By Andrew Tangel

Caterpillar Inc. on Tuesday signaled cautious optimism about the

global economy as it offered fresh evidence that it was recovering

in many of its markets from a yearslong sales slump.

The world's largest heavy-machinery maker, often seen as a

bellwether for economic conditions, highlighted growing demand for

Chinese construction and signs of a global mining industry coming

back to life as the manufacturing giant boosted its outlook for the

year, despite sluggish infrastructure spending in the U.S. and

weakness in Brazil and the Middle East.

The Peoria, Ill.-based maker of bulldozers, mining trucks and

other heavy machinery said Tuesday it expects revenue of $42

billion to $44 billion for all of 2017, up from a previous forecast

of as much as $41 billion.

The company's second-quarter results released Tuesday comes

after four consecutive years of declining sales amid a slowdown in

the construction markets and a downturn in commodities.

But evidence of a sustained, long-term reversal remained unclear

as weaknesses persisted in some countries and markets. And

executives noted revenue increases in some cases followed steep

declines, and that sales were still off highs of recent years.

Caterpillar said it's expecting strengthening demand for

excavators in China in response to government spending on public

works projects, a pickup in the North American natural gas industry

and increasing sales of replacement parts for mining equipment as

fewer trucks remain idle.

Geopolitical uncertainty and commodity-price volatility still

pose risks to Caterpillar's rosier outlook for the year, but

executives declined to speculate how the company's fortunes might

fare next year and beyond. Executives cautioned

construction-equipment sales could slow in the latter part of the

year.

Caterpillar said it second-quarter revenue jumped 10% to $11.3

billion from the prior year. Shares rose about 6% Tuesday afternoon

to $114.15.

Caterpillar is the beneficiary of an upswing so far this year in

the global economy. Stabilized commodity prices have allowed major

developing economies like China, Brazil, Russia and Nigeria to

strengthen, after a commodity price plunge in 2014 that had set

them reeling.

An International Monetary Fund index of global commodity prices

has risen nearly 27% since hitting a 12-year low in 2016. The World

Bank projected last month that by next year global economic growth

would reach a seven-year high.

Developed countries have benefited as well from this improvement

in international prospects. A report this month on industrial

production, found that factory output in the Eurozone was at the

highest level in six years.

Racing to ramp up production in heavy machines such as

excavators, Caterpillar also beefed up its workforce in the second

quarter, a shift following years of layoffs and factory

closures.

Its U.S. payroll grew to 48,500 employees by the end of June, an

increase of 2,000 over the previous three months, and Caterpillar

is hiring at factories in Illinois, Indiana and Arkansas.

Caterpillar's international workforce rose to 62,700, up 1,300

employees.

Sales for construction equipment in North America, its largest

market, rose 3% in the quarter. But in a contrast to the Chinese

market, executives lamented stagnant U.S. government spending on

roads, bridges and other infrastructure that would further buoy its

fortunes.

"The United States is in need of infrastructure investment,"

Caterpillar Chief Financial Officer Brad Halverson said.

While Caterpillar's revenue from construction equipment rose 11%

overall were down in the quarter, sales decreased 5% in Europe, the

Middle East and Africa. And while Latin American sales rose 31% as

several countries' economies showed signs of improvement,

executives cited continued weakness in Brazil.

Evidence of growth in the mining industry has yet to move the

needle on new equipment sales. Second-quarter revenue growth of 21%

in this segment was driven primarily by sales of replacement parts,

which executives said was a likely prelude to eventual orders for

new equipment.

"The cycle is starting to play out," Mr. Halverson said. He

noted mining truck utilization has ticked up, and the parked fleet

has declined.

Signs of turnaround in some of Caterpillar's markets emerged in

the first quarter. That trend continued in the months since as

retail sales of Caterpillar machinery increased 7% world-wide

during the three months to the end of June.

Overall for the second quarter, Caterpillar reported a profit of

$802 million, or $1.35 a share, compared with $550 million, or 93

cents a share a year ago.

Analysts polled by Thomson Reuters had expected $1.26 in

adjusted earnings per share on revenue of $10.93 billion.

--Josh Zumbrun and Austen Hufford contributed to this

article.

Write to Andrew Tangel at Andrew.Tangel@wsj.com

(END) Dow Jones Newswires

July 25, 2017 16:02 ET (20:02 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

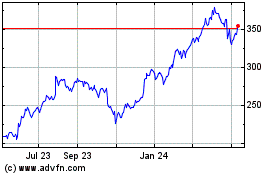

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

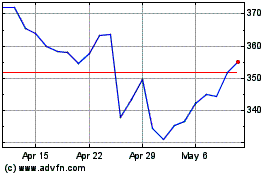

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024