effect

when Mobileye shares are delisted from the NYSE (which was approved

at the Mobileye shareholder meeting on June 13, 2017) (the

“Delisting Amendment”), Mobileye shares acquired after the

effectiveness of the Delisting Amendment and the delisting of

Mobileye shares from the NYSE (including during the subsequent

offering period if the Delisting Amendment becomes effective during

that period) will be subject to certain transfer restrictions,

including the requirement that the Mobileye board approve any such

transfer (as more fully described in the Schedule TO). If the

Delisting Amendment becomes effective during the subsequent

offering period, Mobileye shares could be delisted from the NYSE as

soon as the twentieth day after the Expiration Time. Mobileye

shareholders can avoid such restrictions on the transferability of

their Mobileye shares by tendering their Mobileye shares prior to

the Expiration Time.

D.F. King & Co. is acting as information agent for the

tender offer. Requests for documents and questions regarding the

tender offer may be directed to D.F. King toll free at

(800) 966-9021 (for shareholders) or collect at

(212) 269-5550 (for banks and brokers).

About Intel

Intel (NASDAQ:INTC) expands the boundaries of technology to make

the most amazing experiences possible. Information about Intel can

be found at newsroom.intel.com and intel.com.

Additional Information and Where to Find It

This press release is for informational purposes only and is

neither an offer to purchase nor a solicitation of an offer to sell

any ordinary shares of Mobileye or any other securities. A tender

offer statement on Schedule TO, including an offer to purchase, a

letter of transmittal and related documents, has been filed with

the SEC by Intel and one or more of its subsidiaries and a

solicitation/recommendation statement on

Schedule 14D-9, has been filed with the SEC by Mobileye.

The offer to purchase all of the issued and outstanding ordinary

shares of Mobileye will only be made pursuant to the offer to

purchase, the letter of transmittal and related documents filed as

a part of the tender offer statement on Schedule TO, in each case

as amended from time to time. THE TENDER OFFER MATERIALS (INCLUDING

AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN

OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION

STATEMENT ON SCHEDULE 14D-9 CONTAIN IMPORTANT INFORMATION.

INVESTORS AND SHAREHOLDERS OF MOBILEYE ARE URGED TO READ THESE

DOCUMENTS CAREFULLY BECAUSE THEY CONTAIN IMPORTANT INFORMATION THAT

SUCH HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING

TENDERING THEIR ORDINARY SHARES. Investors and security holders may

obtain a free copy of these statements and other documents filed

with the SEC at the website maintained by the SEC at www.sec.gov,

at the transaction website

(http://intelandmobileye.transactionannouncement.com), or by

directing such requests to D.F. King & Co., Inc., the

information agent for the tender

offer, toll free at (800) 966-9021 (for

shareholders) or collect at (212) 269-5550 (for banks and

brokers).

Forward-Looking Statements

This document contains forward-looking statements related to the

proposed transaction between Intel and Mobileye, including

statements regarding the benefits and the timing of the transaction

as well as statements regarding the companies’ products and

markets. Words such as “anticipate,” “believe,” “estimate,”

“expect,” “forecast,” “intend,” “may,” “plan,” “project,”

“predict,” “should,” “would” and “will” and variations of such

words and similar expressions are intended to identify such

forward-looking statements. Such statements are based on

management’s expectations as of the date they were first made and

involve risks and uncertainties that could cause our actual results

to differ materially from those expressed or implied in our

forward-looking statements. Such risks and uncertainties include,

among others, the outcome of regulatory reviews of the proposed

transaction; the ability of the parties to complete the transaction

in the time expected or at all; the ability of Intel to

successfully integrate Mobileye’s business; the market for advanced

driving assistance systems and autonomous driving may develop more

slowly than expected or than it has in the past; evolving

government regulation of the advanced driving assistance systems

and autonomous driving markets; the risk that we are unable to

commercially develop the technologies acquired or achieve the

anticipated benefits and synergies of the transaction; the risk

that we are unable to develop derivative works from the

technologies acquired; our ability to attract new or maintain

existing customer and supplier relationships at reasonable cost;

the failure to protect and enforce our intellectual property

rights; assertions or claims by third parties that we infringe

their intellectual property rights; the risk of technological

developments and innovations by others; the risk of potential

losses related to any product liability claims and litigation; the

risk that the parties are unable to retain and hire key personnel;

unanticipated restructuring costs may be incurred or undisclosed

liabilities assumed; and other risks detailed in Intel’s and

Mobileye’s filings with the SEC, including those discussed in

Intel’s most recent Annual Report on Form 10-K and in any

subsequent periodic reports on Form 10-Q and

Form 8-K and Mobileye’s most recent Annual Report on

Form 20-F and in any subsequent reports on

Form 6-K, each of which is on file or furnished with the

SEC and available at the SEC’s website at www.sec.gov. SEC filings

for Intel are also available on Intel’s Investor Relations website

at www.intc.com, and SEC filings for Mobileye are available in

the Investor Relations section of Mobileye’s website

at ir.mobileye.com. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of their dates. Unless otherwise required by applicable law, Intel

and Mobileye undertake no obligation and do not intend to update

these forward-looking statements, whether as a result of new

information, future events or otherwise.

Intel and the Intel logo are trademarks of Intel Corporation in

the United States and other countries.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170714005088/en/

Intel Media RelationsCara Walker,

503-696-0831cara.walker@intel.comorIntel Investor RelationsMark

Henninger, 408-653-9944Mark.h.henninger@intel.com

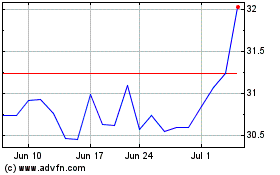

Intel (NASDAQ:INTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

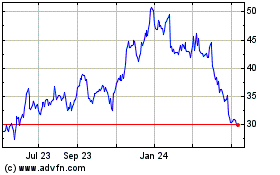

Intel (NASDAQ:INTC)

Historical Stock Chart

From Apr 2023 to Apr 2024