Airbus, Boeing Secure More Than $75 Billion in Plane Orders -- 2nd Update

November 15 2017 - 4:05AM

Dow Jones News

By Doug Cameron

Airbus SE and Boeing Co. secured more than $75 billion in

single-aisle plane commitments Wednesday, demonstrating unrelenting

appetite for their most popular planes from discount carriers as

the airlines lock in deals to support growth for years to come.

Airbus secured what it called one of the biggest aircraft deals

in its history with a 430-jet agreement with airlines linked to

Indigo Partners LLC, a U.S. private-equity group with stakes in

some of the fastest-growing low-cost carriers on three

continents.

The proposed deal, announced Wednesday at the Dubai Airshow,

carried a sticker price of almost $49.5 billion before the

customary discounts that can reduce the true value by 50% or more,

though consolidation in the airline and finance industries is

giving buyers more clout.

Boeing followed shortly after with a deal to sell Dubai-based

Flydubai up to 225 more of its 737 Max 8 planes at a list price

value of $27 billion. The deal is for 175 firm commitments with

purchase rights for more, Boeing said.

Airbus and Boeing are aggressively boosting production of these

single-aisle planes to satisfy demand. Executives at both

manufacturers in recent months have said they could build more

planes. Demand is there, they say, though there are concerns

suppliers may struggle to keep pace with the torrid pace of

production.

Airbus said the Indigo Partners deal tops one by other budget

airlines AirAsia and India's unrelated IndiGo, making the financial

investor its biggest customer by list price.

Indigo, based in Phoenix, is led by industry veteran Bill

Franke, who has invested in a number of carriers including holdings

in Frontier Airlines in the U.S., Hungary's Wizz Air Holdings PLC

and Mexico's Volaris. It also backed JetSmart, a new Chile-based

carrier that launched this year.

The preliminary agreement covers 430 planes--73 A320neos and 157

of the larger A321neo model--doubling the potential orders from the

four Indigo-linked airlines.

Denver-based Frontier plans to take 134 jets, with

Budapest-based Wizz receiving 146 planes. Volaris would receive 80,

with 70 for startup JetSmart.

The European manufacturer has trailed rival Boeing Co. in

securing new orders this year, garnering more than 300 before

Wednesday's announcement, compared with more than 600 for its U.S.

rival.

It is unusual for airlines to order aircraft jointly, though

Dubai's Emirates Airline and Qatar Airways cooperated as launch

customers for the Boeing 777X at the 2013 Dubai Airshow.

Indigo didn't disclose when first deliveries were due to start,

or what engines they would choose. The Pratt & Whitney unit of

United Technologies Corp. and a joint venture between General

Electric Co. and Safran SA offer rival engines.

Airbus and Boeing both have backlogs for their single-aisle jets

stretching five or more years, even though both are boosting

output.

Deals of this scale have become more commonplace in recent

years, in part because of the explosive growth of low-cost

carriers.

However, analysts are cautious on whether some of the big

customers will take all of their planned jets on schedule,

particularly if an economic downturn slows traffic growth. Plane

makers can boost profits by agreeing to defer aircraft

deliveries.

Gus Kelly, chief executive of aircraft lessor AerCap Holdings

NV, this week said placing aircraft orders often represents a

career highlight for some airline CEOs. Speaking at an investor

conference, Mr. Kelly said that some of these orders had served

only to benefit the shareholders of Airbus and Boeing.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

November 15, 2017 04:50 ET (09:50 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

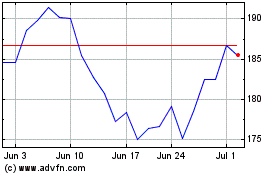

Boeing (NYSE:BA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boeing (NYSE:BA)

Historical Stock Chart

From Apr 2023 to Apr 2024