EU Preps Tax Crackdown on Silicon Valley

September 21 2017 - 5:38AM

Dow Jones News

By Sam Schechner and Natalia Drozdiak

The European Union's executive arm said Thursday that it is

ready to propose new tax taxes on digital companies like Facebook

Inc. and Alphabet Inc.'s Google by next spring if there isn't

"adequate global progress" toward a rewrite of corporate tax rules

at an international level.

The bloc's executive arm, the European Commission, floated

several options that it said could be rolled out in the short term

to raise tax revenue on digital companies, which it contends

declare too little profit in the region. While the commission said

a global solution would be preferable, it added that it "stands

ready" to propose legislation if major countries, including the

U.S., can't make headway on new rules.

The threat of new tax legislation comes amid pressure from big

EU countries including France and Germany, which have recently

increased their push to change corporate tax rules at any level to

capture what they say are billions of euros in lost revenue.

Finance ministers for EU countries expressed support over the

weekend for renewing efforts to change international rules to

better reflect digital profits rules via the Organization for

Economic Cooperation and Development, a forum of wealthy countries

that includes the EU, U.S. and Japan.

European officials argue that companies are taking advantage of

outdated tax rules that were designed on the basis of physical

assets and where the companies operate, rather than virtual

businesses like online advertising and data mining.

"It's a question of fairness: Digital companies use European

networks and infrastructure, and often their content and data are

created by Europeans. Like all taxpayers, they must pay their fair

share of tax," said EU finance chief Pierre Moscovici, adding that

the current system allows for "a big loss in tax revenues for the

budgets of EU member states."

Failing any progress at the OECD level, the commission said its

preferred route would be to amend previously proposed rules to

reform the corporate tax base in Europe. The initiative--known as

the common consolidated corporate-tax base--is designed to create a

common set of rules spelling out how profits should be taxed across

the bloc. But any changes could further delay the legislative

process as that proposal has already been held up in negotiations

with member states who differ over how to proceed.

The other options that the European Commission floated Thursday

as short-term and supplementary measures include an "equalization

tax" on digital revenue--as opposed to profit--that has been

promoted by France and garnered the support from at least 10 EU

nations last weekend. It would impose a new tax on companies that

have very high digital revenue but pay little in corporate income

tax, according to officials in the French finance ministry.

The commission also mentioned a potential withholding tax on

digital transactions that would be levied on online providers of

goods and services that aren't resident in the EU, and a levy on

digital services that would hit transactions made between

in-country customers of a nonresident company--such as if a company

sold online ads to people in France without a taxable presence

there.

The commission acknowledged in its paper Thursday that these

taxes have "pros and cons" including potential conflicts with tax

treaties aimed at avoiding double taxation, as well as with state

aid rules and free-trade agreements. Any tax legislation would also

require debate that could stretch for months, and would typically

under current rules require unanimous approval by EU member

states.

"Yet something has to be done," the commission added.

Write to Sam Schechner at sam.schechner@wsj.com and Natalia

Drozdiak at natalia.drozdiak@wsj.com

(END) Dow Jones Newswires

September 21, 2017 06:23 ET (10:23 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

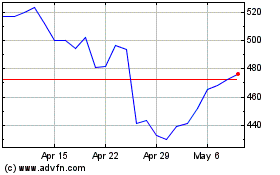

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024