Rio Tinto Lifts Share Buyback Plans as 1st Half Profit Jumps

August 02 2017 - 2:01AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Rio Tinto PLC (RIO.AU) said it would buy

back a further US$1 billion in shares, after the mining company

continued to reduce at debt and its profit jumped in the first half

of the year.

The mining company saidon Wednesday that it would return US$3

billion in cash to shareholders, including a higher dividend payout

and the purchase of its London-listed shares by the end of the

year. Rio Tinto said the capital management was in addition to a

US$500 million share buyback that began earlier this year.

Net profit rose to US$3.31 billion in the six months through

June from US$1.71 billion a year earlier.

That was despite production of iron ore and steel-making coking

coal struggling over the first half with disruptive wet weather and

rail maintenance in Australia, prompting Rio Tinto to scale back

its production targets for both for the full year. Mined copper

output, however, started to rebound in the second quarter from a

lengthy strike at a mine in Chile, while thermal-coal production

grew for the half year.

The Anglo-Australian company said its net debt was cut by US$2

billion over the half year to US$7.6 billion. That took its

gearing--a measure of a company's debt relative to equity--13% from

17% at the end of December.

"By driving performance, focusing on cash and allocating it with

discipline we are delivering superior cash returns to our

shareholders," Chief executive Jean-Sebastien Jacques said.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

August 02, 2017 02:46 ET (06:46 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

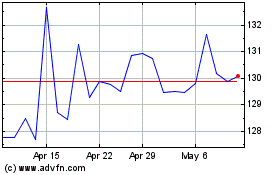

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024