Canadian Dollar Falls On Weakening Oil Prices

November 07 2017 - 12:16AM

RTTF2

The Canadian dollar weakened against its major rivals in early

European deals on Tuesday, as oil prices declined amid a higher

dollar on the back of rising treasury yields.

Crude for December delivery fell $0.09 to $57.26 per barrel. A

stronger US dollar tends to make the dollar-denominated oil

costlier for the buyers in foreign currencies. Oil surged overnight

as Saudi Crown Prince Mohammed bin Salman's anti-corruption

crackdown had led to a new wave of arrests of royals and minister.

The American Petroleum Institute will release its crude inventory

data later in the day, with analysts predicting a drop of 2.8

million barrel in crude oil inventories. This will be followed by

official data from the Energy Information Administration on

Wednesday. European stocks are trading mixed, with banks gaining

ground on growth optimism after ECB President Mario Draghi said

there is little evidence that negative rates are undermining

banking profitability. The currency rose against its major rivals

in the Asian session, with the exception of the greenback. The

loonie edged down to 1.2763 against the greenback, from a high of

1.2703 hit at the commencement of today's trading. The loonie is

likely to find support around the 1.31 mark.

The loonie retreated to 89.52 against the yen, from its previous

high of 89.73. Continuation of the loonie's downtrend may see it

challenging support around the 88.00 region.

Official data showed that Japan labor cash earnings rose 0.9

percent on year in September.

That exceeded expectations for an increase of 0.5 percent and

was up from 0.7 percent in August.

The loonie reversed from an early near a 2-week high of 0.9753

against the aussie, falling back to 0.9772. The next possible

support for the loonie is seen around the 0.99 area.

Australia's central bank decided to leave its key interest rate

unchanged at a record low, as widely expected.

The board of the Reserve Bank of Australia, governed by Philip

Lowe, maintained the cash rate at 1.50 percent. The bank had

reduced the rate by 25-basis points each in August and May last

year.

Having advanced to near a 3-week high of 1.4739 against the euro

at 3:45 am ET, the loonie reversed direction and dropped to 1.4769.

On the downside, 1.49 is possibly seen as the next support level

for the loonie.

Data from Eurostat showed that Eurozone retail sales rebounded

in September largely reflecting a recovery in food sales.

Retail sales grew 0.7 percent month-on-month in September,

reversing a 0.1 percent fall in August. This was the first increase

in three months and came in better than the expected expansion of

0.6 percent.

Looking ahead, U.S. consumer credit for September is slated for

release in the New York session.

At 12:35 pm ET, Federal Reserve Governor Randal Quarles speaks

at The Clearing House Annual Conference, in New York.

BOC Governor Stephen Poloz speaks on inflation at an event

jointly hosted by the Chartered Financial Analyst Society of

Montreal and the Montreal Council on Foreign Relations at 12:55 pm

ET.

At 2:30 pm ET, Fed Chair Janet Yellen delivers acceptance

remarks at the presentation of the Paul H. Douglas Award for Ethics

in Government, in Washington DC.

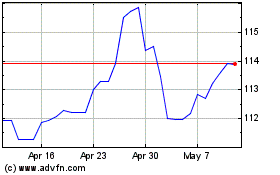

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

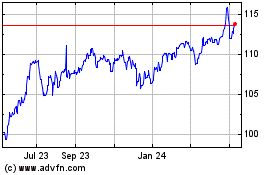

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024