Boeing, Flying High, Stays Course on Job Cuts

July 22 2017 - 9:27AM

Dow Jones News

By Doug Cameron

Boeing Co. is cutting workers at its fastest clip in more than a

decade.

The aerospace giant shed more than 6,000 staff during the first

half of the year, some 4% of its workforce through a mix of

attrition, buyouts and layoffs, most of them at its big jetliner

plants in Washington state.

Boeing has said it needs to improve efficiency and rely on more

factory automation to build the next generation of aircraft as it

works through an order book of more than 5,700 jets.

Executives said the cost-cutting drive was crucial to remain

competitive with Airbus SE. Boeing's European rival has in recent

years claimed more than half of the market for single-aisle

workhorse jets, tilting the balance of what had been an evenly

balanced duopoly for two decades.

The job cuts at the world's largest airline manufacturer by

revenue are most pronounced in Washington state, home to two of its

three commercial jet-assembly plants. Washington's employment

department said Boeing has issued layoff notices to 1,251 staff in

the state this year, with the latest batch of cuts starting on July

21.

Over the past four years, Boeing has reduced its Seattle-area

workforce by more than 20,000, according to company records.

The scale of the cuts have drawn fire from Boeing unions, which

are concerned the company is diluting its engineering skills at a

time when it is boosting aircraft production and transitioning to

new models of two of its best-selling jets.

While focused on the Seattle area, the job cuts also have

extended to the plant in North Charleston, S.C., where President

Donald Trump attended the February rollout of the new 787-10

Dreamliner, extolling plans to boost U.S. manufacturing jobs.

Four months later, Boeing said it planned to lay off around 200

workers at the facility, adding to 700 who had taken buyouts.

Employment at Boeing's Charleston-area facilities dropped to around

7,300 at the end of June from a peak of over 8,000 at the end of

2015.

Richard Aboulafia, an aerospace consultant at Teal Group, said

Boeing's warming relationship with Mr. Trump after a rocky start

over the Air Force One replacement program helped provide some

political cover for the job cuts. In December, Mr. Trump called for

the cancellation of the order for a new Air Force One from Boeing,

citing the cost.

The analyst also questioned Boeing's contention that cuts are

needed to keep pace with Airbus. "Competition is pretty much the

same as it's been for years," said Mr. Aboulafia, who views them as

an opportunistic move to boost profits and stoke the share buybacks

that have propelled Boeing shares to record highs.

The stock is up about 36% so far this year, valuing the company

at close to $129 billion. Boeing reports second quarter earnings on

July 26.

Over 1,800 Boeing employees have accepted voluntary buyouts so

far this year, with 3,000 taking that route in 2016, according to

its two largest unions.

Boeing declined to comment on the unions' numbers and said its

work to increase efficiency is continuing. "Employment reductions

will come through a combination of attrition, leaving open

positions unfilled, voluntary layoff program and in some cases,

involuntary layoffs," the company said.

Boeing hasn't detailed how many more jobs it may cut, but the

existing pace has prompted local Seattle-area officials in March to

seek an emergency grant from the Labor Department, said Dot

Fallihee, interim chief executive of the Workforce Development

Council of Seattle-King County. Ms. Fallihee said it would share

over $300,000 with neighboring Snohomish County to support around

1,000 displaced Boeing workers with benefits such as

retraining.

The job cuts have led some critics to question tax breaks the

company is receiving from Washington state as it moves some work

elsewhere in the U.S. and prepares to open a new center in China to

complete work on jetliners destined for that market.

However, the congressman representing the area housing Boeing's

big plants said the move into China reflected its status as a

multinational company, even if it is the state's largest employer.

"Aerospace is bigger than Boeing," said Rep. Rick Larsen (D.,

Wash.), noting the state is home to 1,800 aerospace suppliers.

(END) Dow Jones Newswires

July 22, 2017 10:12 ET (14:12 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

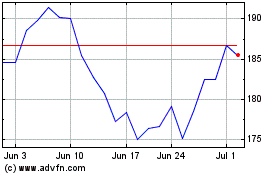

Boeing (NYSE:BA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boeing (NYSE:BA)

Historical Stock Chart

From Apr 2023 to Apr 2024