Commodity Currencies Soar After ECB Meeting

September 07 2017 - 10:26PM

RTTF2

Commodity currencies such as the Australian, the New Zealand,

and the Canadian dollar strengthened against their major

counterparts in the Asian session on Friday, following a meeting on

Thursday of policy makers at the European Central Bank.

In the meeting, European Central Bank chief Mario Draghi hinted

that decisions about the future of the ECB's massive stimulus may

be decided in October.

In other economic news, data from the Australian Bureau of

Statistics showed that the total number of home loans in Australia

climbed a seasonally adjusted 2.9 percent on month in July, coming

in at 56.464. That beat forecasts for an increase of 1.0 percent

following the 0.5 percent gain in June.

Data from Statistics New Zealand showed that the manufacturing

volume in New Zealand was up a seasonally adjusted 1.0 percent on

quarter in the second quarter of 2017. That follows the upwardly

revised 0.2 percent decline in the first quarter.

Data from the General Administration of Customs showed that

China's exports grew at a slower pace in August. Exports increased

5.5 percent year-on-year in August, slower than July's initially

estimated 7.2 percent growth. Shipments were forecast to grow 6

percent.

At the same time, imports advanced 13.3 percent annually, faster

than the expected growth of 10 percent.

As a result, the trade surplus totaled $42 billion in August

versus the expected level of $48.5 billion.

In the Asian trading, the Australian dollar rose to nearly a

2-1/2-year high of 0.8116 against the U.S. dollar and a 1-week high

of 87.72 against the yen, from yesterday's closing quotes of 0.8047

and 87.25, respectively. If the aussie extends its uptrend, it is

likely to find resistance around 0.82 against the greenback and

89.00 against the yen.

Against the euro and the Canadian dollar, the aussie edged up to

1.4879 and 0.9797 from yesterday's closing quotes of 1.4938 and

0.9747, respectively. The aussie may test resistance around 1.47

against the euro and 1.00 against the loonie.

The NZ dollar rose to more than a 2-week high of 0.7324 against

the U.S. dollar and an 8-day high of 79.16 against the yen, from

yesterday's closing quotes of 0.7232 and 78.42, respectively. If

the kiwi extends its uptrend, it could find resistance around 0.74

against the greenback and 80.00 against the yen.

Against the euro and the Australian dollar, the kiwi advanced to

2-day highs of 1.6487 and 1.1069 from yesterday's closing quotes of

1.6620 and 1.1124, respectively. The kiwi is likely to find

resistance around 1.62 against the euro and 1.09 against the

aussie.

The Canadian dollar rose to nearly a 2-1/2-year high of 1.2065

against the U.S. dollar and a 2-day high of 89.66 against the yen,

from yesterday's closing quotes of 1.2113 and 89.47, respectively.

If the loonie extends its uptrend, it may find resistance around

1.19 against the greenback and 90.00 against the yen.

Against the euro, the loonie advanced to 1.4551 from yesterday's

closing value of 1.4563. The loonie may test resistance near the

1.44 region.

Looking ahead, U.K. industrial production, trade balance and

construction output for July are due to be released at 4:30 am

ET.

Reserve Bank of Australia Governor Philip Lowe will deliver

brief remarks at the Bank of China Sydney Branch's 75th Anniversary

Celebration Dinner.

In the New York session, U.K. NIESR GDp estimate for August,

Canada jobs data for August, U.S. wholesale trade sales data for

July and U.S. Baker Hughes rig count data are slated for

release.

At 8:45 am ET, Federal Reserve Bank of Philadelphia President

Patrick Harker is scheduled to deliver opening remarks at a

consumer finance research conference hosted by the Federal Reserve

Bank of Philadelphia.

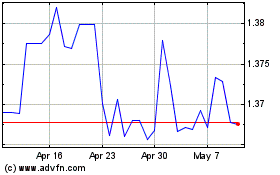

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024