Elliott Says Stake in BHP Billiton Rises

August 15 2017 - 6:00PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--New York hedge fund Elliott Management

Corp. said it now holds 5% of BHP Billiton Ltd.'s (BHP.AU)

London-listed shares, which it says makes it well placed to monitor

the resources giant's progress and hold it accountable for

delivering results.

In a statement Wednesday, the activist investor said the recent

selection of director Ken MacKenzie as successor to Chairman Jac

Nasser was an opportunity for BHP to take heed of shareholders'

calls for sweeping changes.

Elliott for months has campaigned for BHP Billiton to exit its

U.S. onshore oil-and-gas operations and launch an independent

review of its global petroleum division, shift its approach to

capital to ensure greater returns to shareholders and to unify its

dual U.K.-Australia listed structure around a single listing in

Sydney.

"With new leadership, shareholders fully expect the true value

of their company to be unlocked, something which we are confident

BHP's chairman-elect has firmly in mind as he takes the reins,"

Elliott said.

When Elliott went public with its proposals for BHP in April, it

said it held about a 4.1% stake in the London shares.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

August 15, 2017 18:45 ET (22:45 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

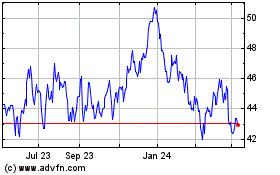

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

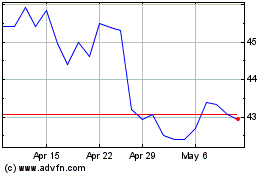

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024