Commodity Currencies Fall As Asian Stock Markets Traded Lower

September 05 2017 - 10:42PM

RTTF2

Commodity currencies such as the Australian, the New Zealand,

and the Canadian dollars weakened against their major rivals in the

Asian session on Wednesday as Asian stock markets traded lower.

This was due to the overnight sell-off on Wall Street amid

geopolitical concerns following North Korea's nuclear test on

Sunday.

Investors also kept an eye on Hurricane Irma, which is bearing

down on the Caribbean islands and Florida, just a week after

Hurricane Harvey disrupted refineries along the Texas coast.

On the economic front, the Australian Bureau of Statistics said

that Australia's gross domestic product expanded a seasonally

adjusted 0.8 percent on quarter in the second quarter of 2017. That

was shy of expectations for 0.9 percent, but up from 0.3 percent in

the first quarter.

Data from ANZ New Zealand showed that New Zealand's job ads

recovered in August. Job ads increased 1 percent month-on-month to

a new record high in August, the bank said. The monthly increase

reversed a 0.9 percent fall in July.

In the Asian trading, the Australian dollar fell to an 8-day low

of 86.69 against the yen, from yesterday's closing of 86.99. The

aussie may test support around the 84.00 region.

Against the euro and the U.S. dollar, the aussie dropped to

0.7976 and 1.4929 from yesterday's closing quotes of 0.7995 and

1.4897, respectively. If the aussie extends its downtrend, it is

likely to find support around 0.77 against the greenback and 1.52

against the euro.

The aussie slipped to 0.9886 against the Canadian dollar, from

an early 6-day high of 0.9926. On the downside, 0.96 is seen as the

next support level for the aussie.

Against the NZ dollar, the aussie edged down to 1.1031 from an

early high of 1.1067. This may be compared to an early 6-day low of

1.1025. The aussie is likely to find support around the 1.09

region.

The NZ dollar fell to 0.7222 against the U.S. dollar and 78.49

against the yen, from yesterday's closing quotes of 0.7235 and

78.72, respectively. If the kiwi extends its downtrend, it is

likely to find support around 0.70 against the greenback and 76.00

against the yen.

Against the euro, the kiwi dropped to 1.6488 from yesterday's

closing value of 1.6463. The kiwi may test support near the 1.67

region.

The Canadian dollar fell to a 6-day low of 87.65 against the

yen, from yesterday's closing value of 87.92. The loonie could find

support around the 86.00 region.

Against the U.S. dollar and the euro, the loonie dropped to

1.2398 and 1.2398 from yesterday's closing quotes of 1.2374 and

1.2374, respectively. If the loonie extends its downtrend, it is

likely to find support around 1.27 against the greenback and 1.50

against the euro.

Looking ahead, Canada and U.S. trade data for August and U.S.

services PMI for August are due to be released in the New York

session.

The Bank of Canada will announce its interest rate decision at

10:00 am ET. Economists expect the bank to retain interest rates

unchanged at 0.75 percent.

At 2:00 pm ET, U.S. Federal Reserve releases Beige Book

report.

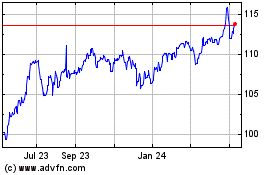

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

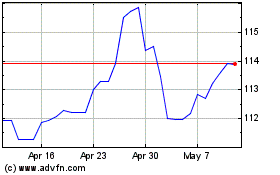

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024