Facebook Launches News Analytics Tool in Partnership With Nielsen -- 3rd Update

July 19 2017 - 3:12PM

Dow Jones News

By Lukas I. Alpert

In its continuing efforts to sell publishers on the benefits of

Instant Articles, Facebook is launching a new analytics tool in

partnership with Nielsen that will give news outlets more data on

how their stories perform on the platform.

Facebook also confirmed it is working on a subscription feature

that would allow publishers to charge for access to their articles.

The paywall product, first reported by The Wall Street Journal in

June, will be available through Instant Articles starting in

October. The paywall will likely kick in after a user reads 10

articles in a month, a person familiar with the matter said. The

feature will be tested with a small group of publishers to

start.

Facebook has long argued that stories posted through its

fast-loading Instant Articles program have led to greater

engagement from readers, but some publishers have remained

unconvinced given the lack of specific enough data.

In the past, Facebook has made available performance data

aggregated across the 10,000 or so publishers who have tried the

program. The new tool will now allow publishers to see how their

specific news organizations' stories perform on Instant Articles

collectively, enabling them to compare against those posted using

traditional links sending readers to a mobile webpage.

"This insight provides an important signal publishers can use to

make informed business decisions about how they share content on

Facebook," said Facebook product manager, Mona Sarantakos.

At the beginning, the tool will provide publishers with a very

basic overview of the performance of their own content, but there

are plans to add layers of detail -- such as country-by-country

data -- going forward.

The new data won't, at least for now, provide information on

each individual story posted to Instant Articles.

Kim Lau, vice president of digital and head of business

development at Atlantic Media, which posts almost all its stories

on Facebook using Instant Articles, said the move wasn't

necessarily a game changer, but was a positive sign Facebook was

trying to better accommodate publishers.

"It helps us understand the trade-offs we are making and to

better understand what the benefits are," she said. "We have been

asking for this from the beginning."

Facebook launched the Instant Article program with a handful of

large publishers such as the New York Times, the Daily Mail,

BuzzFeed and NBC News in 2015. It opened it to all publishers the

following year.

But many publishers have been wary about how much content to

post through the program, expressing concerns about becoming more

deeply reliant on Facebook for traffic and having less access to

information about their readers.

Some publishers have also complained that given the limitations

on the number and type of ads initially placed on stories posted on

Instant Articles, they saw less money coming in compared with what

they got through direct visits to their sites. Facebook has since

eased the restrictions, which some say has improved the

situation.

Still, some big publishers, such as the Guardian and the Times,

have pivoted away from the program, and others have reduced the

amount of content they post there.

Others, such as the Daily Mail, which posts almost all of its

content on Facebook via Instant Articles, say there have been clear

benefits, including drawing in more readers.

"It's true that the CPMs have been a little lighter there than

on our own mobile webpage, but we have seen close to 50% uplift, so

if you do the math you can see that added volume outweighs whatever

little bit we may lose on CPM," said Noah Szubski, the Mail's chief

product officer. CPM refers to the cost to an advertiser for

reaching a thousand people.

Write to Lukas I. Alpert at lukas.alpert@wsj.com

(END) Dow Jones Newswires

July 19, 2017 15:57 ET (19:57 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

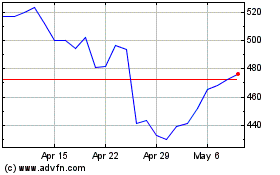

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024