Dollar Mixed As Investors Await A Slew Of Economic Reports

September 25 2017 - 10:00AM

RTTF2

The dollar is turning in a mixed performance against its major

rivals Monday afternoon. The lack of U.S. economic data is keeping

some investors on the sidelines today. Things will begin to pick up

on the economic front tomorrow with the release of the S&P

Case-Shiller data, as well as new home sales and consumer

confidence.

Durable goods orders and pending home sales are slated for

Wednesday, while GDP, weekly jobless claims and international trade

are set for Thursday. Personal income, consumer spending, the

Chicago PMI and consumer sentiment are also set for Friday.

The buck is down against the Japanese Yen Monday, but is up

against its major European rivals. The dollar's gains are strongest

against the Euro, following the results of the German election over

the weekend. German Chancellor Angela Merkel won a fourth term in

office on Sunday, but will have to govern with a far less stable

coalition.

French President Emmanuel Macron also suffered a defeat at the

Senate elections on Sunday.

The dollar has risen to over a 1-week high of $1.1845 against

the Euro Monday afternoon, from an early low of $1.1936.

German business sentiment dropped for the second straight month

in September as companies were less satisfied with their current

business situation and their short-term outlook, survey data from

the Ifo Institute showed Monday.

The business confidence index fell to 115.2 in September, while

it was expected to remain unchanged at 115.9 seen in August.

There is a pocket of risk in the rapid growth of UK consumer

credit, the Financial Policy Committee of the Bank of England said

Monday.

Lenders overall are placing too much weight on the recent

performance of consumer lending in benign conditions as an

indicator of underlying credit quality.

Banks are underestimating the losses they could incur in a

downturn, the FPC noted.

The buck rose to a high of $1.3428 against the pound sterling

Monday, but has since eased back to around $1.3470.

Japan's government maintained its economic assessment for

September, saying the economy is on a moderate recovery.

In its monthly report, the Cabinet Office retained its view on

private consumption, business investment, exports, industrial

production, corporate profits and employment situation.

The greenback reached an early high of Y112.53 against the

Japanese Yen Monday, but has since retreated to around

Y111.625.

The manufacturing sector in Japan continued to expand in

September, and at a faster rate, the latest survey from Nikkei

revealed on Monday with a four-month high manufacturing PMI score

of 52.6. That's up from 52.2 in August, and it moves further above

the boom-or-bust line of 50 that separates expansion from

contraction.

Japan's leading index decreased less than initially estimated in

July, latest data from the Cabinet Office showed Monday. The

leading index, which measures the future economic activity, dropped

to 105.2 in July from 105.7 in June. The reading for July was

revised up from 105.0.

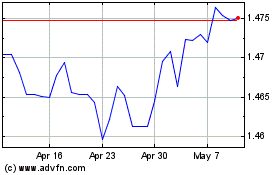

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024