By Sarah Kent

Three years into an oil price slump, investors want the world's

biggest oil companies to do something they have historically

struggled with: Maintain some financial discipline.

The companies are under pressure to show they are continuing to

move on from budget-busting projects once common in the industry,

as they head into second-quarter financial disclosures that begin

on Thursday with Royal Dutch Shell PLC and Total SA.

Shell, Total and peers like Exxon Mobil Corp. and Chevron Corp.,

which both report earnings Friday, have reined in spending through

an oil-market downturn during which crude prices fell from $114 a

barrel to $27 a barrel and remain around $50 a barrel. Those

efforts paid off in the first quarter, when the companies returned

to billion-dollar profits after years of losses or anemic

earnings.

Now, said Jags Walia, senior portfolio manager at Dutch pension

fund manager APG Asset Management, "there's no room to take your

foot off on capital discipline."

"I think that would be quite unforgivable." said Mr. Walia,

whose fund invests in several large oil companies, including Exxon,

Shell and BP.

It's a call for big oil companies to keep the ship steady,

reflecting the fine line they are walking this year.

International oil prices were up nearly 10% in the second

quarter compared with the same time last year. But prices are still

likely too low for many companies to cover spending and dividends

with cash, or break even. At the same time, the companies have to

keep finding new oil to replace the barrels they are pumping. That

means spending money on exploration, development and

acquisitions.

BP, which reports earnings next Tuesday, faced criticism from

investors and analysts after a flurry of acquisitions inflated its

investment plans for 2017 and pushed up the oil price at which the

company could break even to $60 a barrel. The company's shares fell

4% following the February announcement. It has since said it is

working to drive down its break-even oil price to between $35 to

$40 a barrel by 2021.

It isn't just BP. The number of new projects approved this year

across the industry is expected to creep up to between 20 and 25

from just 12 in 2016, according to Edinburgh-based consultancy Wood

Mackenzie.

The oil companies declined to comment ahead of their earnings

reports.

But they have moved to tackle the challenges.

BP's costs are down 40% since 2013 and it has vowed to maintain

a budget cap of $17 billion a year out to 2021.

At BP's first-quarter results in May, Chief Financial Officer

Brian Gilvary said the company intended to deliver on promises to

increase cash flow and dividends in the coming years by

"maintaining strict discipline within our financial frame and

staying focused on delivering returns."

Exxon's capital spending last year was $12 billion lower than in

2015, though it has crept higher this year. The company says it is

focusing a chunk of its firepower on shale developments that start

to generate cash quickly.

Chevron has said it will be able to cover its spending and

dividends with cash at $50 a barrel this year with the help of

asset sales. In April, Chevron said it had lowered capital spending

22% compared with its average quarter in 2016 and 56% versus the

average quarter in 2014. The company plans to spend $17 billion to

$22 billion a year out to the end of the decade.

"If oil prices remain near the $50 per barrel mark, you can

expect to see our future spend near the bottom of this range," CFO

Patricia Yarrington told analysts in April.

The companies have said that they still have room to cut further

and that they can start to invest in new projects without returning

to the spendthrift era that eroded returns before the oil price

crash in 2014. Capital spending on new projects sanctioned so far

this year is on average just $11 per barrel of oil equivalent, down

from $15 in 2015, according to Wood Mackenzie.

"I think a lot of these companies have found religion," said

Brian Youngberg, senior energy analyst at brokerage firm Edward

Jones. "They realize now they can't just spend, spend, spend. They

have to be more disciplined with their capital."

Exxon, Shell, BP and Chevron have all indicated they will be

able to generate enough cash this year to cover spending and

shareholder payouts at $60 a barrel, but at $50 the picture is more

mixed. Even next year, many of them will still need higher oil

prices to cover their costs, according to analysis by

Macquarie.

Investors remain cautious. Big oil companies' share prices are

little changed or lower than at the same time last year, even

though oil prices are higher. For instance, Exxon's share price is

down more than 10% from a year ago.

The companies still have high debt levels, and some -- like

Shell and Total -- offer dividends as company shares, known as

scrip, helping them to preserve cash but also diluting investors'

earnings per share.

"We need to see discipline and people being more realistic about

where oil prices could remain for quite a long time," said Jason

Kenney, an oil-company analyst at Spanish lender, Banco

Santander.

It's a tall order for an industry that struggled to break even

when oil was at $100 a barrel. And the challenge facing the

companies could be more difficult after banks revised their

oil-price forecasts downward in recent months.

"The goal posts have moved," Deutsche Bank said earlier this

month. "It's time to go away and remodel for a $45 to $50 a barrel

world."

Write to Sarah Kent at sarah.kent@wsj.com

(END) Dow Jones Newswires

July 26, 2017 07:14 ET (11:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

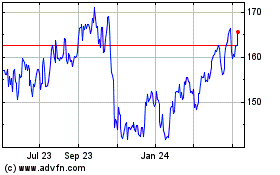

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

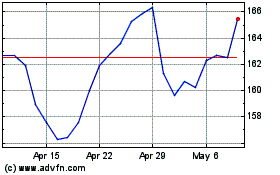

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024