Mobile shopping lifts Chinese titan's results, dispelling old

doubts and driving up stock

By Liza Lin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 18, 2017).

SHANGHAI -- Alibaba Group Holding Ltd. reported a surge in

revenue and profit on surprisingly strong online sales, sending its

shares to new altitudes Thursday -- a scenario few investors saw

coming two years ago.

Back then, Alibaba investors were wary of slowing revenue growth

for the e-commerce giant and a costly battle for mobile market

share in China's online retail marketplace.

Today, naysayers are hard to find as Alibaba has filled its

coffers by tapping into China's mobile shopping spree with its

Taobao shopping app. Investors have sent Alibaba's share price

soaring 87% since the start of the year.

On Thursday, Alibaba said its fiscal first-quarter earnings

nearly doubled from the year-earlier period to $2.2 billion. Sales

rose 56%, to $7.4 billion, beating analysts' estimates.

Alibaba shares closed up 2.8% at $163.92 in New York trading,

above the stock's record close Wednesday of $159.50 a share. The

stock's more than 80% advance this year compares with gains of

about 28% for Amazon.com Inc. and 9% for the S&P 500.

Alibaba is cruising on a wave of spending by China's growing

middle class, which now numbers about 130 million people, nearly

all carrying smartphones. With consumer-to-consumer selling on its

Taobao app and website, and its Tmall online marketplace for

branded products, Alibaba has captured a huge portion of China's

online retail activity, not to mention a trove of consumer-behavior

data. By adding video and other content innovations to Taobao,

Alibaba has managed to keep shoppers engaged and coming back.

"Alibaba has been very successful in transforming the business

to mobile from the desktop," said Hans Chung, a Portland, Ore.,

analyst with Pacific Crest.

Just as Facebook had to reposition to adapt to consumers' needs

as they shifted to mobile, so Alibaba has faced challenges, Mr.

Chung said. Alibaba in 2015 posted its slowest revenue growth in

more than three years, and investors, spooked by its seeming

fallibility, sent shares plunging almost to the stock's 2014

listing price.

Since then, Alibaba has taken large strides in improving users'

experiences with its app, leveraging its technology to personalize

shoppers' home pages and to send them targeted ads. Alibaba's

mobile monthly active users now exceed 520 million.

Alibaba also introduced new features to grab Chinese consumers'

attention. The Hangzhou firm caught on early to China's love for

live-streaming video and introduced live-streaming marketing

channels on its Taobao app. They feature short-form video and

consumer forums to keep buyers on the app longer.

Alibaba's fortunes have benefited as higher incomes have spurred

China's middle class to make bigger purchases and to seek upgrades.

Whereas Chinese buyers once sought out e-commerce platforms

offering cheaper prices and variety, now they search for

higher-priced cross-border products and luxury brands.

"If you believe China is going to be a lot bigger in a decade

than it is today, and that the consumer in China will spend more

money than they do today, this company will benefit," said Mitchell

Green, managing partner of Lead Edge Capital and an Alibaba

investor.

Beneath its rosy financials, though, Alibaba has a few

thorns.

The Securities and Exchange Commission has launched an inquiry

into Alibaba's accounting practices and has asked the company for

more details about a delivery affiliate and operating data from an

online discount festival. Since making the investigation publicly

known in May, Alibaba has yet to release any additional information

or updates on it.

And the Taobao website was included on a U.S. agency's list of

global marketplaces known for selling counterfeit and pirated goods

last year, while critics say the company hasn't done enough to keep

fakes off the site.

In a rapprochement with luxury-goods makers, Alibaba reached an

agreement this month with Kering Co., the French parent of luxury

labels Gucci and Saint Laurent, to end a legal battle over fake

designer merchandise sold on Alibaba websites and to work together

to pursue counterfeiters. Alibaba last week said it cut the time

needed to act on a fake-goods complaint from a rights holder to

less than 24 hours, down from as long as four days. And it has

opened a dedicated space on Tmall stocking high-end products from

fashion brands such as Loewe, Burberry and Hugo Boss.

Meanwhile, JD.com Inc., a much-smaller Alibaba rival, is gaining

ground, forcing Alibaba to step up coupons and discounts in recent

months, analysts say. JD, which reported a second-quarter loss

Monday, plans to open a luxury platform on its online retail site,

ratcheting up the competition Alibaba faces for China's high-end

shoppers.

Founded 18 years ago in an East China city apartment by a group

led by Jack Ma, a former English teacher turned billionaire,

Alibaba operates as an internet marketplace, running platforms for

sellers, including individuals and small and big businesses, to

connect with consumers. The company's core commerce unit earns its

money in part through merchant commissions and paid

advertising.

In pre-IPO meetings with investors, Alibaba was pitched as an

opportunity to invest in the growth of China's middle class, and

investors clamored for access to its shares despite concerns about

its corporate governance.

At the time, Alibaba operated through a series of "variable

interest entities" in China owned by senior executives, including

Mr. Ma, rather than by Alibaba's foreign shareholders. It was run

with a partnership structure where 30 partners held most of the

corporate control. As a result, Alibaba was barred from listing in

Hong Kong.

For nearly a year after its initial public offering of shares,

Alibaba's IPO was deemed an early success as it rose 38% on its

first day of trading and stayed above its $68 IPO price. Yet by

August 2015, amid a global market selloff, Alibaba reported its

slowest quarterly revenue growth in more than three years. It's

share price hovered on either side of the IPO line for the next

year.

Despite Alibaba's surge in 2017, China's e-commerce growth is

slowing, and Alibaba is looking to new ventures to maintain

momentum, including providing services such as logistics to online

merchants and physical store retailers. It said Thursday it plans

to take part in a $1.1 billion investment in PT Tokopedia, an

Indonesian e-commerce marketplace connecting small businesses with

consumers, the Jakarta-based company said Thursday. The investment

follows Alibaba's $1 billion investment to raise its stake in

Southeast Asian online retailer Lazada. It has also sought stakes

in India's PayTM.

In an interview last month, Daniel Zhang, Alibaba's chief

executive officer, said Chinese consumers are seeking personalized

shopping experiences and recommendations. "The mall of the future

will become a consumer community, a service center, an experience

center," he said.

--Maureen Farrell in New York contributed to this article.

Write to Liza Lin at Liza.Lin@wsj.com

(END) Dow Jones Newswires

August 18, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

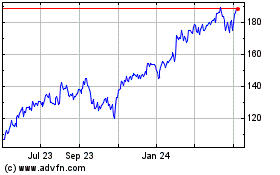

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024