BHP Billiton Lifts Dividend as it Swings to Annual Profit

August 21 2017 - 5:52PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--BHP Billiton Ltd. (BHP.AU) will lift its

final dividend after a swing back to a full-year profit.

The Melbourne-based company also said it had determined its U.S.

onshore oil-and-gas operations were non-core and it was actively

pursuing options to exit the assets for value.

The company, the world's largest listed miner by market value,

recorded a net profit of US$5.89 billion in the 12 months through

June, against a year-earlier loss of US$6.39 billion after

absorbing an impairment hit on its onshore U.S. shale business and

a charge for the fatal 2015 dam failure at the Samarco iron-ore

operation in Brazil.

Underlying earnings before interest, tax, depreciation and

amortization--a measure tracked by analysts--rose 64% to US$20.3

billion. That was modestly below the US$20.37 billion median of 10

forecasts compiled by The Wall Street Journal

Revenue for the year climbed 24% to US$38.29 billion from

US$30.91 billion.

BHP's board declared a final dividend of US$0.43 a share for a

full-year payout of US$0.83, up on US$0.30 last year.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

August 21, 2017 18:37 ET (22:37 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

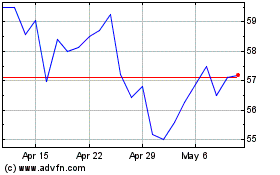

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

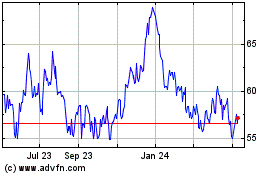

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024