Canadian Dollar Spikes Up As BoC Lifts Benchmark Rate Unexpectedly

September 06 2017 - 5:40AM

RTTF2

The Canadian dollar climbed against its key counterparts in

early New York deals on Wednesday, as the Bank of Canada raised its

benchmark rate unexpectedly given recent stronger-than-expected

economic data.

The BoC upped its key interest rate to 1 percent from 0.75

percent. Economists had forecast the rate to remain unchanged.

In its accompanying statement, the BoC noted that the recent

economic data had been stronger than expected, supporting the

Bank's view that growth in Canada is becoming more broadly-based

and self-sustaining.

The Bank continues to expect a moderation in the pace of

economic growth in the second half of 2017, although the pace of

growth is now higher than the Bank had expected, it added.

Meanwhile, caution prevailed as North Korea warned of "more gift

packages" to the United States just days after it successfully

carried out a hydrogen bomb test.

Also, investors are eager to see whether the European Central

Bank will send a new policy message regarding the timing of an exit

from its ultra-loose monetary policy at its policy meeting,

scheduled for Thursday.

Data from Statistics Canada showed that Canada's merchandise

trade deficit narrowed to C$3.0 billion in July from C$3.8 billion

in June. Economists had forecast a shortfall of C$3.3 billion

Imports fell 6.0 percent, while exports decreased 4.9 percent.

The European Central Bank meets on Thursday and it isn't

entirely clear whether the central bank will send a new policy

message regarding the timing of an exit from its ultra-loose

monetary policy.

The loonie slipped against its major rivals in the Asian

session, as Asian shares fell amid geopolitical concerns following

North Korea's nuclear test on Sunday.

The loonie climbed to 1.2136 against the greenback, a level not

seen since June 2015. Continuation of the loonie's uptrend may see

it challenging resistance around the 1.17 region.

The loonie reversed from an early 5-day low of 1.4812 against

the euro, reaching a 1-1/2-month high of 1.4484. The loonie is

poised to target 1.43 as the next resistance level.

Figures from Destatis showed that German factory orders declined

unexpectedly in July on weak domestic demand.

Factory orders fell 0.7 percent month-on-month in July, in

contrast to a revised 0.9 percent rise in June. This was the first

fall in three months. The loonie spiked up to a 21-month high of

89.74 against the Japanese yen, after having fallen to a 6-day low

of 87.55 at 3:00 am ET. The next possible resistance for the

loonie-yen pair is seen around the 92.00 mark.

Preliminary report from the Ministry of Health, Labor and

Welfare showed that Japan's total labor cash earnings decreased for

the first time in fourteen months in June, defying economists'

forecast for a further rise.

Gross earnings dropped 0.3 percent year-over-year in July,

reversing 0.4 percent rise in May, which was revised from a 0.4

percent fall estimated previously.

Following a 5-day low of 0.9926 hit at 9:15 pm ET, the loonie

reversed direction and strengthened to an 8-month high of 0.9676

against the aussie. The loonie is seen finding resistance around

the 0.95 mark. Looking ahead, at 2:00 pm ET, U.S. Federal Reserve

releases Beige Book report.

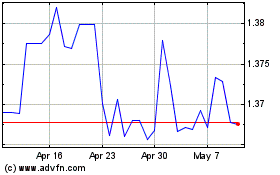

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024