U.S. Dollar Falls On Hopes Of Powell To Be Named As Next Fed Chair

October 30 2017 - 1:46AM

RTTF2

The U.S. dollar weakened against its major counterparts in the

European session on Monday, following a media report that Fed

member Jerome Powell seemed to be the most likely choice for the

U.S. President Donald Trump as the next Fed Chair.

The Wall Street Journal reported that Jerome Powell may be named

as a successor to Yellen, whose term expires in February.

But the president is yet to make a formal decision and may

change his mind, the report showed.

Powell, who joined the Fed board in 2012, is perceived as a

moderate on monetary and economic policy.

Trump is likely to make an announcement on new Fed chair ahead

of his Asia tour beginning with Japan on November 5.

Investors await a two-day Fed meeting beginning tomorrow for

more clues on the possible trajectory of monetary policy.

Other central bank decisions this week include the BoJ

announcement on Tuesday and the BoE meeting on Thursday.

The currency has been trading in a negative territory in the

Asian session.

The greenback fell back to 113.54 against the yen, a pip short

of its Asian session's 4-day low of 113.53. If the greenback

weakens further, 112.00 is possibly seen as its next support

level.

Preliminary figures from the ministry of Economy, Trade and

Industry showed that Japan's retail sales increased as expected in

September, after falling in the previous month.

Retail sales rose a seasonally adjusted 0.8 percent

month-over-month in September, reversing a 1.6 percent fall in

August. The figure also matched consensus estimate.

The greenback declined to a 4-day low of 0.9965 against the

Swiss franc, from a high of 0.9990 hit at 3:15 am ET. Continuation

of the greenback's downtrend may see it challenging support around

the 0.98 region.

The greenback weakened to 1.1642 against the euro, compared to

1.1606 hit late New York Friday. Further downtrend may see it

challenging support around the 1.18 mark.

Figures from Destatis showed that Germany's retail sales grew

more than expected in September.

Retail sales increased 4.1 percent year-on-year in September,

the biggest in four months. Economists had forecast sales to rise

3.2 percent following the revised 3 percent increase in August.

The greenback slipped to a 4-day low of 1.3169 against the

pound, after having advanced to 1.3118 at 5:00 pm ET. The next

possible support for the greenback is seen around the 1.33

region.

The greenback dropped to a 4-day low of 0.7688 against the

aussie, off its early high of 0.7664. The greenback is seen finding

support around the 0.78 area.

The greenback eased to 0.6864 against the kiwi, from its

previous high of 0.6833. This may be compared to a 4-day low of

0.6888 hit at 5:00 pm ET. On the downside, 0.70 is possibly seen as

the next support for the greenback.

On the flip side, the greenback bounced off to 1.2835 against

the loonie, from a low of 1.2812 hit at 5:00 am ET. The greenback

is likely to locate resistance around the 1.31 level.

Looking ahead, U.S. personal income and spending outlays for

September as well as German preliminary CPI for October are set for

release in the New York session.

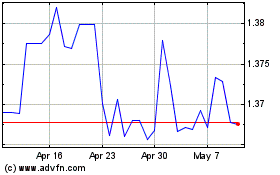

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024