Strong Euro May Deter Draghi From Tapering, For Now

September 06 2017 - 5:03AM

RTTF2

The European Central Bank is set to adopt a highly cautious

stance Thursday regarding any gradual withdrawal of monetary

stimulus or "tapering," as a strong euro presents a tough conundrum

for rate-setters, who are already flummoxed by the Eurozone's weak

inflation amid solid growth.

The Governing Council, led by ECB President Mario Draghi, is

widely expected to keep all three of its interest rates unchanged

for a twelfth consecutive policy session and retain the EUR 60

billion monthly asset purchases that are set to run until the end

of the year.

Additionally, caution is likely to prevail at the post-decision

press conference as a possibly dovish Draghi navigates the

subtleties of central bank communication with his verbal

intervention tool to avoid feeding markets with hopes of an

imminent tapering that could further strengthen the euro and hurt

the euro area recovery.

"While a clear hint on tapering at this week's meeting could

send the euro even higher, potentially undermining the recovery,

room to postpone tapering is limited due to bond scarcity," ING

Bank economist Carsten Brzeski said.

He added, "Therefore, we expect Draghi to strike a cautious

balance between giving the first clear hint at upcoming tapering

and adopting a dovish tone in order to calm the FX market."

Economists widely expect an actual decision on tapering in

October. They also expect that a modest tapering would only start

in January after the end of the on-going round of asset

purchases.

Draghi will also unveil the latest ECB Staff economic

projections during the press conference. Economists widely expect a

further upgrade to the growth outlook but yet another trimming of

the inflation projections.

In the previous round in June, the bank projected euro area

growth at 1.9 percent this year, 1.8 percent next year and 1.7

percent in 2019. Inflation projections were cut to 1.5 percent for

this year, 1.3 percent next year and 1.6 percent in 2019.

Meanwhile, ECB policymakers were already worried about a

strengthening euro in July and pointed out the risk of the exchange

rate overshooting in the future, the minutes of the policy session

revealed. They also stressed that favorable financing conditions

are still supported by the massive stimulus.

The euro has strengthened robustly since late June, when

Draghi's comments in Sintra, Portugal, fed market expectations of

an imminent tapering and sent yields and the euro soaring.

That said, a stronger euro could be reason enough for the ECB to

delay its exit from the massive stimulus. Yet, the question remains

- "For how long?"

Some analysts expect the ECB to entirely wind down its massive

stimulus by the end of next year and start raising interest rates

modestly in 2019.

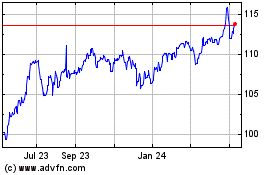

CAD vs Yen (FX:CADJPY)

Forex Chart

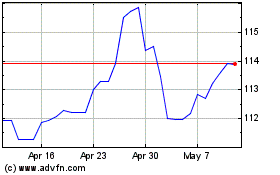

From Mar 2024 to Apr 2024

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024