Canadian Dollar Advances As Oil Prices Strengthen

July 19 2017 - 5:25AM

RTTF2

The Canadian dollar climbed against its most major counterparts

in early New York deals on Wednesday, as oil prices rose following

an industry data showing a draw in gasoline stockpiles last week

and investors await official data on crude supplies due

shortly.

Crude for September delivery rose $0.10 to $46.69 per

barrel.

Data from American Petroleum Institute showed a drop of 5.4

million barrels in gasoline supplies for the week ending July 14,

far higher than analysts' expectations for a fall by 500,000

barrels.

Distillate inventories fell by 2.9 million barrels, compared to

expectations for a 700,000-barrel draw.

However, U.S. crude stockpiles rose by 1.628 million barrels

last week, defying forecasts for a draw of 3 million barrels.

The Energy Information releases oil inventory data at 10:30 am

ET, with analysts expecting a drop in crude stocks by 3.2 million

barrels.

A joint meeting between OPEC and non-OPEC producers, including

Saudi Arabia and Russia, is scheduled in Russia next week, at which

the delegates will discuss compliance with production cuts and the

current situation in the oil market.

In economic news, Canada's manufacturing sales increased for the

third consecutive month, up 1.1% to $54.6 billion in May. The gain

was mainly attributable to higher sales in the transportation

equipment and chemical manufacturing industries.

The loonie has been trading higher against its major rivals in

the European session, with the exception of the yen.

The loonie recovered to 0.9993 against the aussie, off its early

low of 1.0035. If the loonie rises further, 0.98 is likely seen as

its next resistance level.

The latest survey from Westpac Bank showed that a leading index

for the Australian economy continued to show pessimism in June, and

at a sharper rate.

The index was down 0.14 percent after easing an upwardly revised

0.01 percent in May.

The loonie reversed from an early low of 1.2652 against the

greenback, advancing to over a 1-year high 1.2579. Continuation of

the loonie's uptrend may see it challenging resistance around the

1.23 region.

The loonie hit a 2-day high of 1.4505 against the euro, from a

low of 1.4593 hit at 6:00 pm ET. On the upside, 1.43 is possibly

seen as the next resistance level for the loonie.

Data from Eurostat showed that Eurozone construction output

declined in May after recovering in April.

Construction output fell 0.7 percent in May from April, when it

rose 0.3 percent. Civil engineering slid 0.9 percent and building

construction dropped 0.6 percent in May.

On the flip side, the loonie fell to 88.51 against the yen, from

an early high of 88.89. The next possible support for the loonie is

seen around the 86.00 mark.

The Japanese government maintained its economic view,

reiterating that the economy is on a moderate recovery.

The government retained its view on private consumption,

business investment, exports, industrial production and corporate

profits. Assessment of employment and consumer prices were also

kept unchanged.

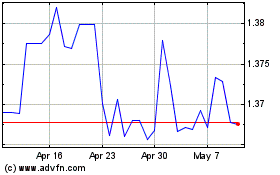

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024