Canadian Dollar Falls As BoC Keeps Rate Unchanged

October 25 2017 - 5:47AM

RTTF2

The Canadian dollar weakened against its major rivals in New

York deals on Wednesday, after the Bank of Canada left its

benchmark rate unchanged following a 25 basis-point hike in

September.

The BoC maintained its overnight rate at 1 percent, as

expected.

The recent strength in the Canadian dollar is weighing on

inflation and exports, the bank noted.

Although less monetary policy stimulus is likely to be required

over time, Governing Council would be cautious in making future

adjustments to the policy rate, according to the accompanying

statement.

"The Bank will be guided by incoming data to assess the

sensitivity of the economy to interest rates, the evolution of

economic capacity, and the dynamics of both wage growth and

inflation," it added.

The BoC Governor Stephen Poloz and Deputy Governor Carolyn

Wilkins will host a press conference in Ottawa at 11:15 am ET.

Crude oil prices inched lower after an industry report showed a

surprise build in U.S. stockpiles.

Crude for December delivery fell $0.31 to $52.16 per barrel.

The American Petroleum Institute reported a small build of

519,000 barrels in United States crude oil inventories. While

gasoline supplies plunged, the rise in crude oil inventories

couples with OPEC's sluggish compliance with supply quotas suggests

the global market is still awash in crude oil.

The currency has been trading in a negative territory in the

European session, with the exception of the yen.

The loonie declined to more than a 2-month low of 1.2771 against

the greenback, after having advanced to 1.2635 in the immediate

aftermath of the announcement. The next possible support for the

loonie is seen around the 1.29 region.

Data from the U.S. Department of Commerce showed that orders for

long-lasting manufacturing goods surged in September.

The durable goods orders rose by 2.2% in September. Economists

had expected the figure to rise by 1.0 percent.

The loonie fell to near a 2-month low of 1.5058 against the

euro, off its early high of 1.4895. The loonie is seen finding

support around the 1.52 area.

Survey results from Ifo Institute showed that Germany's business

confidence improved in October.

The business confidence index rose unexpectedly to 116.7 from

revised 115.3 in the previous month. The expected reading was

115.0.

After climbing to near a 2-week peak of 0.9752 against the

aussie soon after the decision, the loonie reversed direction and

fell to 0.9839. The loonie is poised to challenge support around

the 1.00 region.

Data from the Australian Bureau of Statistics showed that

Australia's consumer prices rose 0.6 percent on quarter in the

third quarter of 2017.

That was shy of expectations for a gain of 0.8 percent but was

up from 0.2 percent in the three months prior.

The loonie weakened to an 8-day low of 89.21 against the yen,

reversing from a recent high of 90.09. On the downside, 88.00 is

likely seen as the next support for the loonie.

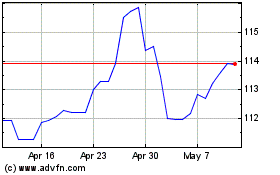

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

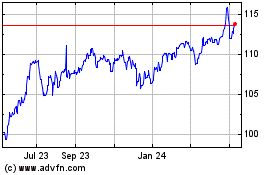

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024